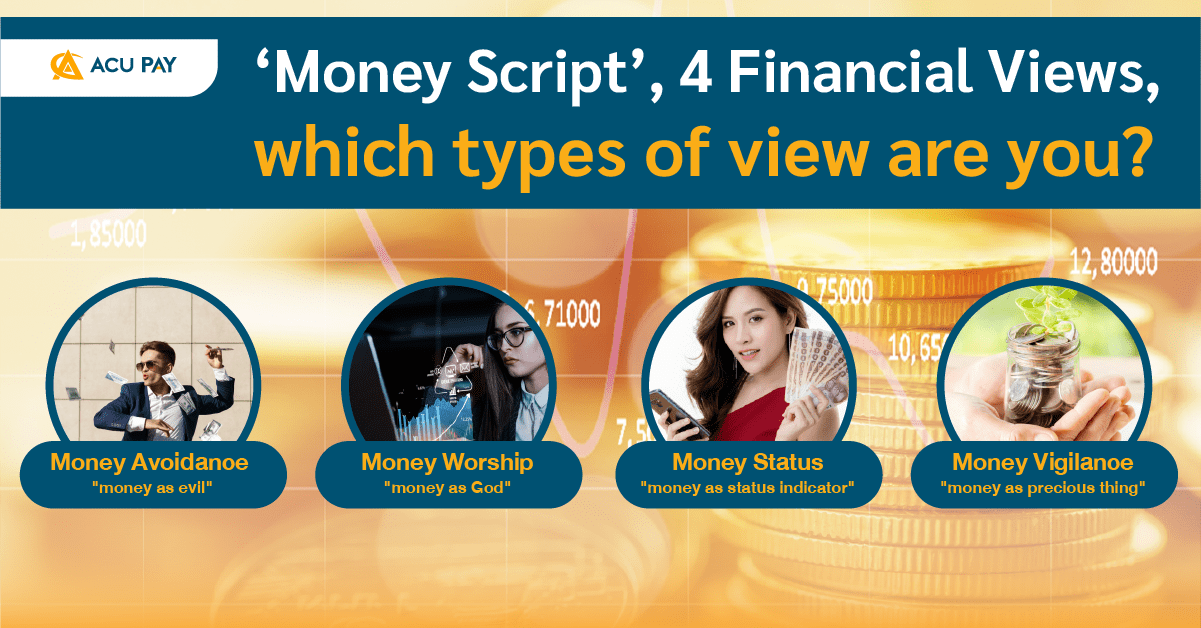

We all have different viewpoints, thoughts, and lifestyles. Both lifestyles and thoughts depend on experience or society that we have grown with. Those perspectives also influence how we spend our money and the differences in our investment styles. Today, ACU PAY will take you to take a look at 4 Financial Views, which types of view are you?

Dr. Brad Klontz, a financial psychologist from Creighton University, USA, author of Mind Over Money, studied and theorized about the financial belief called “Money Script”, which is a result of family background that influences attitudes and perspectives on money in various areas such as spending, saving, risk-taking in investment.

Based on the research on Money Belief and Financial Behavior: Development of the Klontz Money Script Inventory, which can indicate each individual’s financial beliefs. Then asked about a sample group, the summary can be divided into four groups as follow;

Thus, people in this group tend to spend without thinking. They spend as much as they earn and do not focus on savings. As a result, they tend to prefer investment in line with current trends because they are not interested in profit and loss.

Perspective adjustment: This group of people should first separate good and evil from money. View money as just an object, an object that they can use to add value to life through experiences and giving.

These people have a concept idea that having money is the key to happiness. They often feel that every problem can be solved by having more money, so they tend to work hard to make a lot of money and spend it on happiness, making them prone to high credit card debt.

In addition, these people prioritize their work over their family. They often let others borrow their money even though they do not have much. In terms of investment, these people are likely to take high risks because they often expect high returns to make themselves rich quickly.

Perspective adjustment: Remind yourself that money is important, but not everything in life. Give a list of life priorities such as family, lovers, pets, and hobbies. Explore your happiness without using any money, even though money can give you freedom and power, it is not the only path to success or happiness.

These people tend to relate their values to the value of money they have, spend money to create identity, and pay for socially acceptable things. They may grow up in a lower environment and society or live in a family that appreciates people with money.

There is a chance to spend too much money, risk debt, and may fall into the gambling industry to get money to spend. They often rely on other people’s money and may prefer to hide their spending from people at home.

The investment patterns of these people are similar to Money Worship, which is ready to take risks and create a shortcut to wealth.

Perspective adjustment: If you are in this group, observe yourself on why you still need to rely on money to show your status. Try questioning yourself if no one knows what you spend money on, are your priorities going to change?

This last group of people is considered the people with the best financial view out of all four groups; they often have the goal of planning their savings to make sure that they can collect money according to their goals in the smartest way.

Nevertheless, everything is often viewed as money. Money is for keeping, not for using. Sometimes they are viewed as stingy people because they tend to think and think again before spending each baht.

They often avoid borrowing money from others and avoid using credit cards, so there may be no credit history for future loans.

The investment patterns of these people will be prudent, and slow but sure to achieve the exact returns they expect because they can’t handle losses.

Perspective adjustment: These people are needed in four categories because they know how to manage budgets, savings, or planning. However, if you find that your financial goals are negative for your physical and mental health, you might want to reconsider your way of achieving them.