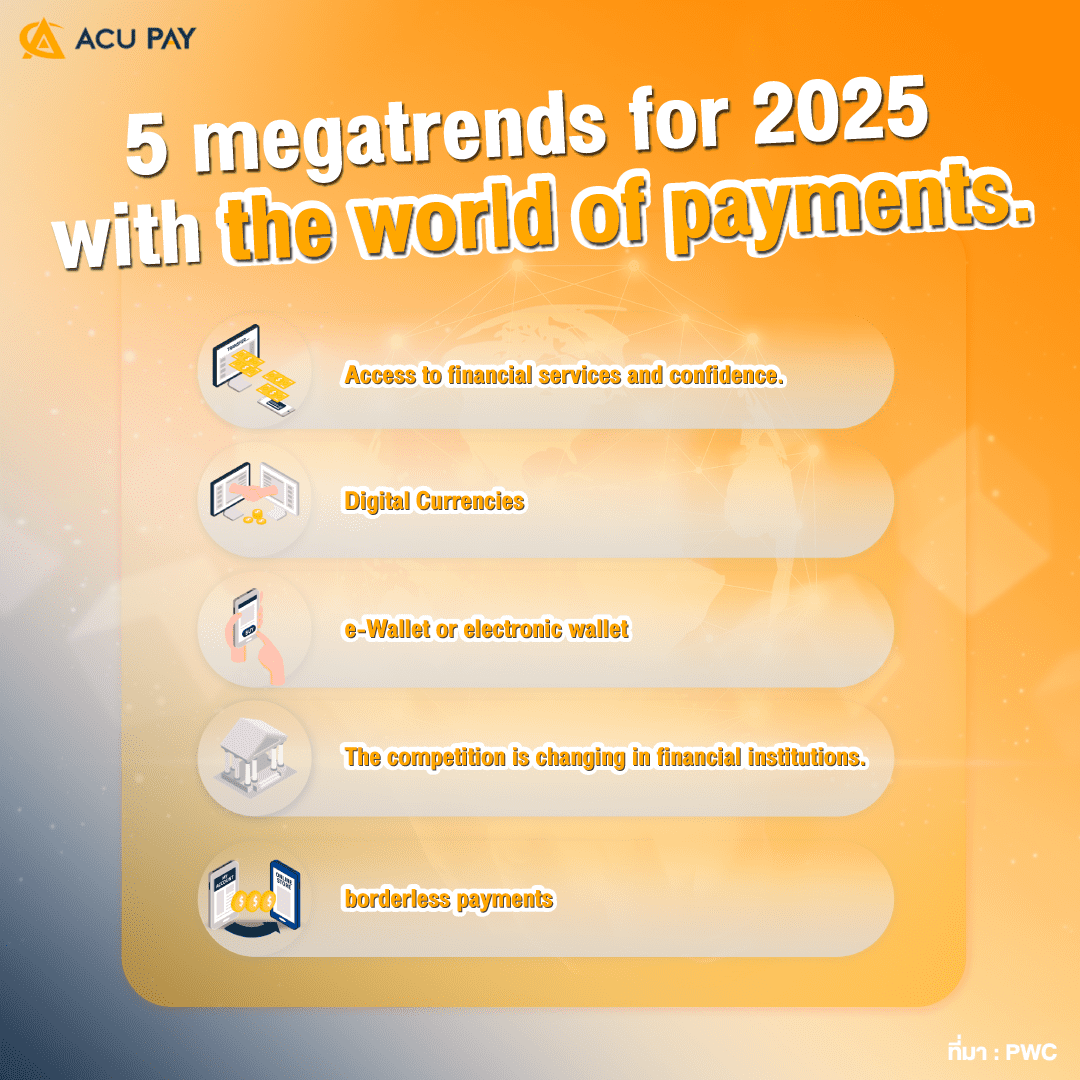

According to PwC, the five megatrends that will change the world payment system in 2025 are as follows

Over the past several years, we can see that the world is paying attention to development and financial inclusion to reduce inequality for people in the country. that still lack the opportunity to access the financial system or have no bank account. For example, in Thailand, there are Prompt Pay and e-Wallets that allow users and merchants to access e-Payment services more conveniently.

In addition, the growth of e-Commerce businesses is another important factor that drives the payment system further. Because nowadays, many people have access to smartphones, making people who live in rural and remote areas or in poverty able to have the opportunity to access financial services. By 2025, global mobile phone accessibility will reach 80%, led by emerging markets such as Indonesia, Pakistan, and Mexico.

However, central banks continue to play a role in overseeing data privacy and stabilizing payment systems in order to build overall consumer confidence.

Both Central Bank Digital Currencies (CBDCs) and private-sector cryptocurrencies will increasingly play a role in the financial and payment systems in the future. According to the PwC Global CBDC Index 2021, 60% of global central banks are currently investigating the development of digital currencies in both wholesale and retail CBDCs. or Facebook’s Diem Currencies (formerly known as Libra) There are also news reports that the People’s Republic of China will likely use the Digital Renminbi, or E-yuan, for the first time at the Winter Olympics next year.

The Financial Services Technology, FIS, states that in the past year, global digital wallet transactions grew by 7%, and by 2025, e-wallet payments will account for more than half of global e-payments, according to consumers, who will turn to using QR Codes instead of cash or cards to pay for goods and services. And to respond to this trend, banks and credit card companies must work together to invest in the e-wallet business to develop a payment platform that may also replace the traditional form of payment in the next phase.

The shift from card payments to e-wallets has forced financial institutions and credit card service providers to accelerate their strategies to gain more competitive advantages. For example, it has to evolve into Open Banking, or where financial service providers disclose their clients’ financial information to third-party providers (TPPs). which must be approved by the customer who owns the account first. At the same time, cloud and platform infrastructure must be outsourced to help support the payment infrastructure within the organization to help operators take advantage of customer data analytics. in offering different products and services It also meets the needs of consumers who use more digital devices.

In a digital world where financial transactions can be done quickly and at a lower cost, The innovation of cross-border payments has also been developed. Recently, Singapore has joined hands with Thailand to link the country’s payment systems together. to help users make real-time international money transfers via a mobile phone number. Next, we will certainly see a push for cross-border payments innovation and investment in infrastructure that will take financial integration to the next level.

ที่มา : pwc