The protracted Russian-Ukrainian conflict is unlikely to end, and Western countries may impose more sanctions on Russia, including measures related to energy exports. Information from KKP Research estimates oil prices will hit an average of $130 a barrel in the second quarter and a full-year average of $110 a barrel.

The protracted Russian-Ukrainian conflict is unlikely to end, and Western countries may impose more sanctions on Russia, including measures related to energy exports. Information from KKP Research estimates oil prices will hit an average of $130 a barrel in the second quarter and a full-year average of $110 a barrel.

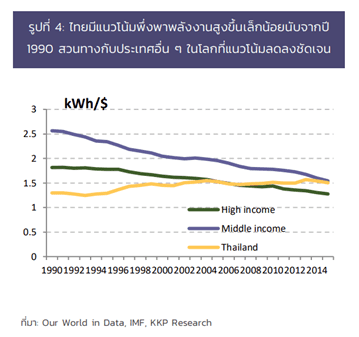

This is because the Thai economic structure always has a high dependence on oil consumption while the world has a tendency to decline. This is reflected by the amount of energy consumption per GDP or energy intensity. This represents the efficiency of using energy for the production of goods and services. Therefore, the Thai economy is one of the countries that has been severely affected and is quite susceptible to external factors. Therefore, although Thailand has experienced similar situations in the past during high oil prices, the policy structure has not been adequately and appropriately revised.

Thailand is one of the largest net energy importing countries in the region, so when oil prices go up, Thailand has to pay more for imported oil, resulting in a trade deficit. Every 10% increase in oil prices would result in an additional deficit of 0.3%-0.5% of GDP in Thailand’s current account, equivalent to 1–1.6 million foreign tourists.

In many cases, when the oil price increases, the trade deficit increases, the baht tends to depreciate at the same time. Likewise, Thai inflation is more responsive to energy prices than other countries in the region due to a higher proportion of energy consumption. Although there are some government subsidies for price measures

KKP Research estimates that the current rising oil prices are only the initial impact, but there is still a chance that prices of other commodities will continue to rise due to two factors:

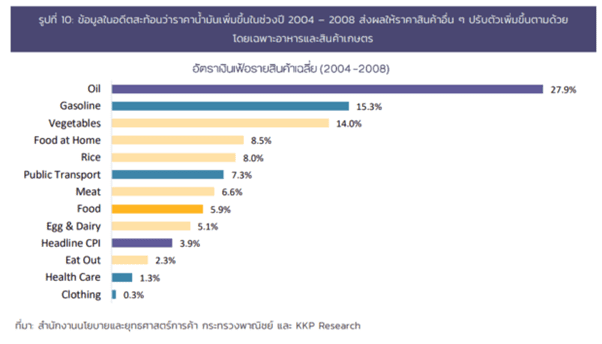

Despite some price control measures, food prices will inevitably rise in line with energy prices. From 2004 to 2008, Thailand faced inflation as energy prices accelerated by an average of 28% per year. Despite the fact that the majority of essential goods are priced using Department of Internal Trade measures. The prices of food and beverage products continued to rise by 6%, with the prices of some sub-categories rising sharply. For example, vegetables and fruits increased by 14%, rice by 9%, meat by 7%, etc. because energy prices are the main cost of transporting agricultural products. Higher production costs will increase the prices of other products, increasing the pressure on total inflation. Even though the economy has not fully recovered,

KKP Research believes that finding a mechanism that can help identify those affected and address the problem will benefit fiscal policy implementation and reduce its impact in the long run. In addition, the cost of the fiscal burden on subsidizing oil prices is on the rise. In a situation where the economy has not fully recovered, the use of government resources is necessary to be cost-effective. In the long run, there is a need to restructure the economy to use energy more efficiently and reduce dependence on energy to strengthen the Thai economy.

KKP Research comments that the rising cost of living from energy price hikes is affecting people’s purchasing power. In particular, for low-income groups, the government needs to take care of and manage. But with the rising fiscal cost of subsidies, it is becoming more challenging for the government and may need to reconsider policy actions to help people.

should focus on measures that do not distort the market. Because when the situation is long, there may be a shortage of goods and a stockpiling of goods. Therefore, subsidies by fixing oil prices may not be the most efficient method of resource allocation. The burden of finance is increasing steadily and the support that distorts the market price. So, people don’t cut down on their energy consumption when the price goes up. And it might be funding people who don’t need subsidies, causing the cost of the fiscal sector to be too high. In addition, the price subsidy measures help all groups of people, including those who use diesel cars. This may cause government costs to be unnecessarily high as well.

What kind of management methods do you think we should use? And what measures should be taken to deal with rising oil prices from the conflict that arises?

Source : kkp-research