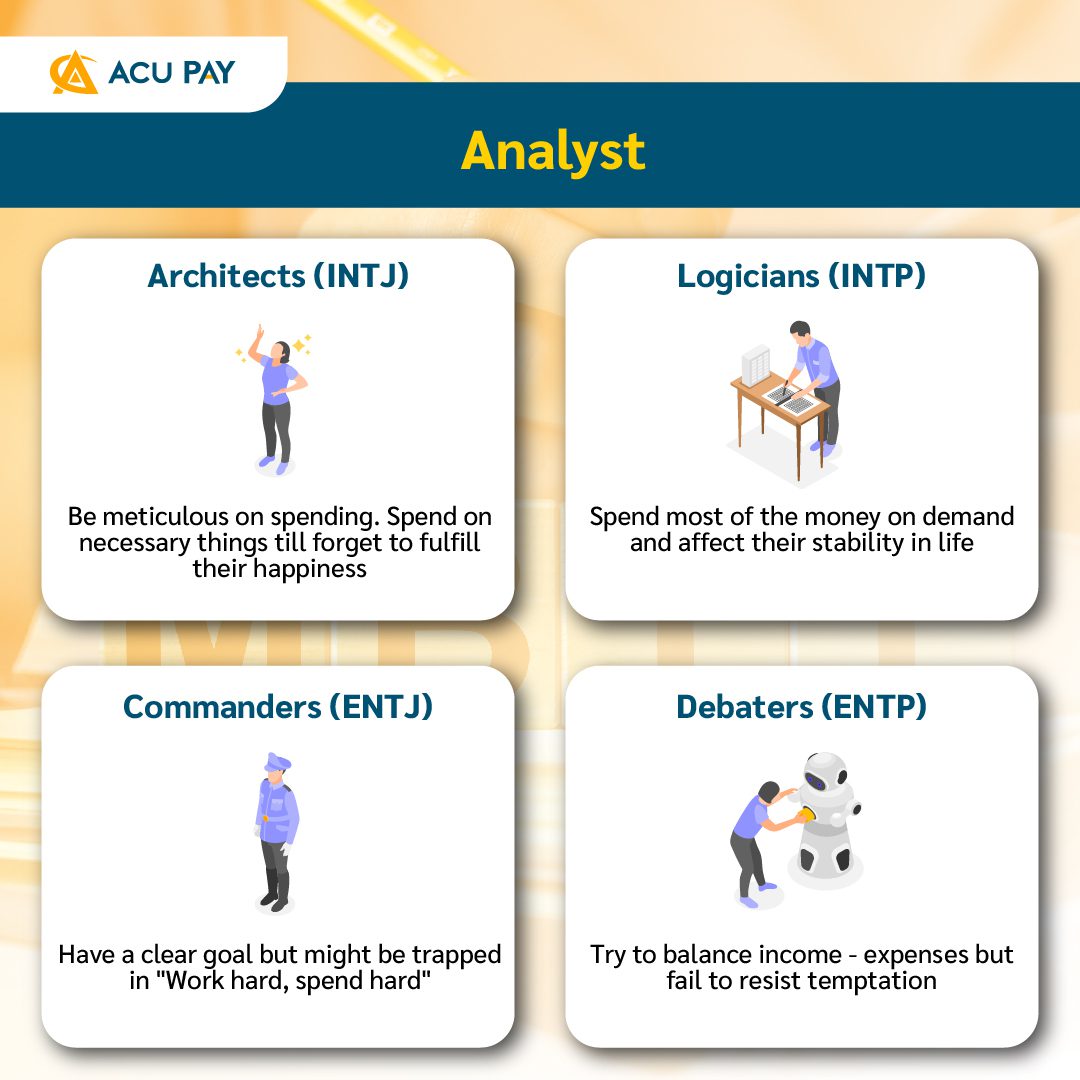

Analyst: INTJ, INTP, ENTJ, and ENTP

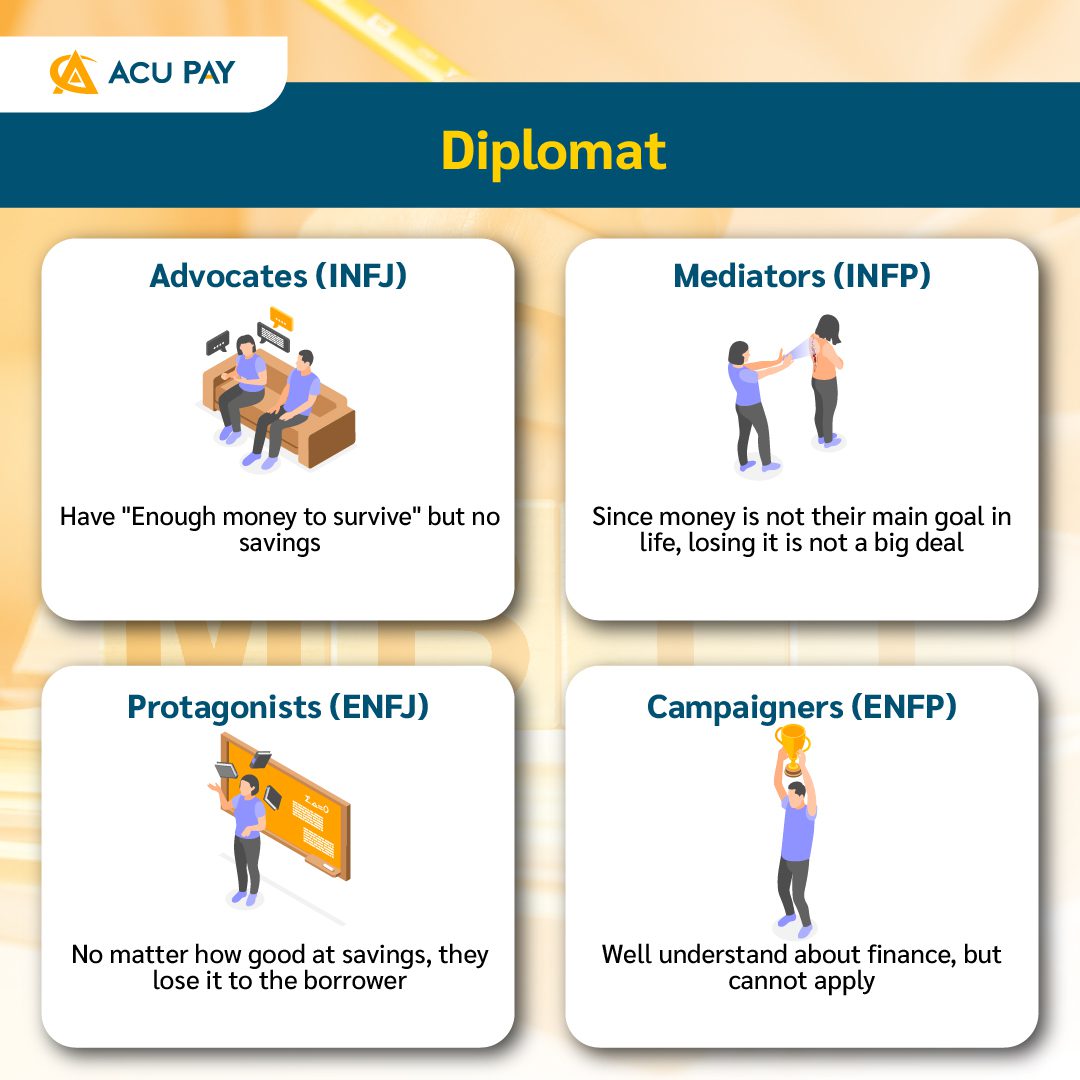

Diplomat: INFJ, INFP, ENFJ, and ENFP

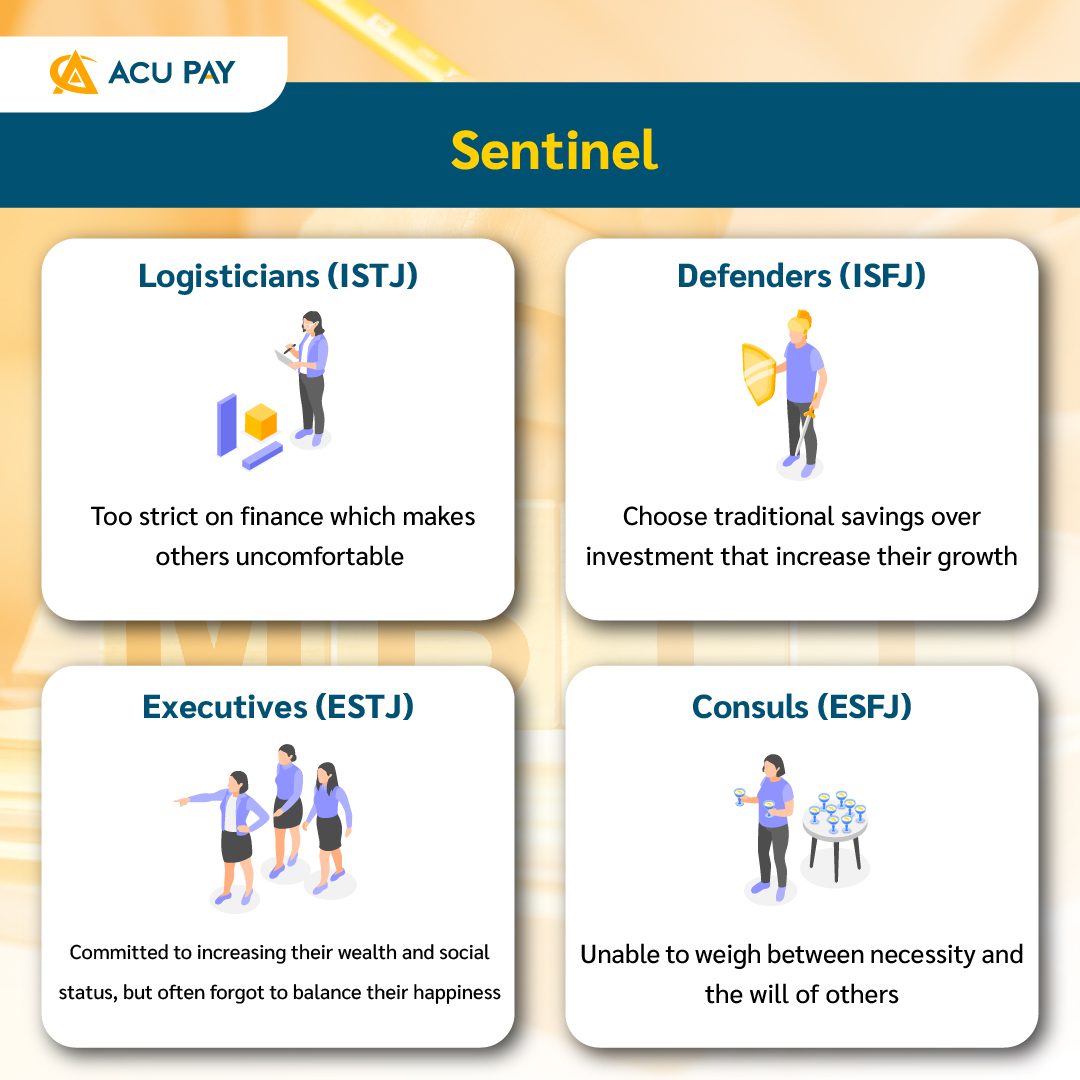

Sentinel: ISTJ, ISFJ, ESTJ, and ESFJ

Explorer: ISTP, ISFP, ESTP, and ESFP

People in this group have a personality of a designer. They are smart, cautious, and good at keeping details. They are farsighted and take their job very seriously.

Spending habits: INTJ people are meticulous about spending. They are thrifty, not overspending, and can resist temptation. In addition, they plan and learn how to have money work for them to make a profit within 10 years. Their plan is going to succeed for sure because they plan and think thoroughly.

Financial tips: It can be seen that INTJ people have good Spending habits, but they may lose some joy and excitement in their lives. Try buying themselves happiness occasionally because our lives are so short.

People in this group are introverted, full of ideas, curious, and analytical. They are so creative and tend to find answers for everything on earth.

Spending habits: Spend money on demand more than on accumulating wealth. People in this group spend their time planning to make as much profit in the financial world as possible from small investments and risks, which is good. However, if they only think about it in their head and don’t do it, they can endanger their financial situation.

Financial tips: There should be financial advisors or those close to them who have financial and investment knowledge who can advise them.

People in this group are born to be a leader. They are diligent, serious at work, confident, bossy, and strict in working and generating income.

Spending habits: WHen it comes to finances and investments, ENTJ are not afraid of any risks or hesitate to take out a loan or borrow money from the bank because they are confident that they can repay all the money in the blink of an eye. Thus, they may fall in the trap of “Work hard, spend hard”

Financial tips: It is recommended to set the automatic transfer to transfer a part of your monthly salary to your savings account or long-term investment that have low risks. This will help people in this group to save something for the future.

People in this group have the personality of a debater. They are sociable, talkative, realistic, creative. They get the energy from the outside world and love the challenge.They tend to look for jobs that require minimal labor and low responsibility but receive more reasonable returns than regular jobs that require fixed time.

Spending habits: ENTP people will use up all their monthly wage as soon as they receive it. They try to balance their income and expenditure but fail to resist buying something they really want. They may end up using too much on credit cards and taking out too many loans.

Financial tips: To prevent spending without thinking thoroughly, it is recommended not to use credit cards if there is no reserved money to repay the credit card debt. They should check their debt burden to be not more than 50% of the assets.

People in this group tend to be introverted, kind, genial, caring, and polite. They are quick learners, hard to reach, and tend to perceive things deeply.

Spending habits: Finance is a vulnerable thing for INFJ people. They rather dream about it rather than actually do it. They see money as sufficiency which means that they only need enough money just to survive with little savings, which can have some impact on their retirement. Since they also trust others easily, there is a chance that they can be taken advantage of.

Financial tips: They need to be more ambitious. In addition to reserving money for emergencies, they need to start investing to make more returns than just a deposit interest. They have to save money and do not borrow their own money.

They are romantic, emotional, introverted, tend to live in their imaginary world rather than the real world, perceive the world ideally, and pay attention to beliefs and true value in themselves and their families.

Spending habits: They do not care about money and stability. They often spend their money with poor decisions because money is not a principle in their lives. They only want enough money to survive, but they will be very tired if they have to take care of others.

Financial tips: Find a financial advisor with knowledge who can provide advice on setting goals, establishing financial discipline and making good investments.

People in this group are sociable, optimistic, creative, don’t perceive the world as it actually is, but can take good responsibility for their life.

Spending habits: They are good at money savings, generous, sharing, and highly extroverted. They love to buy presents for their friends and people around them. They are soft-hearted and are pitiful of people who suffer.

Financial tips: Prioritize spending and adjust the criteria for spending, including setting financial goals.

They love fun, like to create smiles and laughter, happy in living, are competitive, but interest in something doesn’t last long and can get bored easily.

Spending habits: ENFP people spend money like water, but they will not reveal their financial status. People in this group believe that using less money can make their lives better but they also have enough money to spend on what they like. This is why they are distracted and forget what they intend to do.

Financial tips: Use an app that can track their own financial status both income-expense record and savings.

People in this group tend to be serious, introverted, thrifty, sensible in solving a problem, see the world realistically, and respect the rules and also would like everyone to do so.

Spending habits: ISTJ people are thrifty, strict, and very careful in spending. They will think over and over again before using money. They believe that their way of managing finance is correct and cause others to feel uncomfortable.

Financial tips: They should talk openly about finance with people around them to prevent others from feeling uncomfortable and find the balance in spending and savings.

People in this group are warm-hearted, gentle, kind, and caring for others. They love to help others and are happy to help them.

Spending habits: ISFJ people choose savings over making more money. They like to save in a traditional way, little spending, and do not spend on something unnecessary. They focus on safety for the stability in their and their loved lives.

Financial tips: Increase additional skills on finance more, including confidence and better decision making in saving and investment.

People in this group have the personality of an executive. They are serious, responsible, highly careful, love to be leaders, emphasize on a system of classes, rules, and traditions.

Spending habits: Social status is very important to them. They can pay higher to get better things. People in this group are very good at making money. They have a high income, plan their finances carefully, focus on making more money than using it, and not forget to save.

Financial tips: ESTJ tend to work hard and do not have enough rest till they lose a balance in living their life. It is recommended to take a day off and hangout with your lover to recharge themselves before getting back to work.

People in this group are sociable, cheerful, caring, and give importance to others’ feelings. They have a lot of friends and highly sympathize with others.

Spending habits: They are careful about spending money but tend to prefer traditional saving to making more money. However, with the personality of a consultant, be sociable and care for others, they often make decisions based on others’ demands.

Financial tips: Understand both the perspective of others and the need for their own money use. Find creative ways to balance, learn to negotiate, and prioritize.

This group of people often make decisions and see the world in reality, be reasonable and fully engaged in all activities, and enjoy various fun and exciting things.

Spending habits: ISTP people are simple. They spend less than they should, ignore the externalities, and are eager to find a high-yield job where the workers are not tired and have little commitment to their careers. They can quit if they get what they want or have saved enough money.

Financial tips: Should change the way of thinking that money is unstable and can change at any time, to start strategies for future financial planning.

This group of people has adventurers’ personalities, making them see the world as it is, be down to earth, emotional, imaginary, and highly flexible in life. They are observant and can get energy from the inner world.

Spending habits: Life is a journey, so wealth is not their destination for this group of people. They tend to do more of what they care about, have freedom, and have no pattern.

Financial tips: Getting too much information about financial planning may make ISFP people so bored and lose interest. They should invest in something that is more interesting, such as art or value collections, watches, and hi-end handbags.

These people are entrepreneurial, passionate, and risk-taking.

Spending habits: Using money as a tool to create value, think big, and be enterprising. Traditional savings bore ESTP people, so they prefer investments that are exciting and high-risk because the riskier they are, the more profitable they become.

Financial tips: Being at risk all the time is not good. ESTP people are recommended to be conscious, analyze factors, think slowly, and not rush. They should ask themselves if the money wasted is worth it.

This group of people are funny, sociable, giving happiness and laughter to others, and love to be the center of attention very much.

Spending habits: Socializing makes ESFP people enjoy life the most. They tend to reward themselves with a luxurious lifestyle, and will not allow saving money to be a hindrance to their lifestyle.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY