In the past few years, many people have used e-payment. What would a cashless society be like if there was no COVID-19? In which direction will it be? Today let’s try to make some predictions.

We saw 2 factors that directly affect consumer behavior are:

Almost every business, no matter how big or small, can nowadays accept all payments via e-Payment, but there is one business that is the top factor affecting the spending behavior of users: online businesses, whether e-commerce or social commerce, etc.

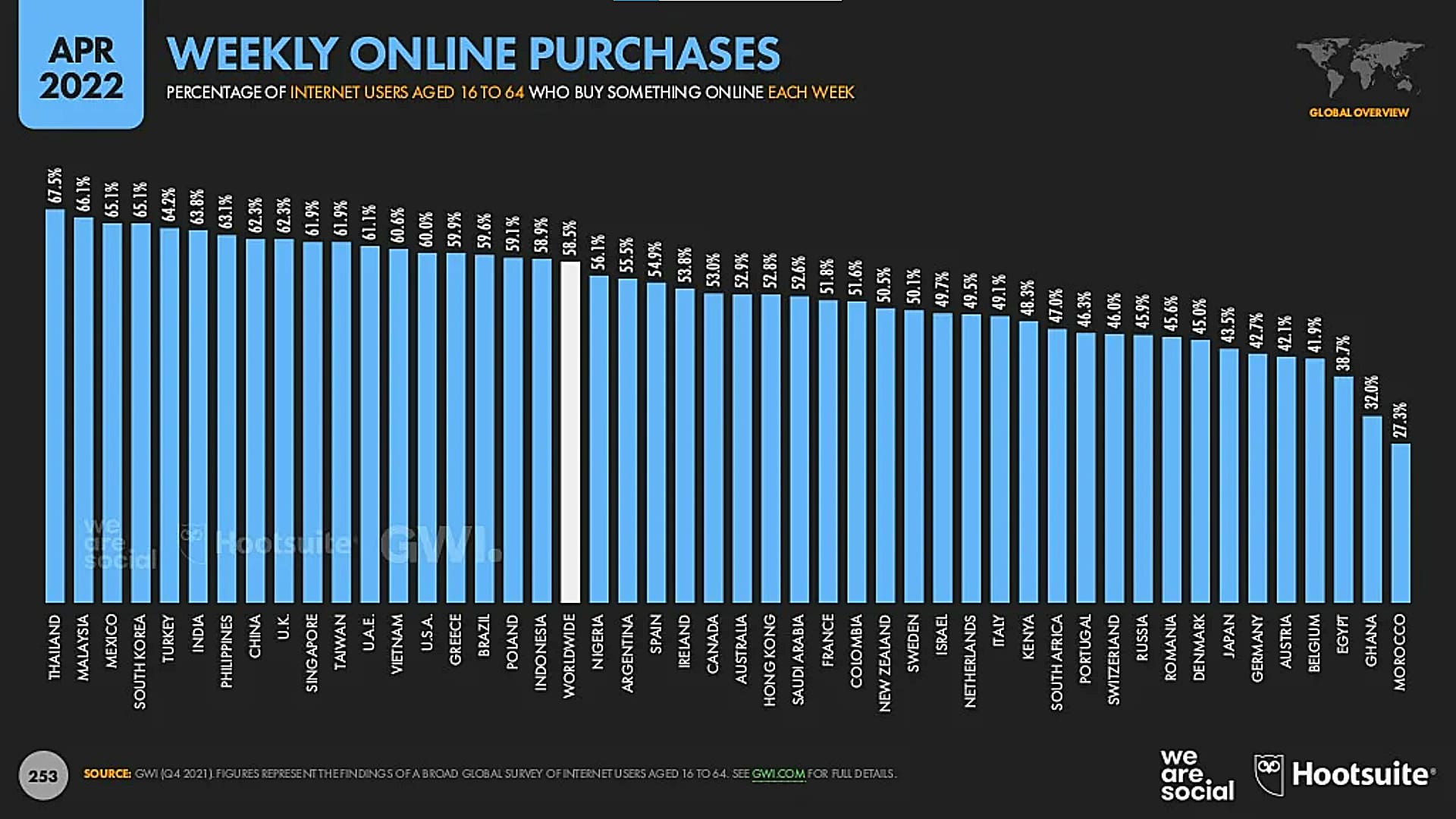

From the past 2-3 years, we can see that it is a time that the e-Commerce business has grown a lot and many people have traded products and services widely through e-Commerce. And directly affecting e-Payment, or electronic payment, has seen significant growth, and, in 2022, Thailand will be the number 1 in online shopping.

