The policy interest rate is a national bank’s tool to maintain financial stability in order to avoid adverse economic conditions in that country. Are you guys wondering how these policy interest rates will be able to stabilize? Today let’s see together what is the impact of a change in the policy interest rate on us and the economy.

The policy interest rate is set by the central bank, and it is the most important rate since it influences all other interest rates in the economy.

The policy interest rate is the rate at which the central bank will pay or charge commercial banks for their deposits or loans. This rate will consequently affect the interest rates that commercial banks apply to their customers, both borrowers and depositors.

The Bank of Thailand’s policy interest rate is the 1-day bilateral repurchase rate.

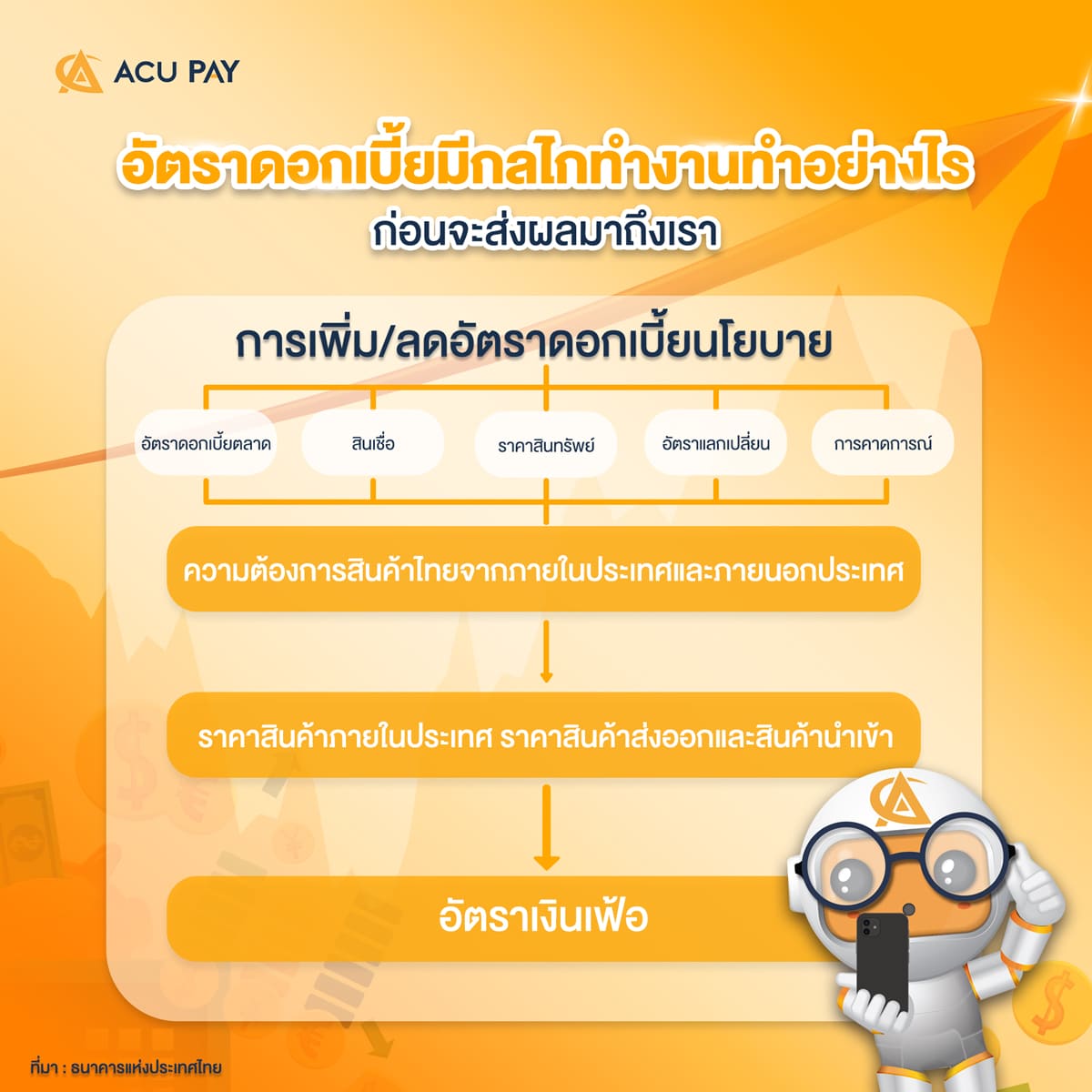

Transmission follows 5 main channels including:

The transmission under these channels will broaden to changes in spending and investment in the economy and will ultimately affect production volumes and inflation.

When the central bank decides to decrease the policy rate, adjustments in short-term money market rates occur. Given that prices are sticky, real interest rates (i.e., inflation-adjusted nominal interest rates decline firstly in the short-run then in the long-run, in line with the term structure.) Part of these adjustments can be explained through portfolio management of financial institutions in order to maintain competitiveness and generate profit and ultimately result in a decline in deposit and lending rates.

From above, a decline in real interest rate lowers the opportunity cost in consumption and investment causing private domestic demand to expand. Subsequently, the economy grows at a higher pace and inflationary pressures increase.

From above, a decline in real interest rate lowers the opportunity cost in consumption and investment causing private domestic demand to expand. Subsequently, the economy grows at a higher pace and inflationary pressures increase.

This channel of transmission can also be explained through price level expectations since an accommodative monetary policy stance also leads to higher price level and inflation expectations. As a result, real interest rates decline and higher economic growth is achieved as above.

When the central bank decides to decrease the policy rate, adjustments in short-term money market rates occur. Debt obligations of businesses decline, thus strengthening their balance sheets. In turn, financial institutions are more willing to lend to businesses given lower risks. As a result, investment increases, resulting in higher economic growth. At the same time, inflationary pressures rise.

When the central bank decides to decrease the policy rate, adjustments in short-term money market rates occur. People then reallocate their savings towards non-interest-bearing assets such as real estate and equity. A rise in demand for these assets results in higher prices. As a result, wealth increases and higher consumption follows. Moreover, higher equity prices also increase the market value of firms, thus making it more worthwhile to invest. Ultimately, an expansion in domestic demand would lead to higher economic growth.

When the central bank decides to decrease the policy rate, adjustments in short-term money market rates occur. Returns on domestic investment decline relative to those from foreign investments, thus causing outflows of capital. As a result, the baht depreciates, benefiting exports, employment and income. This would in turn stimulate consumption. At the same time, depreciation in the baht causes imports to be lower. Thus, net exports increase and lead to higher economic growth.

Changes in monetary policy stance affect expectations of the public concerning inflation, employment, growth, future income and profits/losses. Such changes in expectations in turn determine private economic activities. However, the impact of monetary policy through this channel is the most uncertain of all channels, as it depends on the public’s interpretation of such changes in monetary policy stance. For example, the public may view a decrease in the policy rate as a signal that the economy is going to expand higher in the future, boosting their confidence to consume and invest. On the other hand, they may believe that the economy is weaker than previously expected, lowering their confidence and ultimately consumption and investment.

Inflation forecasts help guide inflation expectations which are important determinants of wage increases and actual inflation in each year as well as long-term interest rates. Thus, inflation-targeting countries are committed to anchoring inflation expectations of the public through the announcement of an inflation target.

How’s everything? Can you guys see a clearer picture of how the rising and falling interest rates will be passed on to us? even in terms of macro, it’s the part we can’t control. But what we should do is adjust according to the situation that arises to get the best at that moment.

Reference: Bank of Thailand