Apart from investment in traditional assets such as stocks, funds, and gold, there is another way of investing to generate Passive income which is Collectibles. Knight Frank, a world-class real estate consultant, has rated Passive Investment’s performance which is interesting to invest in the last year to see how much assets have risen in the last year and the past 10 years.

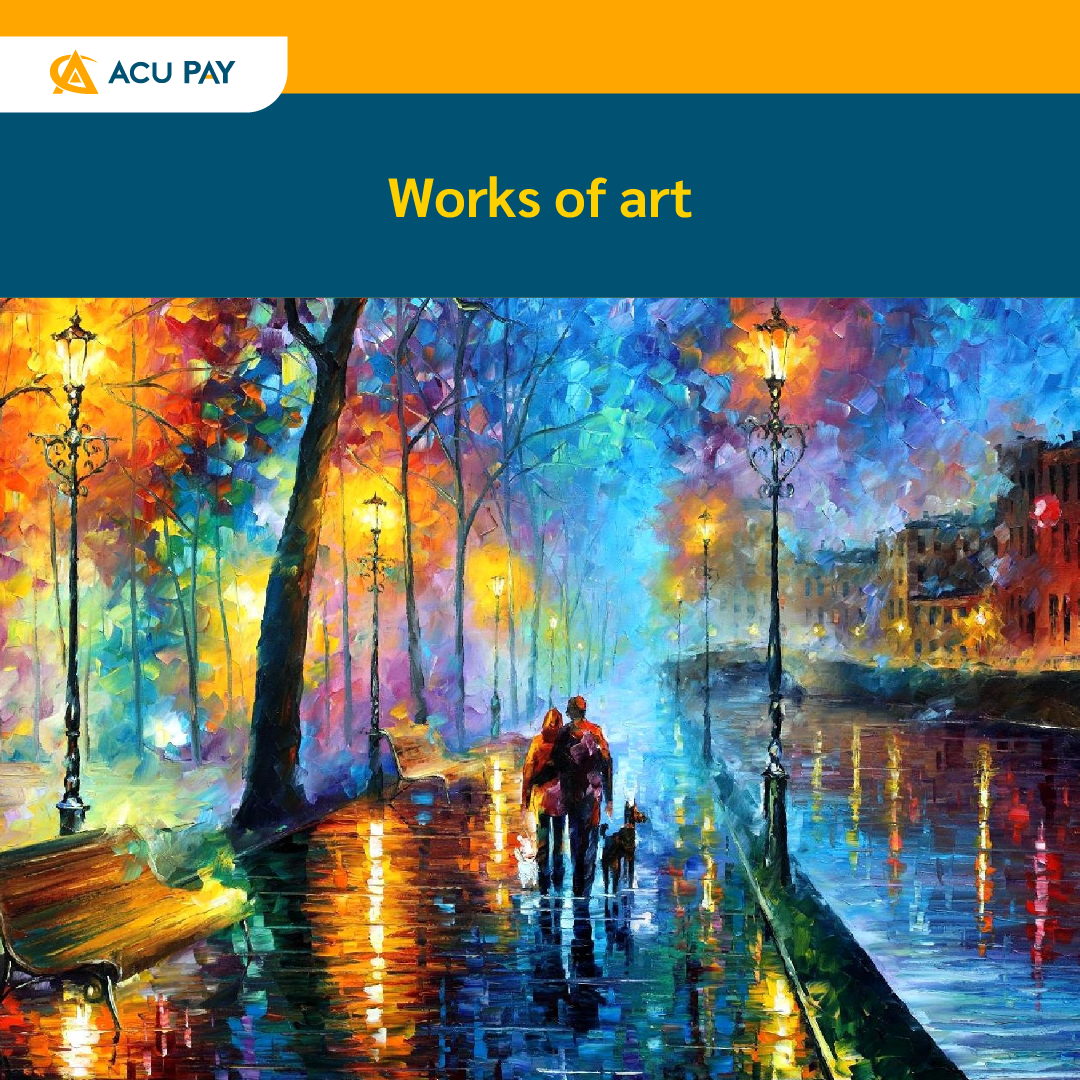

An investment in the works of art is another interesting option. Arts market tends to grow continuously. In 2020, it was found that the auction value reached 17.08 billion, or around 633 billion, increasing by 60%.

