Are you familiar with the word GDP? When we listen to economic news or read articles related to investments, we often hear the word GDP on a regular basis, so let’s simply summarize: what is GDP? And how is it related to investment or related to us?

“GDP” stands for Gross Domestic Product. It is calculated from the final value of goods and services that were produced in the country at that time, or simply put, GDP is the total economic value that takes place in a country. If the GDP of Thailand is higher, it means more income is generated in Thailand. This may be from the spending of people in the country; increased employment; the government’s having invested in various projects, including more tourists to spend money in our country; etc.

It can be seen that GDP can be positive or negative. It comes from the four components: consumption, private investment, government spending, and net exports. This reflects the overall economic outlook of all parts of the country.

If GDP is positive, it indicates that the economy is expanding, more money is flowing into the country, and people are spending more. On the other hand, if the GDP is negative, it represents the overall recession of the economy.

We can use GDP numbers to determine investment strategies in the big picture. What was the country’s economy at that time? Is it causing us to grow, stall, slow, or recover? Because different economies affect the methods and strategies of the four components: consumption, private investment, government spending, and net exports. There will be differences in how they use different resources.

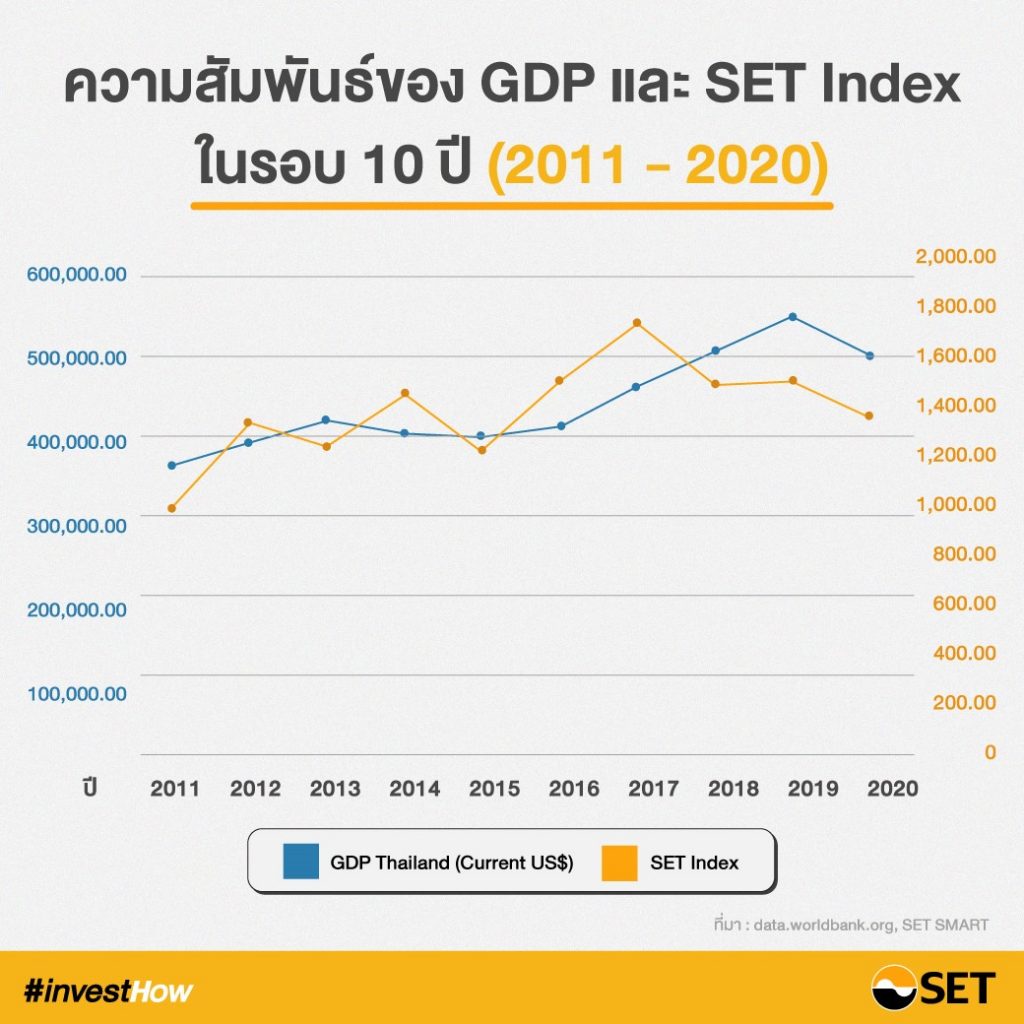

Of course, GDP is a measure of economic growth, which is important to the direction of investment. Investors generally want a stable economy that can grow well and sustainably. But the question is, how much does the GDP figure released each time affect the movement of the Thai stock market?

When comparing the value of Thailand’s GDP with the stock market movements (SET Index) retrospectively, from 2011 to 2020, the correlation is quite the same. “Up and down together.” Only from 2013 to 2015 were there any fluctuations. This was because there were quite a lot of external factors affecting both the economic crisis in the EU and the political events in the country.

Finally, investors can use GDP growth to analyze future investment directions. Don’t forget to consider other factors along with it in order to get a complete investment perspective. You can read the analysis of individual stocks at the Stock Exchange of Thailand. Collected here. Click. You can also try the SETSMART tool for important stats and to help screen out interesting individual stocks. Click

References: www.setinvestnow.com