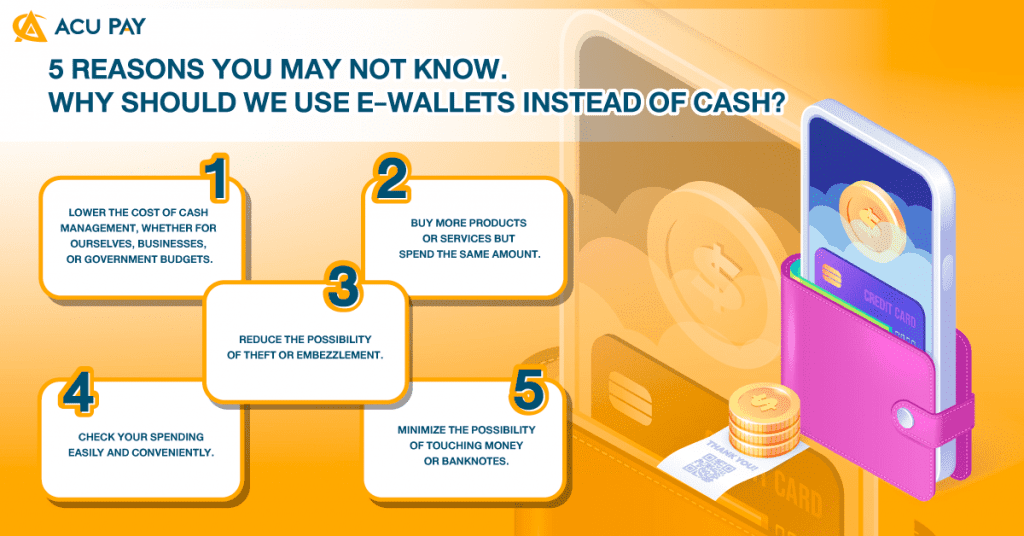

Not only for the convenience of paying for goods or services, but e-Wallets can help you save a lot and reduce the disadvantages of using cash. Let’s take a look at why you should use an e-Wallet instead of using cash or reduce your use of cash.

For example, we don’t waste time picking up money, finding a place to store it, or even checking what we pay is easy and convenient. No need to travel to withdraw cash. As for the store, it helps to reduce the cost of time, whether it is for bookkeeping. or even reducing errors in receiving or withdrawing money, because it can be checked in real-time. On the part of the government, it helps to reduce the cost of the cash management budget. From the banknote printing house to the delivery to the bank or ATM, it requires a management budget of more than 50 billion baht per year.

Nowadays, there are promotions for e-wallet payments all the time. to incentivize people to reduce their use of cash or banknotes and eventually change their spending behavior. Therefore, it is beneficial for users like us to get more products or services by paying the same amount or paying less through discounts. and can collect points from spending to redeem rewards as well.

The user and the store or service When we don’t have to carry or store cash, reserve money, or worry about employee embezzlement or theft, the savings are greatly reduced, so we don’t have to worry about losing money; we don’t have to check; and employees don’t have to worry about missing money, which even reduces the problem of receiving counterfeit bills.

able to check all past expenses, making it easy to check the origin of expenses. This makes it easy to manage expenses on a daily and monthly basis. Both for the users themselves or even the merchants, who have to make an account and check it all the time.

Whether it’s COVID-19 or even other contagious diseases caused by touching money Because we can’t know what money or banknotes that we hold or touch have been passed or what has been touched. To protect ourselves, there may be several methods, such as spraying with alcohol or cleaning before use. But one way that we can hardly worry or prevent ourselves from transmitting the disease to others is through e-Wallets that do not have to touch anything other than our phones.

However, using an e-Wallet or e-Payment is an alternative that will allow us to conveniently pay for goods and services.