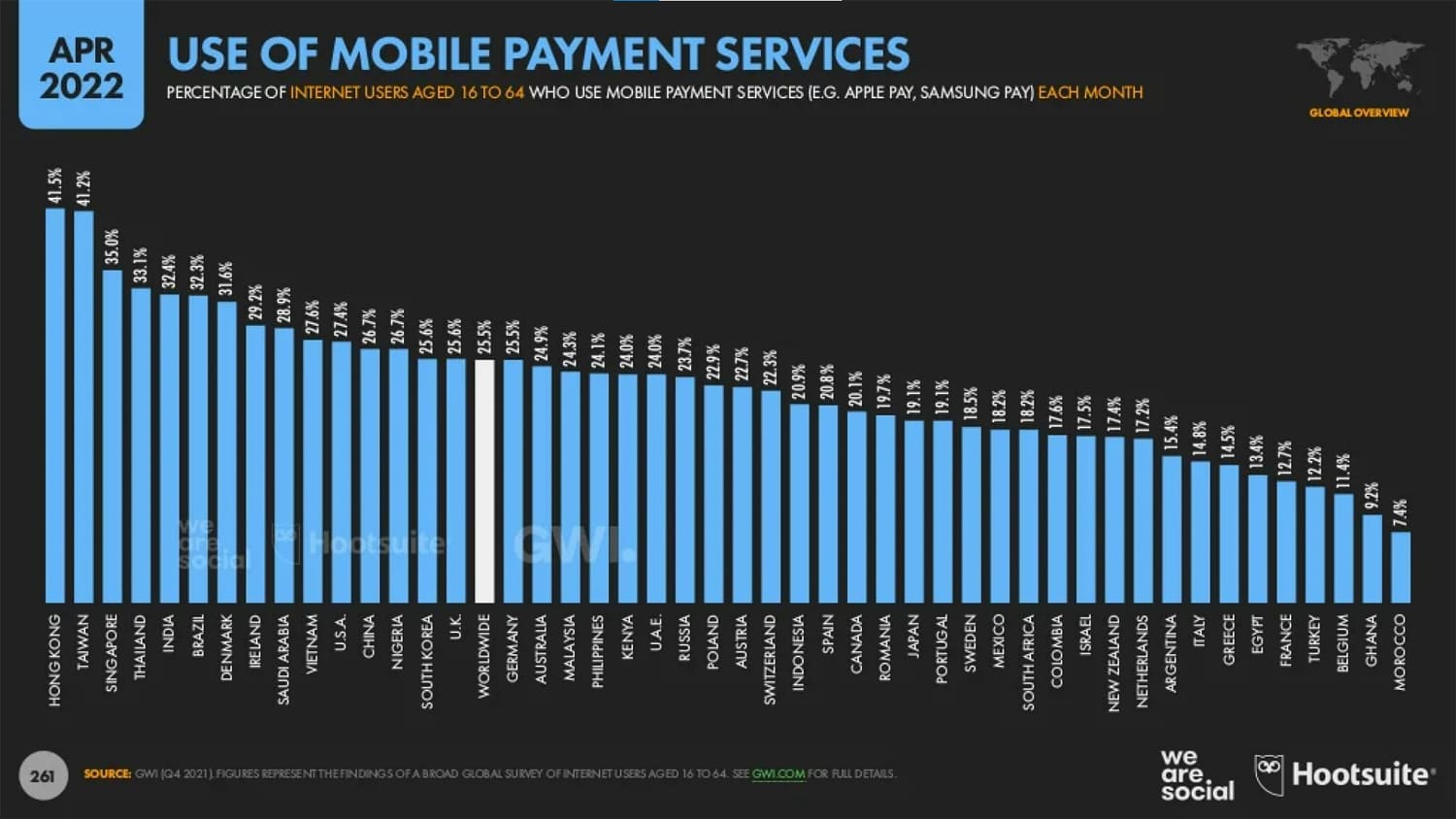

As mentioned above, the next big thing is online payments. At present, we will pay or buy products for doing business on mobile phones. This therefore reflects that the number of Thai people transacting through e-Payment has greatly increased. Therefore, it cannot be denied that online businesses have made the cashless society grow even higher.

