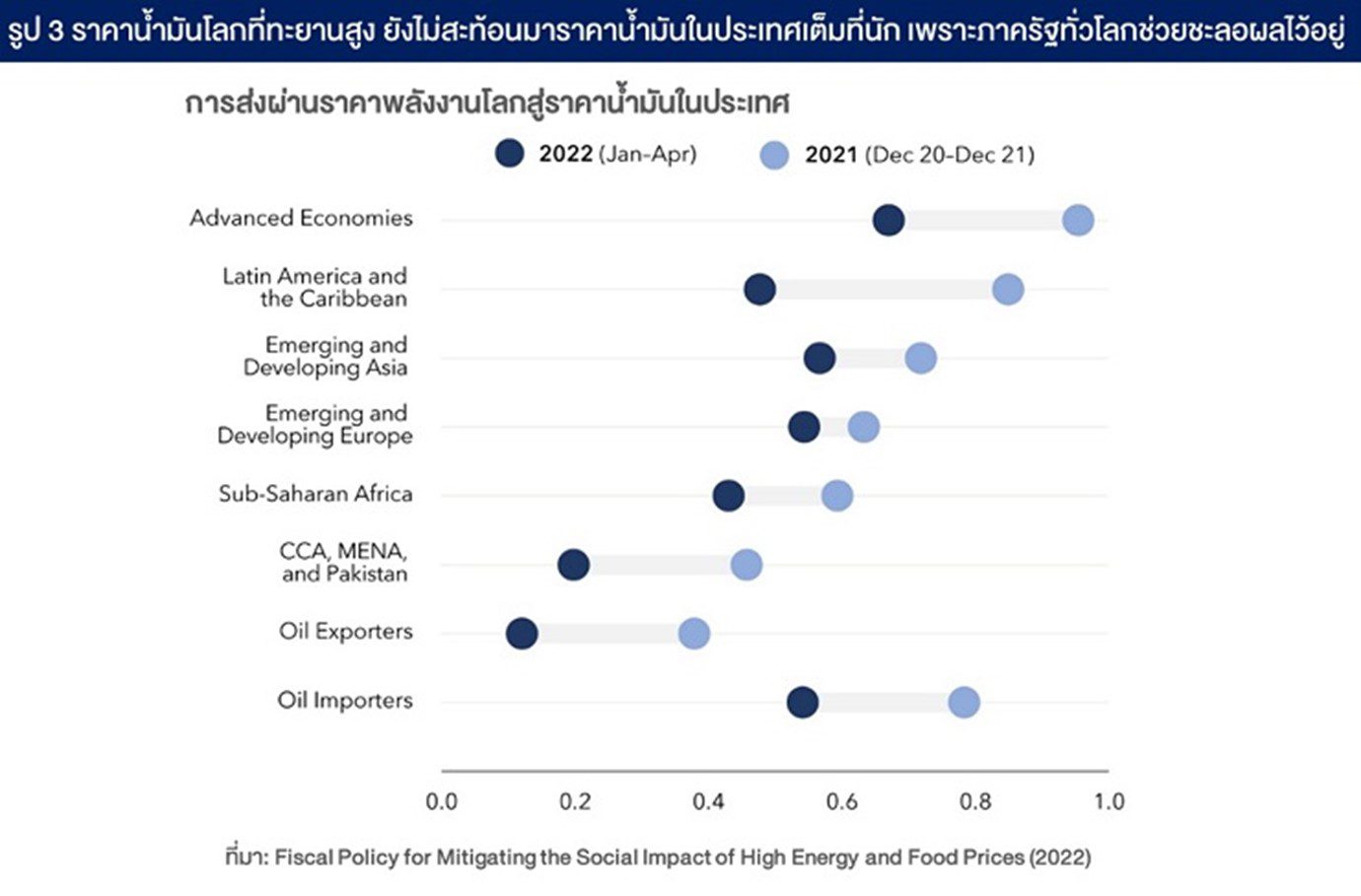

This year, producers face high costs all the way from world oil and commodities It is expensive, especially after the Russo-Ukrainian war even further exacerbated the cost of logistics that came with the disruption of the global production chain since last year.

