accelerating inflation and followed by a rate hike. So, what next is an increase in liabilities? Let’s see how to arrange a payment.

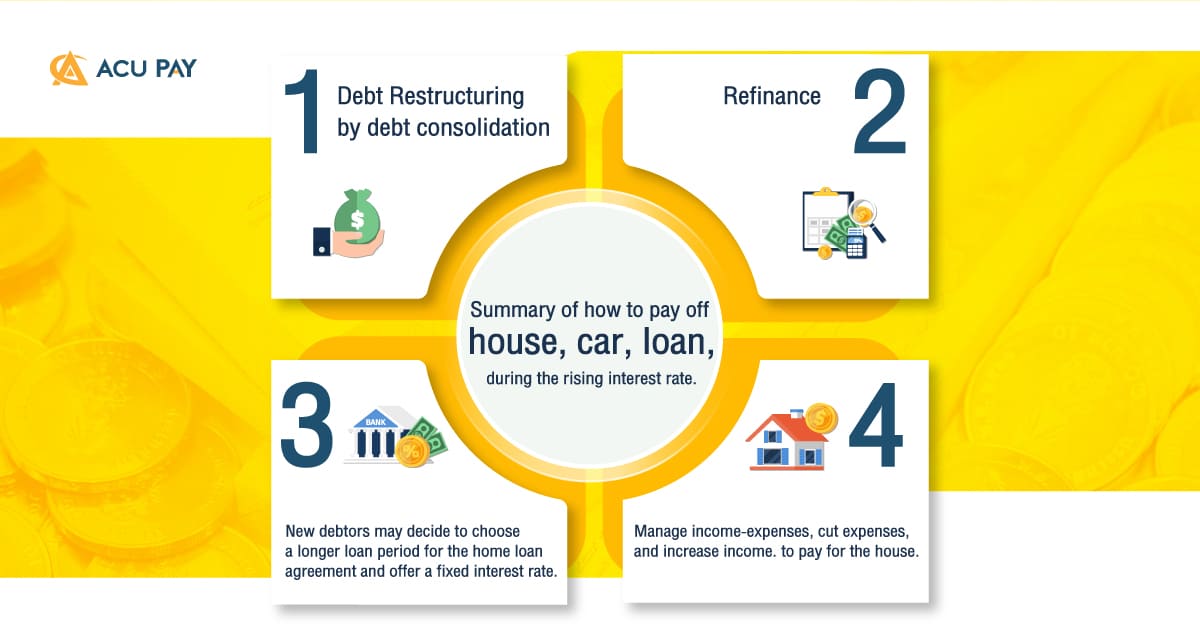

It is suitable for those who have mortgage and retail loans at the same time, such as credit cards and personal loans. Consolidating debt by using a house as a guarantee will reduce the interest burden and down payment. because the interest on the house is lower.

suitable for lenders that lower interest rates and suitable for those who have been burdened with mortgage payments for a while.

The interest rate will be fixed for a period of time before being raised to a floating rate in the future or a hybrid loan.

Both reducing expenses and increasing income will help us save more money each month (remaining money = income – expenses – debt burden). We can use the money as a debt cover to pay off debt faster. And it also helps to save the interest that we have to pay as well.

We may start by reducing unnecessary expenses like the lottery or coffee. If it can be reduced, for example, from buying every day to once a week, or reducing the amount paid. There may still be a large sum of money left that may surprise you. (Try calculating the approximate amount in the “Where Did the Money Go?” program). Or you may also be looking for additional income, such as selling online or selling clothes.

Even the medium-term inflation figures are not expected to accelerate. And the consumer price index (CPI) in July was at 7.61%, a slight deceleration from the previous month.

But the Bank of Thailand said that Thailand’s inflation has not yet passed its lowest point. because the government also helped to support the price in some areas. Furthermore, the Bank of Thailand is concerned that core inflation will remain high in the coming phase. There is still a high risk of passing costs to core inflation, and that may be much faster than expected. Therefore, the policy rate hike will continue until inflation is lower next year.

“The policy interest rate hike will be gradual. Moreover, the rapid rate hike during the economic recovery period gives the MPC room to gradually raise interest rates in the next period without forcing the economy to slow down to accelerate inflation. despite the increase in labor wages at the end of this year or early next year. “

And after raising the interest rate by 0.25% this time, most analysts expect the MPC to raise interest rates by 0.50-0.75% to 1.00–125%, and next year by 1% to reach 2.00-2.25%.

Reference ttb analytics BOT