Everyone, this is almost New Year, right? Of course, the festival that Thai people who have income need to prepare themselves for is ‘Tax Filing 2023’ in early 2024, including filing tax returns or tax allowances.

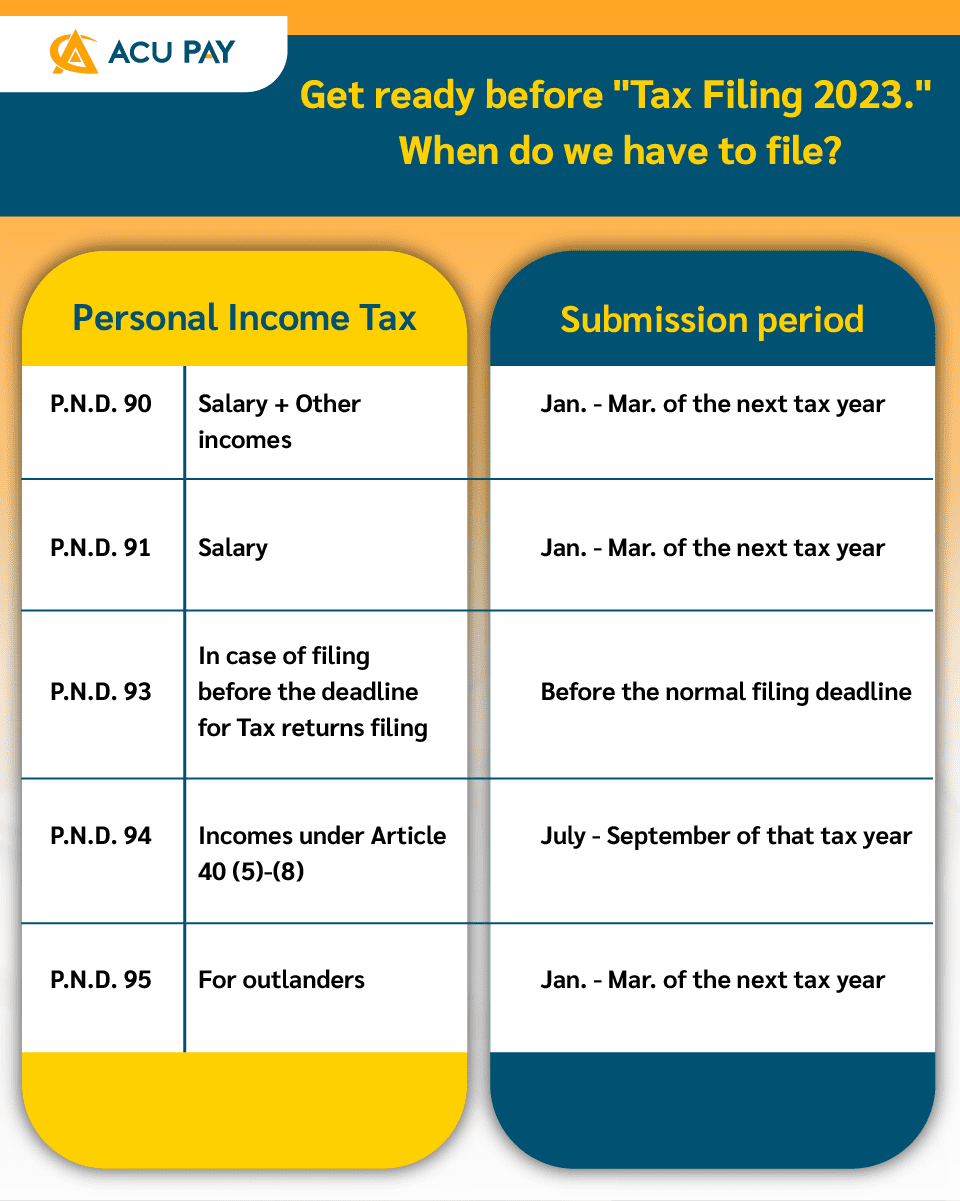

As for the timeline of tax filing, according to the Revenue Department, Ministry of Finance, the guidelines for individual tax filing in 2023 are as follows.

Assessable income earners under Article 40 (1) – (8) of the Multiple or Single Revenue Code.

Tax Filing period; January to March of the following Tax year

Those with employment income under Article 40(1) of the Single Revenue Code according to the following criteria:

Tax Filing period; January to March of the following Tax year

Individual income tax return form for applications for prepayment of taxes before the normal filing deadline.

Tax Filing period; Before the deadline for Tax returns filing

The filing of a half-year personal income tax return for those who have received an assessable income under Section 40 (5)-(8) of the Revenue Code. It is an income from leasing, freelance, income from a contracting, issue important materials besides existence luggage equipment, income from being public figure, and income from business operations

A mid-year tax filing will be calculated from all income summaries from 1 January 30th June. If the income exceeds $600,000 (for single persons) or more than $120,000 (for spouses), P.N.D 94 must be filed, which is not included in the income from regular employment

Tax Filing period; July to September of that year.

Individual income tax return for foreigners who have earned income from employment of workers of Regional Operating Headquarters.

Tax Filing period; January to March of the following Tax year

Taxes can be filed online via the website www.rd.go.th or through the RD Smart Tax application. For offline channels, the tax filing can be made at all local Area Revenue Offices and post offices. (Only those who receive services who have domicile in Bangkok and only within January to March.)