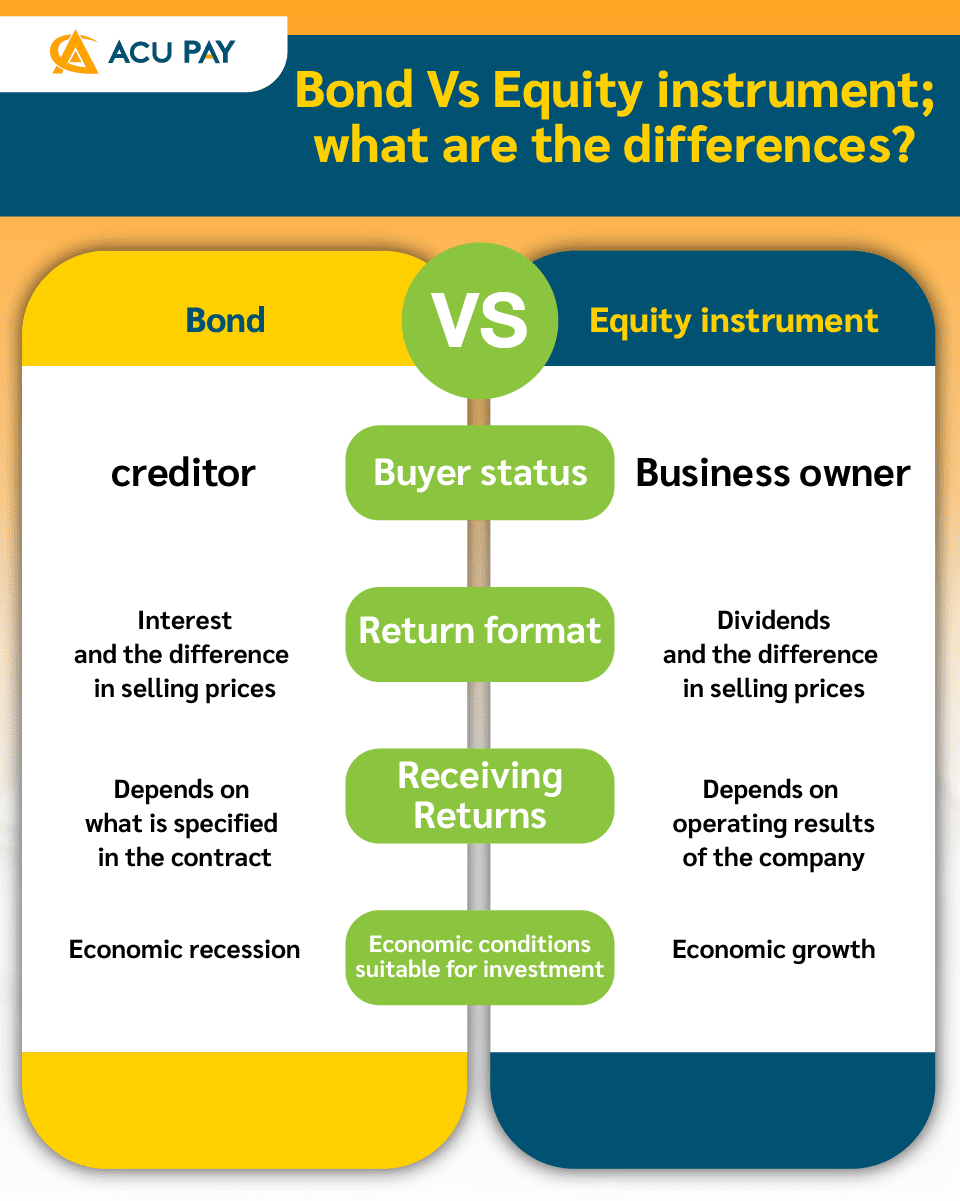

Anyone who starts studying about investing or is interested in investing in bond and equity instruments may have questions about the difference between these two types of investment. Today, ACU PAY will take you to understand the similarities and differences between these two investments.

Bonds are financial instruments in which the holders or ‘investors’ have the status of ‘creditors’ and those who issue the instruments have the status of ‘debtors’ Creditor will gain returns in form of ‘interest’ regularly at a fixed time and will receive ‘principal’ at maturity. The examples of bonds that we may have heard of are such as Treasury Bills, Government Bonds, and Private Bonds.

For example, The A Company wants to expand its business by using a large sum of money, the company then borrows other people’s money to operate its business which is called debenture for individuals to purchase. The debenture is divided into units and each unit has the same value. In Thailand, the debentures are usually valued at 100 baht per unit and 1,000 baht.

This type of investment has stable returns because creditors will receive returns every 3 or 6 months. Bonds are relatively low-risk investments but offer consistent returns that are higher than general deposit rates of 2-5%.

Investing in government bonds which are issued by the government have lower risk than investing in debentures which are issued by the private companies. Investors need to study carefully to make sure that such a company that issues the debenture has stable financial status that can pay interest consistently and be able to repay the principal.

Bonds are considered low-risk investments, so investors will get low returns as well. It can help diversify risks but if you invest too much in bonds, you may lack wealth in the investment and lose the opportunity to invest in other things.

Investors who invest in equity investments have the status of ‘business owner’ who can issue the instruments and have a stake in or right to property and income of business. Equity instruments that we may have heard of are such as common stocks and stock warrants, including Derivative Warrant or DW.

Equity instrument holders will receive the returns called ‘dividend’ but the business that issues equity instruments has no obligation to pay dividends. In terms of risk, there are many risk factors such as risks arising from changes in market conditions that may affect stock prices, including risks in terms of the company’s operations, such as changes in management or company policies.

For example, The B Company is open for individuals to jointly own business. When we invest our money, the company will divide its shares with us and we will get dividends as a return. The company will determine how many and when dividends are paid, depending on the business performance of each year

Investment in equity instruments requires confidence that the businesses we choose are stable, have a chance to grow, and be reliable. We need to learn more about the businesses we’re interested in investing in. Although some may not have a lot of investment money, we would definitely like to see our business grow.

As we know that Bonds and Equity instruments are both investments but have different objectives. ‘Investors’ who invest in Bonds have the status of ‘creditors’ while the companies that issue bonds have the status of ‘debtors’ Creditors will receive ‘interest’ as return on their investment at the fixed time and will get ‘principal’ back when at maturity. It is a low-risk investment that helps diversify risks.

This is in contrast to equity securities that must be ‘company owners’ or have rights to property and business income, which will receive ‘dividends’ and returns depending on the company’s performance. Equity instruments will have a higher risk of loss, but they will also be highly profitable.

No matter what type of investment you make, you always have to study what you’re going to invest in because every investment, not only money and profit but including the time that we spend to achieve the desired return.

ไม่ว่าการลงทุนแบบไหนเราก็ต้องมีการศึกษาหาข้อมูลในสิ่งที่เราจะลงทุนเสมอ เพราะทุกการลงทุนนอกจากเงินและกำไรแล้ว ยังรวมถึงเวลาที่เราได้ลงทุนรวมไปด้วย เพื่อให้ได้ผลตอบแทนตามที่ตั้งไว้