The collections of arts is relatively wide because of many different kinds of art. Recently, one of the works of art that is popular in trading is Pop Arts and Art Toys.

According to information from Knight Frank, it is found that a work of art in a year gives a return of around 30%. However, after 10 years, the work of art gives a return of around 109%. This depends on the renown of the work of art or artist reputation. If he or she is a new artist, we have to look at the development and consistency of whether there is a chance of growth or not. In terms of types of art at present, Contemporary Art has more price movements than art from other eras.

Beside being an accessory to tell the time, a watch has been a valuable asset and eye-catching collectibles in the past few years. The best luxurious wrist watch brands to invest in are Rolex, Patek Philippe and Audemars Piguet. The watches from those brands are high in quality, special and unique. Watches from these brands tend to keep increasing in worth or value over time, such as having limited models that raise prices.

In Thailand, the Watch Collection Market is still attractive. There are a lot of new investors joining the investment. Knight Frank’s information shows that after 1 year, a watch gives a return of 10%, after 10 years, the watch gives a return of 147%.

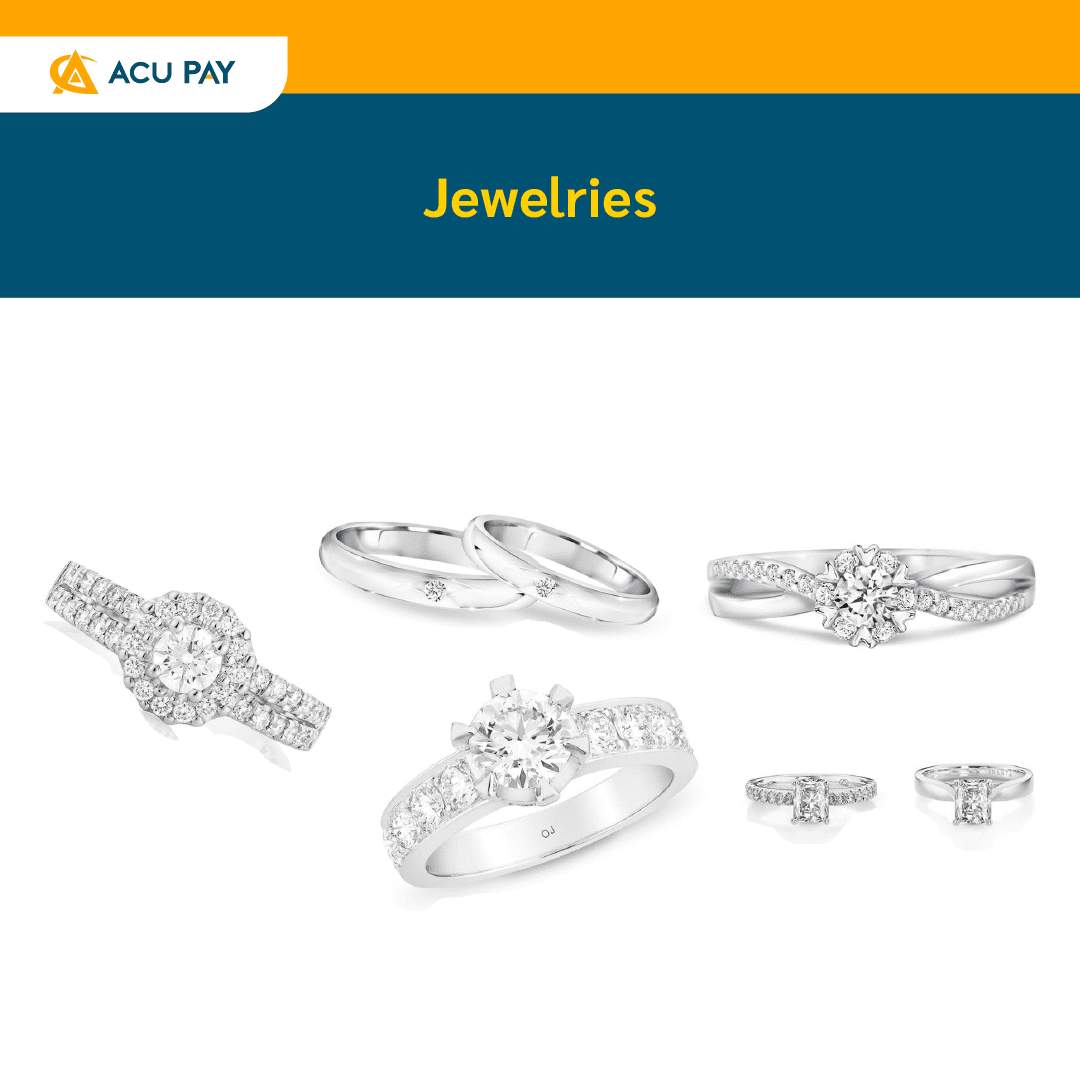

In the world of investment, jewelries are not suitable for buying and selling out to make profits in a short time. Jewelries are suitable for long-term investment. Besides the profits in return, you will feel good when wearing them.

For Jewelry investment, according to Knight Frank’s data, the return of jewelry after 1 year is 10% and 39% after 10 years. It is recommended to start investing in the jewelry that you are interested in, then allocate a budget according to your passionate jewelry.