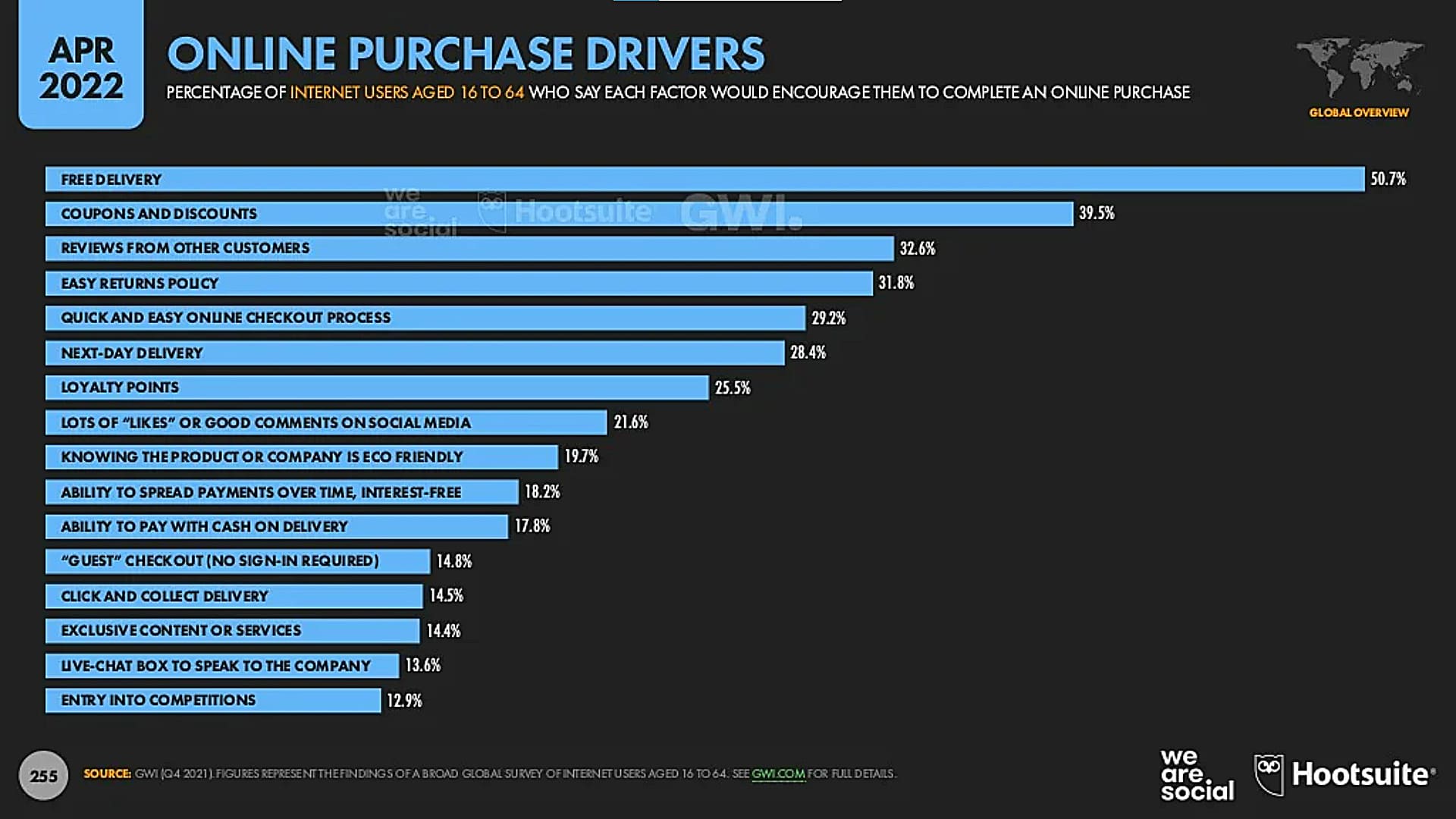

Let’s look at the factors that contribute to the growth of online businesses. The reason for this is the index that indicates why consumers use e-Commerce and why it has become a factor in the growth of the cashless society.

If we look at it in practice, we will see that the use of free shipping promotions sometimes stipulates that payment must be made via e-Payment or e-Wallet only. In terms of coupons and discounts as well, if paying by cash or cash on delivery, these promotions cannot be used. Therefore, it is also an indirect incentive that leads to spending via e-Payment rather than using cash. Not only e-Commerce uses this strategy, but other businesses as well, such as TikTok, have TikTok shop to make a payment via e-Payment as well. And it is becoming interesting and is expected to grow better than the e-Commerce business because TikTok has many times more users than e-Commerce. This reason alone is enough to propel TikTok’s growth. So, if we are to predict that a cashless society will continue to grow after COVID-19, it’s easy to guess that it is likely to grow even more.

In terms of offline business, in the past, many shops accepting e-payment, either through Paotang, PromptPay, or e-Wallets, have played an important role in changing consumer behavior. because the reasons are quite similar to online promotions. for some stores where we purchase large quantities. But it is cheaper to pay via e-Wallet, tens to hundreds of baht. This creates incentives that can significantly reduce the use of cash. Accepting payments via e-Payment or online has great advantages for merchants. Therefore, the cashless society that will happen with offline businesses in the future is not difficult and can grow a lot. Because nowadays, according to the Payment Diary survey, 80% of people in Thai society use cash, which gives them a very high opportunity for growth.

