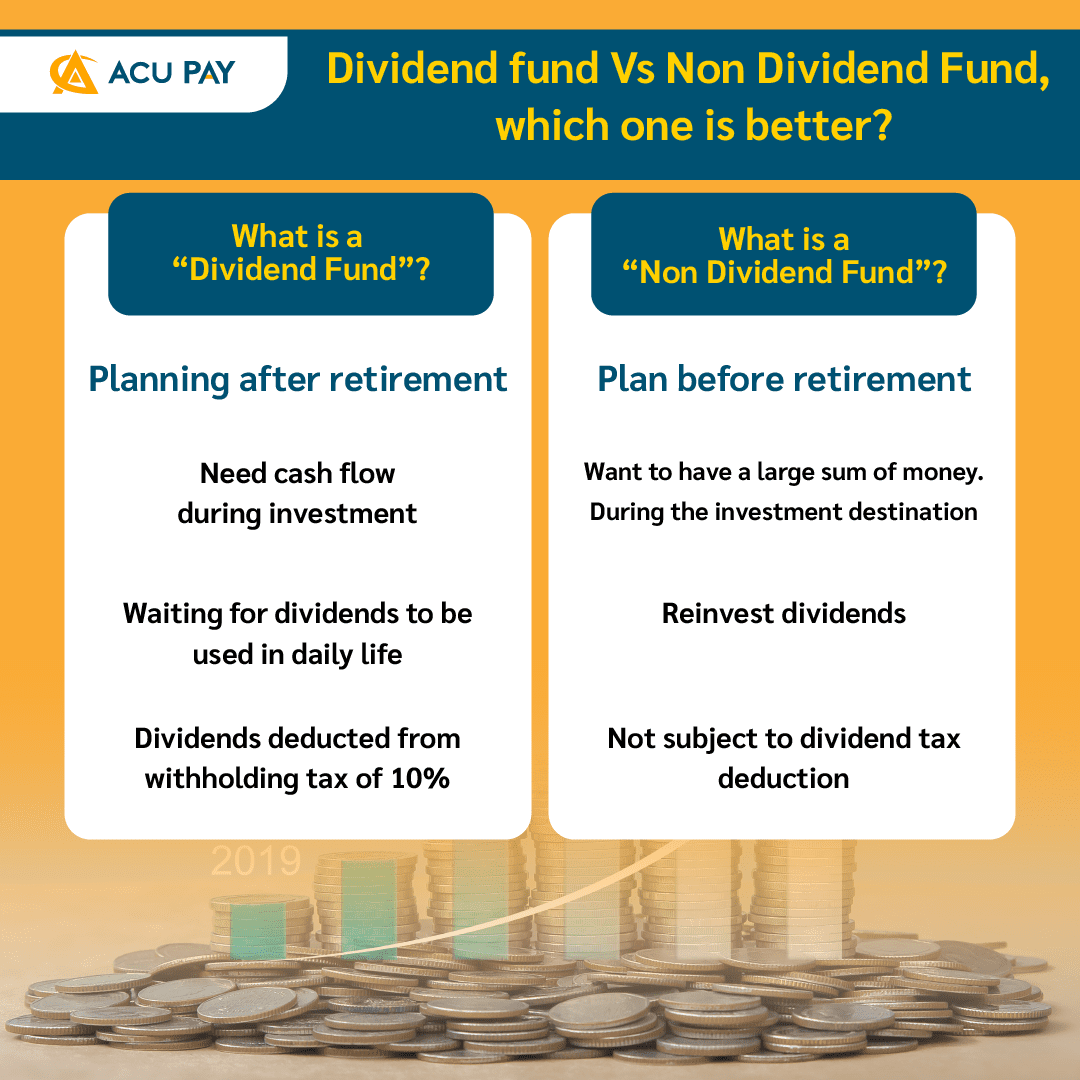

A Dividend Fund is a fund that pays returns to investors who invest in funds. Profits are paid as dividends to investors like us. The dividend is taxed with a withholding tax of 10% by calculating dividends and the frequency of payments depending on the fund policy.

A non-dividend fund is a fund that does not pay dividends to investors. However, the fund will continue to use the profit from investment to invest more which will increase the value of the fund so we can clearly see the power of compound interest. (in case investment continues to improve)