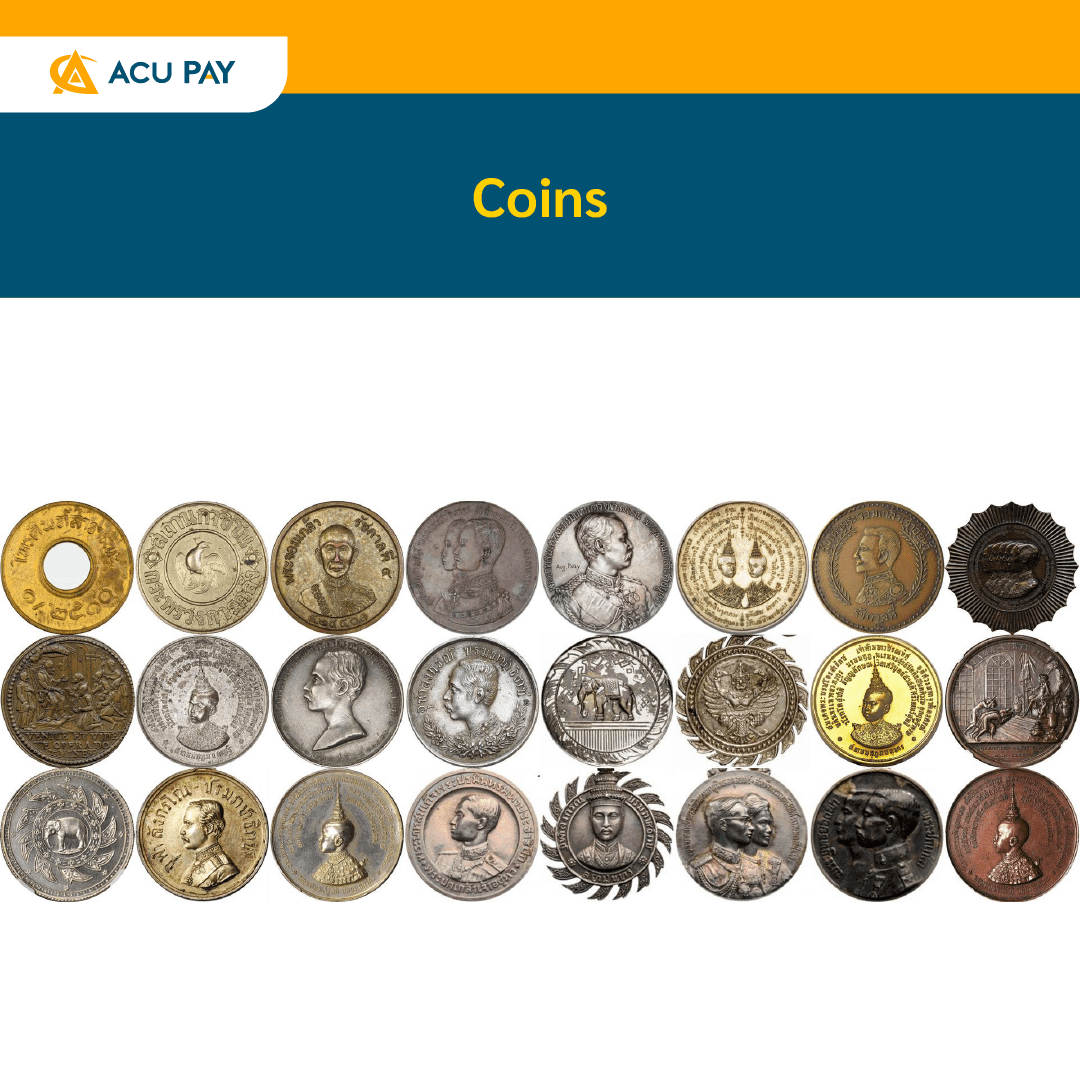

The Treasury Department, Ministry of Finance, usually produces coins for the fiscal year and keeps modifying the appearance and identifying the B.E. year of production on the back of the coin.

The specialty of coin collection is a limited and non-repeated edition of coins. Normally, coin collectors collect coins used in daily life or commemorative coins have different prices. In Thailand, there once collected 10 baht coins produced in 2533 B.E. and sold for hundreds of thousands of baht.

For coin collection investment, a return after a year is 8% and 59% after 10 years.