On the part of users, we must now admit that mobile phones are more than just making calls because they can be very versatile. Whether it’s watching movies, listening to music, taking photos, working or searching for information over the Internet, and the use of mobile payment services over the Internet, Therefore, telephone and internet access are one index that can measure how readily a user is able to make cashless payments over the phone.

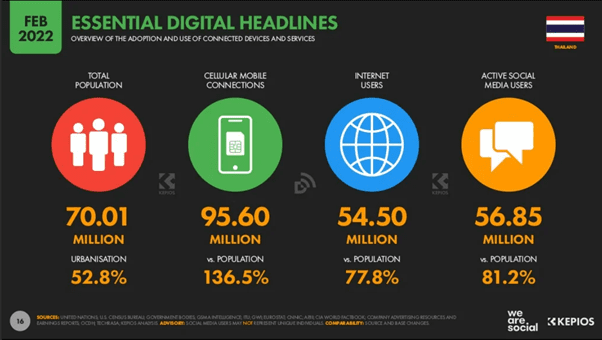

According to data reportal statistics, Thais themselves will have access to 95.60 million phones in 2022, which is 1.3 times that of the country’s population. As many as 54.5 million people have Internet access, which is considered a very high number given that 77.8% of the country’s population has Internet access. This shows the readiness of people in the country to be able to access financial services via mobile phones.

Therefore, we use the data from Payment Dialy to analyze that about 80% of Thai people still use cash, which is about 56 million people who still use cash. If we cut off, the number of people who do not have access to the Internet today is about 12.4 million people. Therefore, of the estimated 43.6 million people who will make a cashless society grow further by using e-payment more. If we look at the possibilities in the future, there is a high probability that a cashless society will continue to grow. and may return to grow again after our world situation returns to normal.

Everyone can follow ACU PAY Thailand through other tracking channels.