Inflation or not, we use CPI (Consumer Price Index), which is a statistical number that measures the change in the prices of goods and services that consumers currently purchase for regular consumption compared to prices in a given year as a base year.

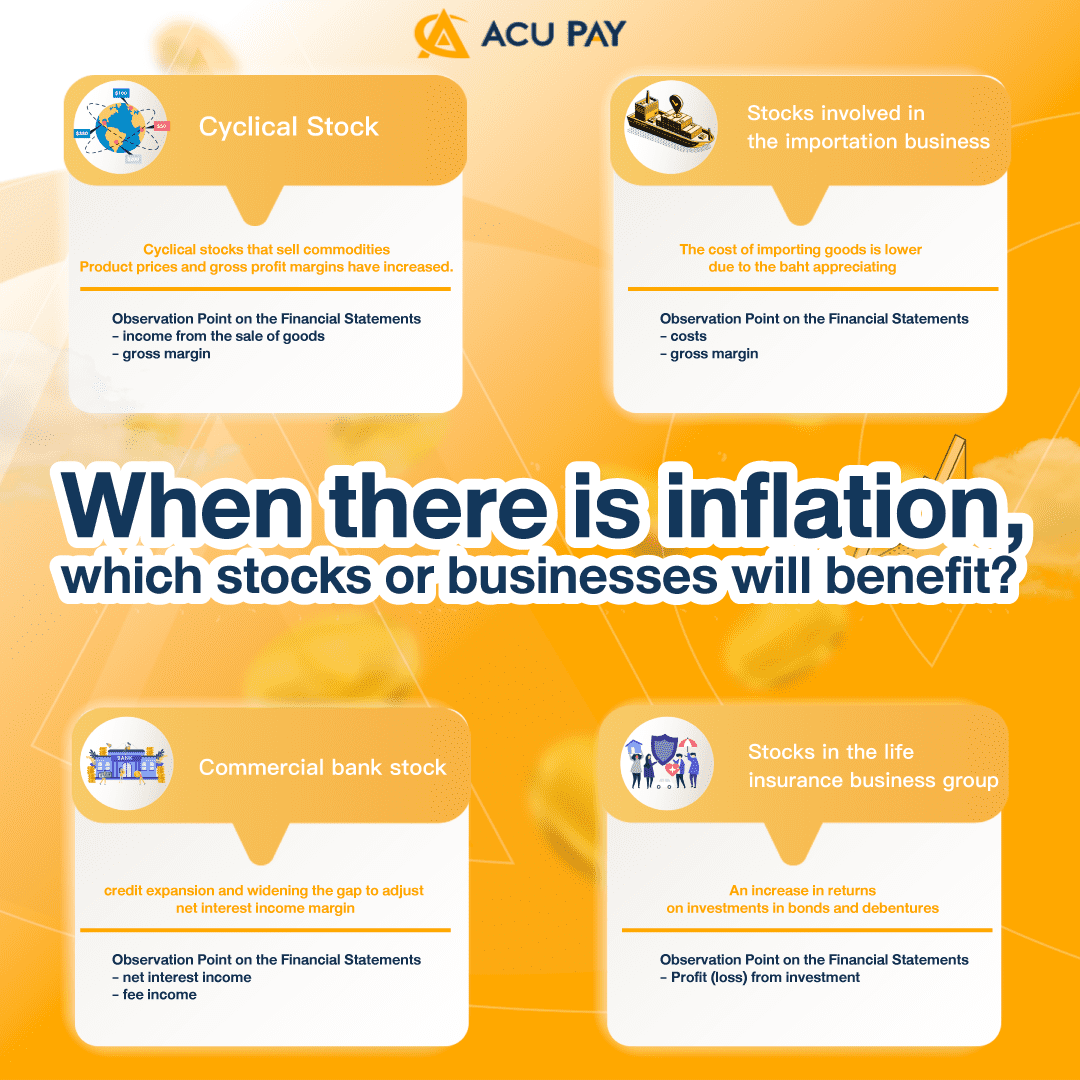

Cyclical stocks that sell commodities such as oil, natural gas, coal, asphalt, rubber, etc. The nature of these stocks is that their prices fluctuate according to economic cycles. When the economy is good, business is good too. But if the economy is sluggish, the company’s earnings will stagnate as well. This is because inflation is directly correlated with commodity prices, which have benefited from an increase in gross profit margins.

Rising interest rates will be a positive for import-related businesses. Because when the interest rate in a country is higher, it will attract foreign investment and result in the appreciation of the country’s currency. Therefore, those who do import business will benefit from the lower cost of importing goods. or spending the same amount of money but getting more quantity. The appreciation of the baht will be reflected in the gross profit margins of listed companies operating in the business of importing goods. There may also be special gains or losses from exchange rates.

As economic activity recovers, banks will benefit from potential credit growth as the business sector expands in investment, manufacturing, and employment. At the same time, inflation affects policy interest rates, which directly affects commercial banks. because the bank’s main income comes from interest on lending. Therefore, when raising the policy interest rate, the bank will have the chance to adjust the interest rate higher to increase the net interest margin.

Investors are well aware that bond yields, or government bond yields, are closely related to inflation. Therefore, the group that invests in bonds will benefit from higher returns. And one of them is the insurance business. Because customers’ premiums are invested to generate returns, most of which are in non-high-risk assets like bonds and debentures. Investors can analyze investment efficiency to generate returns on life insurance business through profit (loss) from investment.

Reference : www.setinvestnow.com

However, if you want to learn about investing, always remember and remind yourself that every investment carries risks. What we should do first before investing is minimize the risk as much as possible to increase the possibility of obtaining a return on investment.

Note: This article is for preliminary use only, not intended to guide investment in any way. Investors should study more information before making an investment decision.