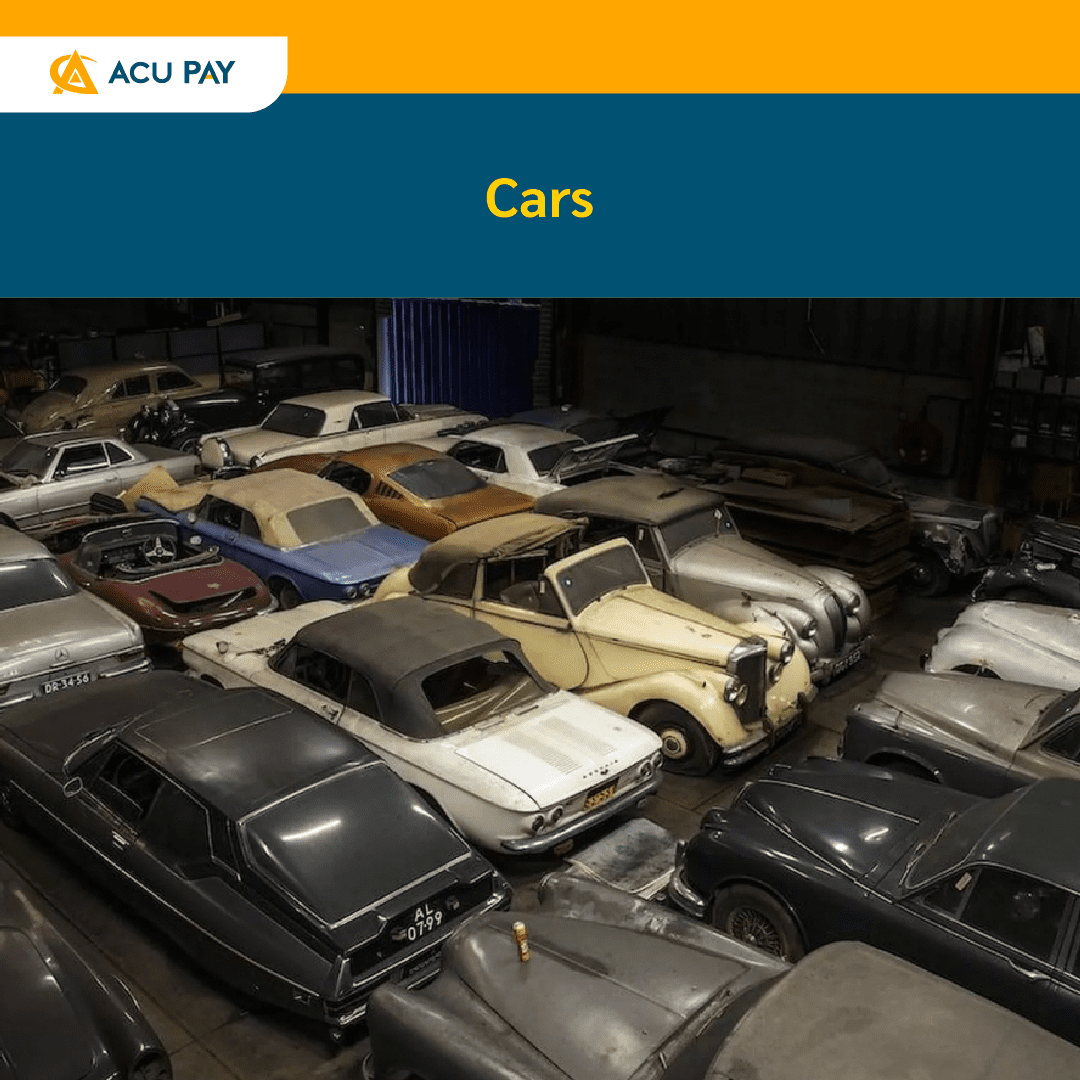

An investment in car collection is not new abroad because classic cars that originated in Europe are hard to find at present. The longer you purchase those cars to collect, the higher the price is. In Thailand, the trend of buying cars to collect and sell for profit has become increasingly attractive to people due to higher imports.

After 1 year of investment in car collection, the return is 5% but after 10 years, the profits rise by 118%. It is recommended to invest in the cars that you like but you need to reserve some money for additional repairs.

Another investment option for those who are passionate about the taste of wine, but not every “wine” is worth investing in. Investors need to study and choose to collect wine in Grand cru grade which is produced from an excellent source of wine or En Primeur wine, fresh wine in the process of fermentation and shall be launched in the market no later than two years from the date of the beginning of production. It needs to be a famous wine brand and popular among wine collectors as well.

After 1 year of investment in wine, a return is 5% but after 10 years, the return can rise to 149%. It might seem high in return but may lack liquidity in trading because the size of the market does not grow for the general public.

“Diamond” is still one of the assets which always has increased in value and is the thing that investors are passionate about. The diamond you purchase should be held for a long time and the diamond should have certification as well. You need to understand that there are many grades of diamonds starting from below the K to M Color Diamond to D Color Diamond. The grade of diamond which is the easiest to trade and is in the demand of the market is F Color Diamond.

The diamond with the highest price in 2023 is Blue Royal with the price of 43.8 million dollars or 1.55 billion baht at the Christie’s auction, Geneva.