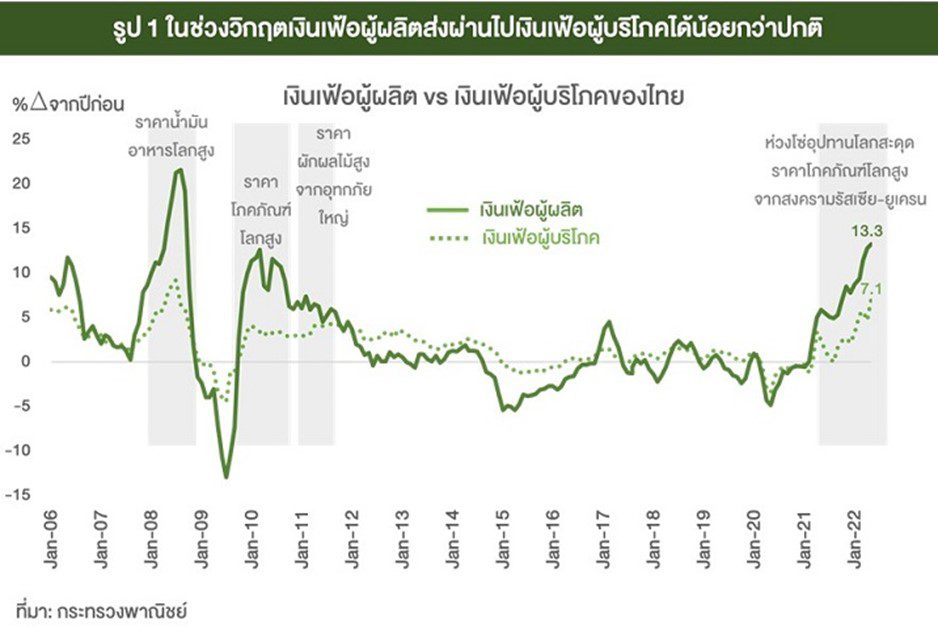

This global situation has made Thailand’s producer inflation grow. For several months in a row, it was 13.3% in June (compared to a growth of 7.1% last year). In terms of consumer inflation in Thailand, although it has accelerated more slowly. But it is moving closer and closer to 7.66%. As soon as the government gradually reduced the measures to fixed the price of energy, oil, gas, and electricity since June because they couldn’t bear the burden of tens of billions of baht per month. After assessing that the conflict situation between the two sides in the world would not be easy to end, economic sanctions against Russia by the United States, the European Union, and some Asian countries will continue. resulting in pressure on world commodity prices for a long time.

Producer inflation and consumer inflation in Thailand have a correlation coefficient of nearly 90%. Thai producer inflation has a four-month pre-inflation qualification, but at some point, the lead qualification may be shorter or longer depending on special events. such as during a crisis.

The Producer Price Index (PPI) reflects the price of all domestic produce. It is the price at which local manufacturers sell products at the production site, in front of the factory, or in front of the farmland. The Consumer Price Index (CPI) reflects the final price of goods and services that consumers spend. The consumer inflation basket consists of locally produced goods, imported goods as well as services such as utilities, fares, medical expenses, education costs, cell phone/internet charges, housing rent, service charges, and wages.

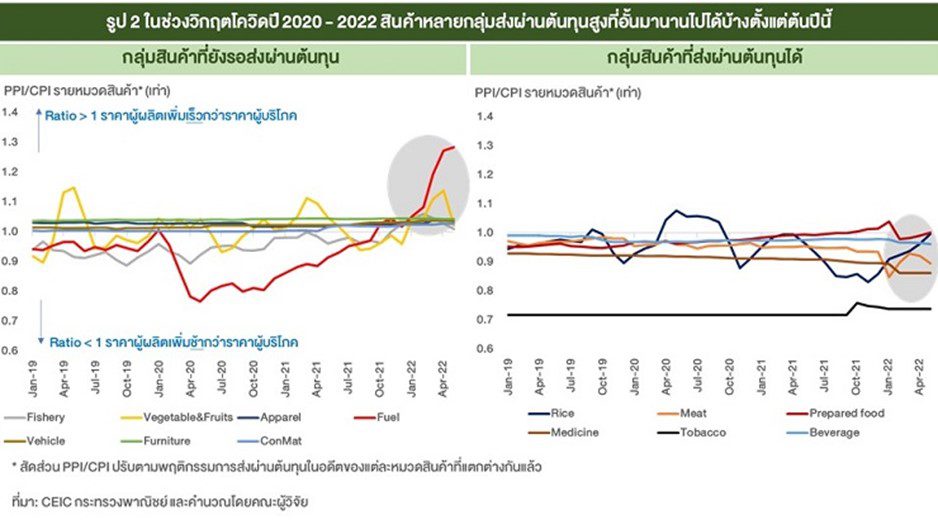

Since the coverage of these two price indices is different, the Producer Price Index and the Consumer Price Index do not completely move together. About a third of Thailand’s inflation basket is comprised of daily expenses, and about 16% of imported goods are included in the inflation basket. Another difference is that the Producer Price Index reflects the cost of domestic and imported raw materials and intermediate goods used in the production process. including the cost of production factors other than raw materials, such as labor, capital, operations, and land, but does not include transportation and taxes. while the consumer price index is influenced by passing through the total cost of the producers. which includes shipping and intermediary fees. wholesale and retail from the factory to the consumer. Taxes collected from producers (such as excise tax) and VAT collected from consumers.

Author:

Dr. Thitima Chucherd

Monetary Policy Department

Column “Bang Khun Phrom Chuankid,” Thairath Newspaper

The issue date is June 18, 2022.

This article is a personal opinion. which does not necessarily correspond to the opinions of the Bank of Thailand.