The term “financial stability” has been a buzzword in the past 10 years. Especially after the 2008 hamburger crisis, which was caused by the United States’ failure to stabilize the financial system as it should have. This makes the cumulative risk bigger until it explodes in the US home loan market. and became a risk to the entire financial system (systemic risk), including affecting global financial markets in 2008.

It can be seen that financial stability is of great importance in the economy. Financial stability is the condition in which the financial system can withstand both internal and external pressures. including providing financial services and facilitating private investment from every incident.

This financial system covers many sectors, such as financial institutions, non-financial service providers (non-banks), investors in capital markets, etc. The question is, who is the Thai government’s financial stability regulator?

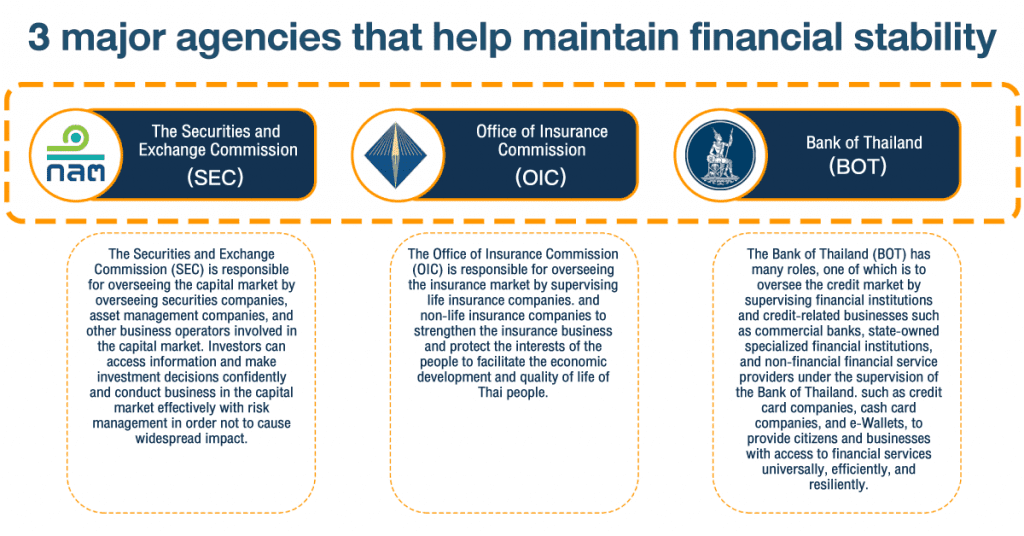

Who has the ability to maintain financial stability in Thailand?

The Securities and Exchange Commission (SEC) is responsible for overseeing the capital market by overseeing securities companies, asset management companies, and other business operators involved in the capital market. Investors can access information and make investment decisions confidently and conduct business in the capital market effectively with risk management in order not to cause widespread impact.

The Office of Insurance Commission (OIC) is responsible for overseeing the insurance market by supervising life insurance companies. and non-life insurance companies to strengthen the insurance business and protect the interests of the people to facilitate the economic development and quality of life of Thai people.

The Bank of Thailand (BOT) has many roles, one of which is to oversee the credit market by supervising financial institutions and credit-related businesses such as commercial banks, state-owned specialized financial institutions, and non-financial financial service providers under the supervision of the Bank of Thailand. such as credit card companies, cash card companies, and e-Wallets, to provide citizens and businesses with access to financial services universally, efficiently, and resiliently.

The regulators of all 3 agencies have clear powers as stipulated in the law. But due to the complexity of the financial system that is interconnected in many dimensions, the SEC, OIC, and the BOT work closely together. There is a quarterly meeting between the 3 agencies called the “3 Regulators Meeting.” to exchange information and views, as well as to discuss policies to prevent risks and maintain the stability of the Thai financial system.

The executives of all three regulators will be in the Financial Institutions Policy Committee (FIPC), which is also one of the Bank of Thailand’s (BOT) core committees. responsible for formulating appropriate policies for the financial institution system to maintain the stability of the financial institution system.

The law requires the Financial Institutions Policy Committee to be composed of the Secretary-General of the SEC, the Secretary-general of the OIC, the BOT Governor, two deputy governors of the BOT, and the Director of the Fiscal Policy Office (FPO), and 5 qualified members, for a total of 11 people. It can be seen that; besides the three regulators, the Financial Institutions Policy Committee also has representatives from the Ministry of Finance and external independent directors with expertise as well.

Many of you who follow the Thai economy is probably familiar with the Monetary Policy Committee (MPC), another central committee of the Bank of Thailand that sets the policy interest rate with three goals. These include economic growth, inflation rate, and financial stability. It can be seen that financial stability is also one of the goals of the Monetary Policy Committee. because it is important and affects everyone in the economy.

Therefore, the Monetary Policy Committee and the Financial Institutions Policy Committee will have joint meetings twice a year, in June and December. To share information and perspectives on financial stability, as well as to discuss the policies that each regulator will implement and coordinate to strengthen the Thai financial system’s stability. A statement will be issued after the meeting to communicate the latest situation and risks to the public.

Not only the three main agencies mentioned above, but Thailand also has many agencies that help maintain financial stability. both broadly and specifically, such as the Fiscal Policy Office (FPO), which oversees overall fiscal, financial, and economic policies. as well as overseeing certain types of financial service providers such as Pico Finance, the Cooperative Promotion Department, and the Cooperative Auditing Department, which supervises all types of cooperatives. including Savings and Credit Cooperative, which has a large number of users in the Thai financial system.

How important is financial stability?

The importance of financial stability is like our health. When we are healthy and able to lead a normal life, we may neglect health care, regular exercise, and eating healthy foods because it can be tiring and unsatisfying. But whenever we have health problems, we regret that we should have done many things in the past. as well as stabilizing the financial system. Regular check-ups and listening to the advice of doctors to maintain good health are important. This will benefit those who participate in the Thai financial economy and ourselves as well. However, do not forget to maintain the stability of your own money.

Referrence : ธนาคารแห่งประเทศไทย