The return after 1 year is 4 % and after 10 years is 13%. However, the popularity of the diamond industry has decreased since new generations turn to synthetic diamonds more, especially the Z Generation people who value diamonds differently from the past.

As we all know that apart from beaty, luxury, and style of designer handbags, another value of designer handbags is to be an asset that can create value to the owner as well.

Currently, these kinds of goods or collectibles can make the profit high up to 13% and tend to go higher continuously. The designer handbag brands that are popular to invest in are CHANEL CLASSIC FLAP, HERMES BIRKIN, and LOUIS VUITTON NEVERFULL

The profit in designer handbags investment after 1 year is 1% but can get high up to 60% after 10 years.

Did you know that furniture or home decorations can create value for us as well? Investment in this type of asset has the same characteristics as mentioned before which are rareness and uniqueness that can not be bought anywhere else.

For example, Chandelier is one type of furniture that has value more than lighting, but it also represents success. The price of a Chandelier starts from hundreds of thousands, millions, or tens of millions. The price of a Chandelier tends to be higher and higher each year.

For general furniture investment, home decoration was 0% profit after 1 year and 13% profit after 10 years.

Those who love drinking alcoholic beverages, purchasing liquor as collectibles is another way to invest such as rare whisky. There are 2 factors for purchasing whisky in the investing grade which are the rareness and quality. AN example of whisky which is desired by many collectors are those whisky which are discontinued or from a legendary refinery that has closed down.

For investment in rare liquor, after a year it will have a -4% profit, but after 10 years it will be 322% higher.

References from

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY