Most of you might already know what stocks and funds are. They both have advantages and disadvantages, what will happen if we combine stocks and funds? Today, ACU PAY will introduce you to EFT or index funds. Let’s see.

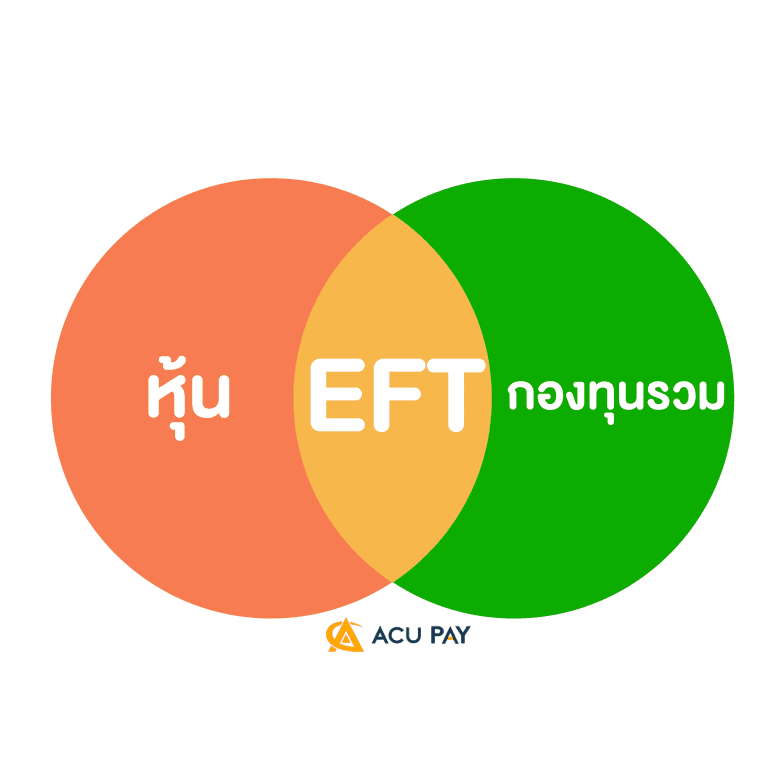

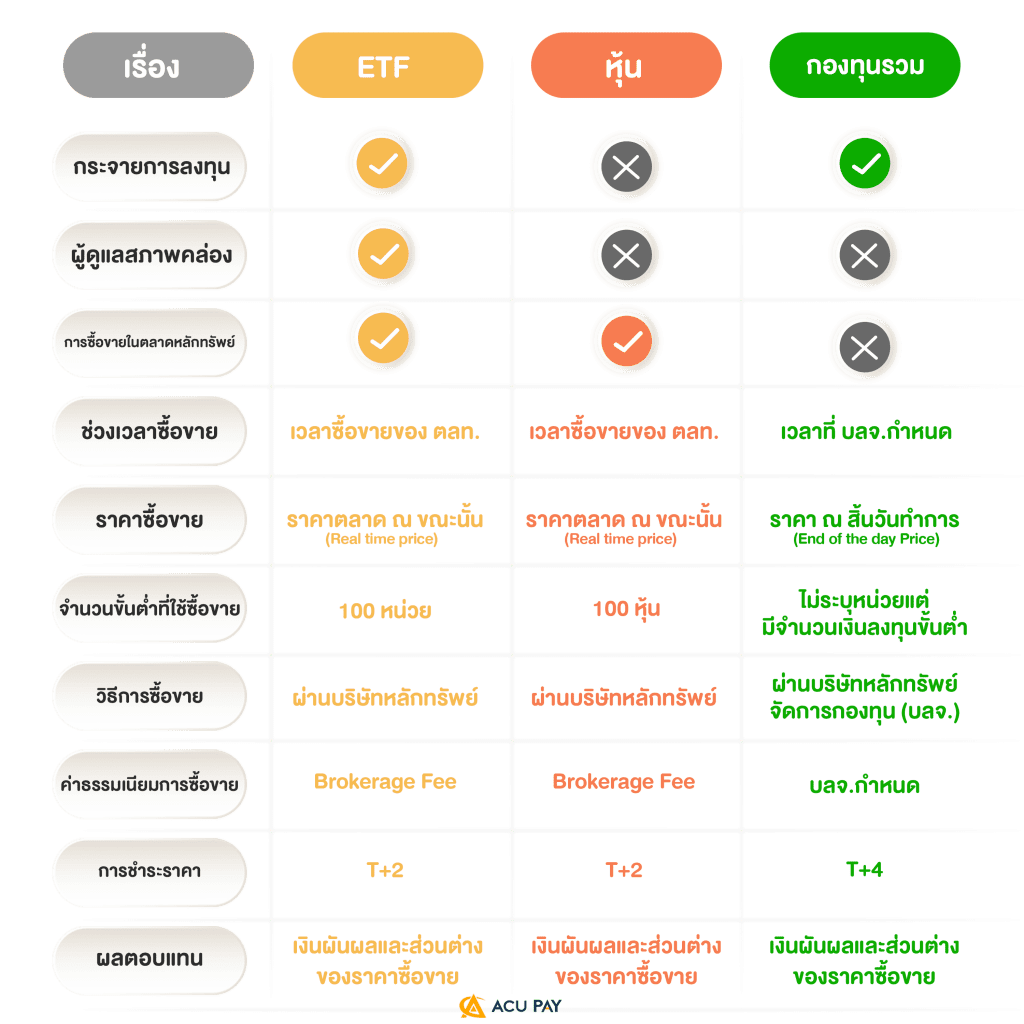

ETF, which stands for Exchange Traded Fund, is an index fund that is listed on the Thai stock exchange and aims to achieve a return that is similar to the index or reference asset prices. A passive fund, or index fund, aims to earn a return as close to the index as possible. For example, today the SET Index is +5%, which means index mutual funds must be +5% or +4.9%, or +5.1% approximately (get the closest). ETF can be sold like a stock.

In conclusion, EFT is financial innovation that combines the advantages of stocks and funds.

Many people say that investments carry risk, including ETFs. The main risk of EFT is a change in the asset price in which it is invested, which can result in net asset price changes that can be higher or lower.

This includes the risk that ETFs are unable to generate returns that are close to or equal to the yields of the citation index, or “Tracking Error”. This may be caused by unfavorable market conditions or the fund manager’s ability to manage the fund. This causes the return received to be different from the return of the citation index.

There are also trading liquidity risks and other risks such as foreign exchange risks that may arise in the event of investing in foreign asset-based ETFs. Due to currency fluctuations, the rate of return in Thai baht may not match the yield of the citation index.

Investment carries risks, but we can reduce some by learning and understanding. such as the citation index, return and risk, and EFT price before making decisions.

For more information: https://www.set.or.th/set/etfstatistics.do?language=th…

There is a variety of them, but not as many as in the global exchange market. But it’s comprehensive and can adjust asset allocation.

There are 2 methods, and it’s very convenient. because you can open a trading account online.

More information on EFT investments at www.setinvestnow.com/ETF and https://www.setinvestnow.com/th/etf-campaign

Investments carry risk. Please invest with caution.

Reference : NamFinance

https://www.scb.co.th