Gold reserves are very important to the country’s economic stability. Gold acts as a valuable and reliable asset, especially during times of economic uncertainty.

Back in the 1900s, most countries around the world pegged the value of money to the so-called “gold standard” system that maintained the value of paper money to the amount of gold by setting a fixed exchange rate between the national currency and gold. That means that each unit of money that comes out is the same value as gold, that’s why people can exchange paper money for real gold at a certain rate.

Although the gold standard system was officially abolished in the 1970s, many countries still keep gold as reserves because when economic uncertainties occur, demand for gold reserves increases.

Therefore, the central banks of each country have turned to gold as a Safe Haven. This gold reserve continues to play a role in determining the country’s financial credibility and economic outlook despite the current economic environment has already been developed a lot.

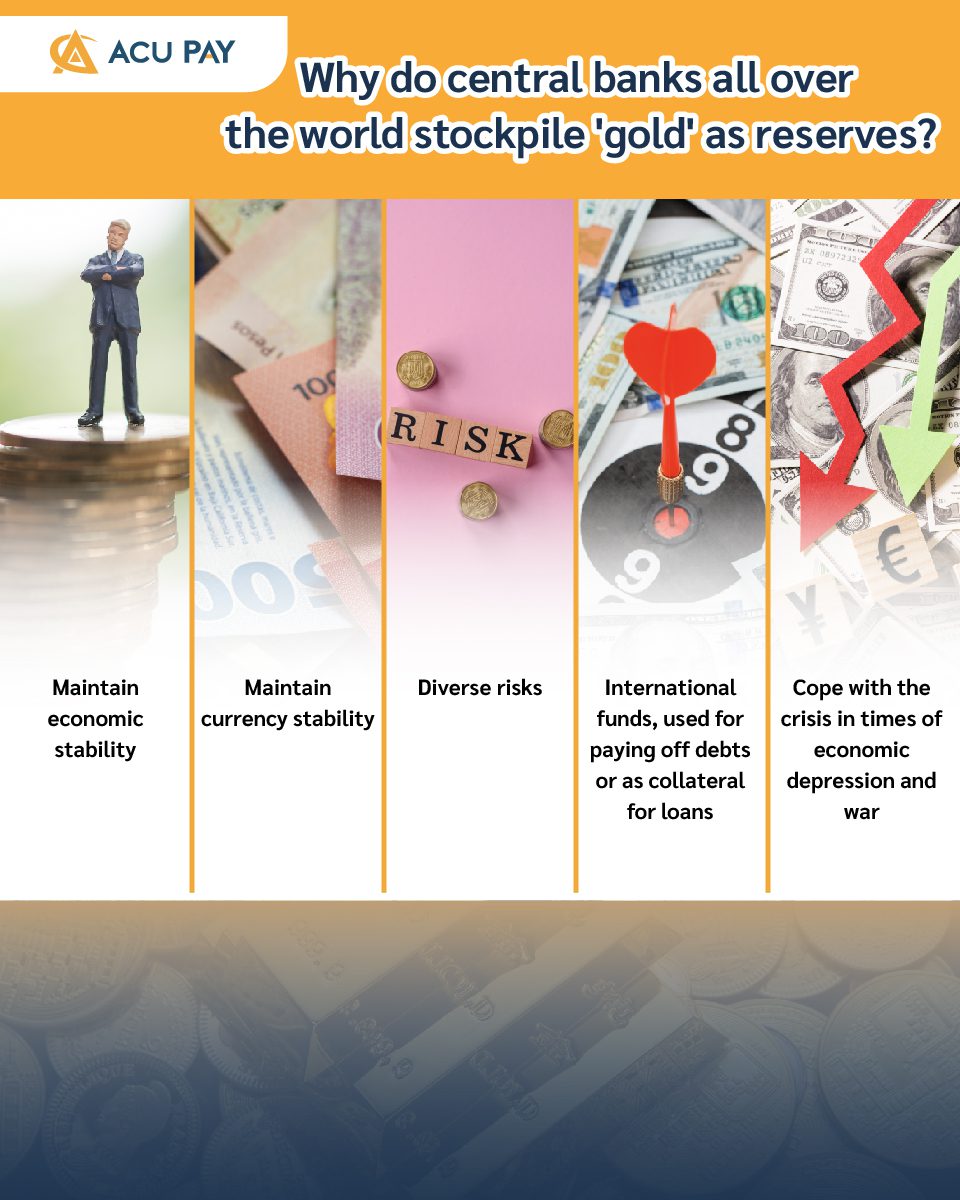

There is a reason why the central banks choose to stock gold as follows:

Gold is recognized as a stable and reliable value-storage. The country’s holding of gold represents economic stability, particularly during times of financial market volatility.

Although the money value of each country was based directly on gold, which this system is no longer used, many countries still consider holding gold reserves as a way of stabilizing the currency. In addition, gold can also prevent the risk of local currency value falling due to falling purchasing power during inflation.

Gold is a kind of asset that is different from foreign currency. Having gold reserves allows banks to diversify their investment portfolios and reduce their dependence on foreign currency solely.

International trade and capital in some countries use gold for international debt repayment or as collateral for loans. Having a lot of gold reserves will help improve the creditworthiness of that country.

Gold is known to increase its value during economic downturns or when political uncertainties arise in war, so gold reserves play an important role in preventing inflation and devaluation of the currency.

inally, during the economic crisis, gold reserves are safer than currencies or foreign assets. Thus, gold is dependent on many central banks around the world to maintain financial stability and attract foreign investors to invest again.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY