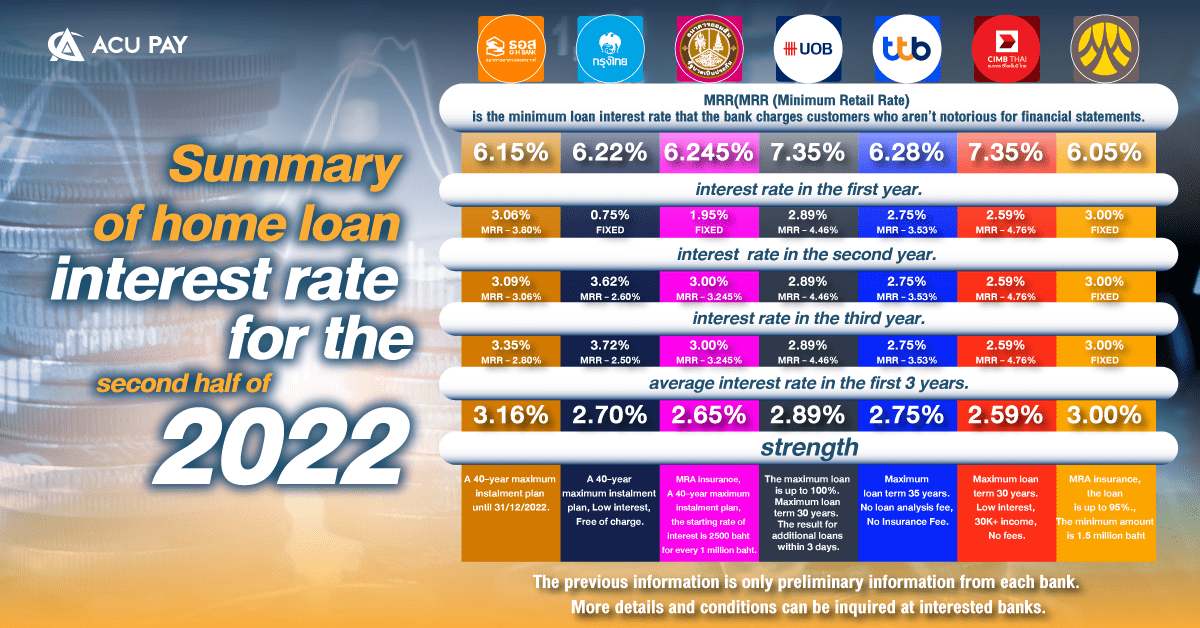

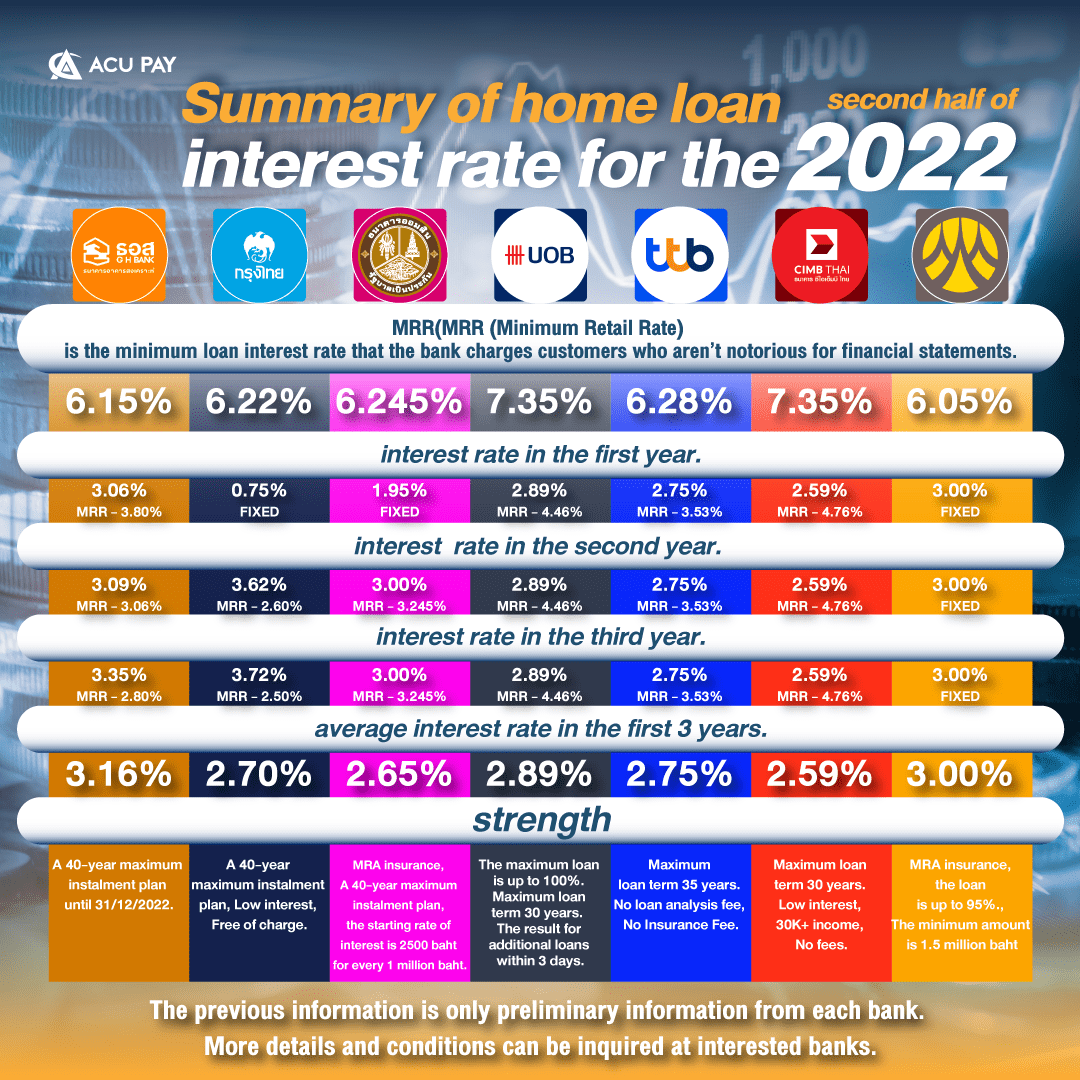

Guru Living said that the most noticeable thing is that many banks have switched their interest rates from fixed to floating for three years, which is something we have discussed in the second half of the year and from now on. We will definitely see an increase in interest rates. Therefore, banks have started to gradually adjust their defense plans by changing interest rates to floating instead.

Home refinancing is about applying for a new loan with a new bank. Why should we have to change the bank when we already pay the installments with the old one? because the house loan rate is cheap in the first 3 years (3% to 10%). After 3 years, the interest is going to be higher and higher.

It might be up to 5%-6% per year. So refinancing is to reapply for the same loan at a new bank to remain at the same rate of interest for the first 3 years. Which means this allows us to save money in the hundreds of thousands or millions of baht. Moreover, it’s helped us pay off the house faster too. and that’s how I give you a rough idea of home refinancing. I used to film a video clip to explain thoroughly about refinancing on my YouTube channel. If you want any further information, please click the link below. https://youtu.be/NsI2IwVv8g0

Guru Living said that refinancing is the process to help people reduce the load of interest payments for those who have a house loan. Moreover, we can determine a plan for a home loan every 3 years. I think this is important and necessary for people who have a mortgage now. We should learn about interest rates in detail and conditions carefully before we start the transaction to make it most beneficial to us.