Due to the fluctuating economic era, the way of generating income or earning income has to change. There are 2 ideas to generate income which are Active Income and Passive Income. Have you ever wondered what are the differences between Active and Passive Income, and which one is the best? This time, ACU PAY will take you to find out the answer to these questions!

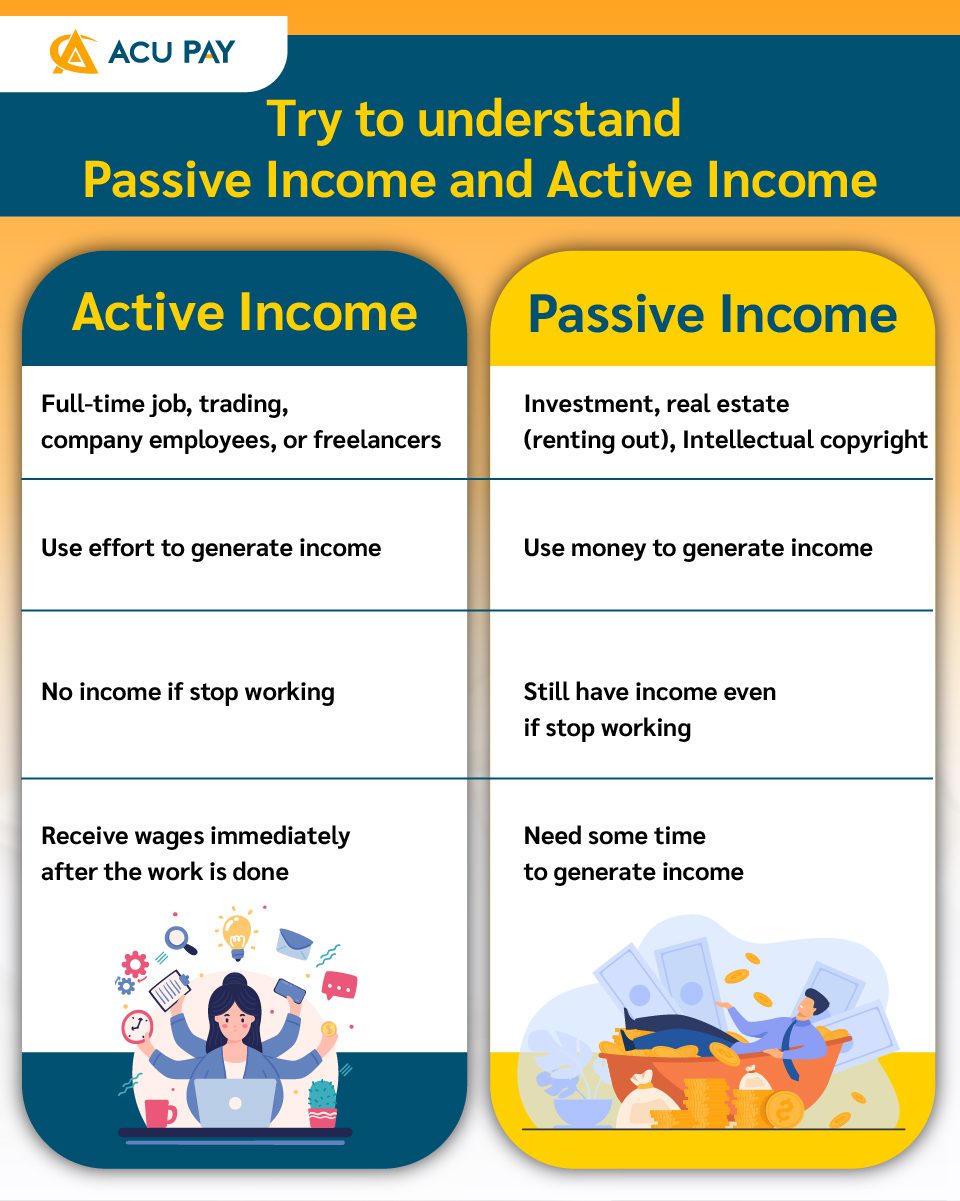

Active income is to complete the assigned tasks within the given time or another explanation which is easier to understand is to be salarymen. To generate Active Income, as everyone knows, is to use your personal effort and time to work all the time. Once you stop working or are fired, you will have no more income.

Passive income is another way to generate income in which you have to create a system and use the money to invest in the first phase, but when everything falls into place, the system will be able to continue on its own without the need for more time to care as it was in the early stages of starting the system. Itc can also generate cash flow to business owners all the time. The most important is you can have more than one way to generate Passive income.

Active Income is from our effort to do our jobs in exchange for money such as salary, commission, and freelance money. On the other hand, Passive Income is also from our effort in the early stage, but still generates income continuously even though the work is done such as real-estate investment from renting out, intellectual copyright, and investment in stocks, funds, and bonds.

We need to work to generate Active Income, while Passive Income requires effort to build property in the first stage, but that property will work for us after you own the property. You still have income although you do not work anymore.

Active Income has limited time to generate, it can be said that we will earn Active Income as long as we can work. However, we will still earn income from Passive Income even if we cannot work or quit our jobs.

Active Income is money from our work that we will receive almost immediately such as wages after we put effort into getting our work done which we may receive monthly or once at a time. However, Passive Income requires some time to generate income.

We do not need to have only Active Income or Passive Income, in fact, we can have both Active and Passive income at the same time. Having both Active and Passive Income is an interesting way for people in modern society to have sustained income.

Earring income from both ways will create convenience and make you spend to meet the demand more. In addition, it decreases the work pressure such that you can work in what you are really like without worrying about the amount of income.

However, for anyone who would like to have more than one channel to generate income, such as us as salarymen who want to have Passive Income as our second income channels, we may need to mainly rely on Active Income for some time. After our money reaches a certain point, we may accumulate money to create Passive Income.

In this regard, we need to study about what asset is suitable for us, including risks that may occur. Passive Income in each asset category has different returns and risks. The higher returns the assets give, the more risks. Therefore, we should study about it prudently and carefully.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY