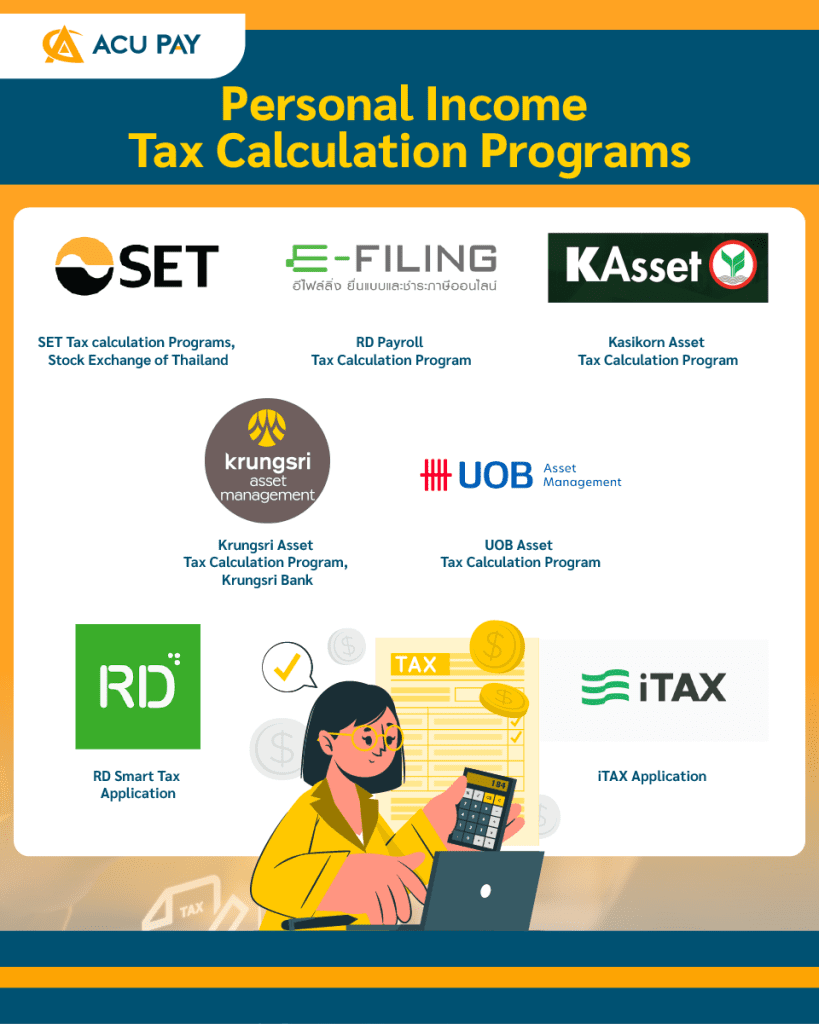

Today, ACU PAY gathers Tax Calculation Programs for those who are still confused about tax calculation. What are the highlights of each program? ACU PAY will conclude and explain it to you guys!

Let’s start with the first Tax Calculation Program from SET, Stock Exchange of Thailand. The web page is modern and easy on the eyes. The website divides its usage into 3 main pages which are income, allowance, and the result of the calculation. There is a blank to fill in the number so you will know the tax payable and tax allowance.

Nevertheless, this website is ideal for those who file taxes regularly. This might not be suitable for those who are not familiar with taxes because there is no explanation about the information that you need to fill out in each blank which may cause confusion and overlook.

It is available on the website www.set.or.th

This is a program to help in tax calculation and tax filing from the Revenue Department. There will be a choice between filing the form P.N.D.90/91 or P.N.D.94, then there will be a page to fill in the income data, and tax allowances, and update the tax allowance from the state to try calculating the tax payable.

Highlights of this program is to save the file and use the file for tax filing at the Revenue Department website. It is so convenient in tax filing.

Next is the tax calculation program from Kasikorn. This web focuses on using fund purchasing for tax breaks. This is suitable for people who are interested in SSF/RMF but the income page isn’t very detailed.

After calculating, the website will recommend mutual funds purchasing according to the stipulated criterias by the government. This is another option for online merchants or individuals who would like to purchase funds for tax allowance.

It is available on the website www.kasikornasset.com

Next is the Krungsri Bank tax calculation program. The web page looks simple, and concise, and has 3 parts together. The first part is annual income, personal allowance, and other tax allowances. The topic contains a brief description of the allowance.

This program is suitable for people who have knowledge in finance and the sources of income is not very detailed in this website. It can be used to calculate preliminary taxes.

It is available on the website www.krungsri.com

UOB’s tax calculation program is designed to suit the majority of people interested in funds for tax breaks, such as RMF, SSF, pension insurance, and ThaiESG, but does not focus much on personal income and expenses. It is more suitable for those who are interested in buying a fund with UOB. It is another web site that helps calculate the value of fund investment.

It is available on the website www.uobam.co.th

Rd Smart Tax App is a new dimension of government transaction services from the Revenue Department. It facilitates both taxpayers and individuals with a modern look and is easy to use. The highlight of the RD Smart Tax app is to update information directly from the Revenue Department or even government agencies.

In addition, it can check tax refund applications and submit documents for consideration. This app can also find the location of the Revenue Service and Tax Payment Unit.

The outstanding feature of the RD Smart Tax App is that once we have filled in the calculation data in the app, we can directly apply that file for tax filing. So interesting!

Download RD Smart TAX App on iOS

Download RD Smart TAX App on Android

The iTAX app is a personal income tax calculation app that developers believe all taxpayers are the real heroes of the country, so taxes should be the easiest, most convenient, and most economical way for all taxpayers. Therefore, iTAX makes complex taxation into an easy-to-use application at every stage. The iTAX is a personal income tax calculation program that supports tax calculations of all income categories and provides us with detailed tax planning which makes taxation no longer difficult.

Download RD Smart TAX App on iOS

Download RD Smart TAX App on Android

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY