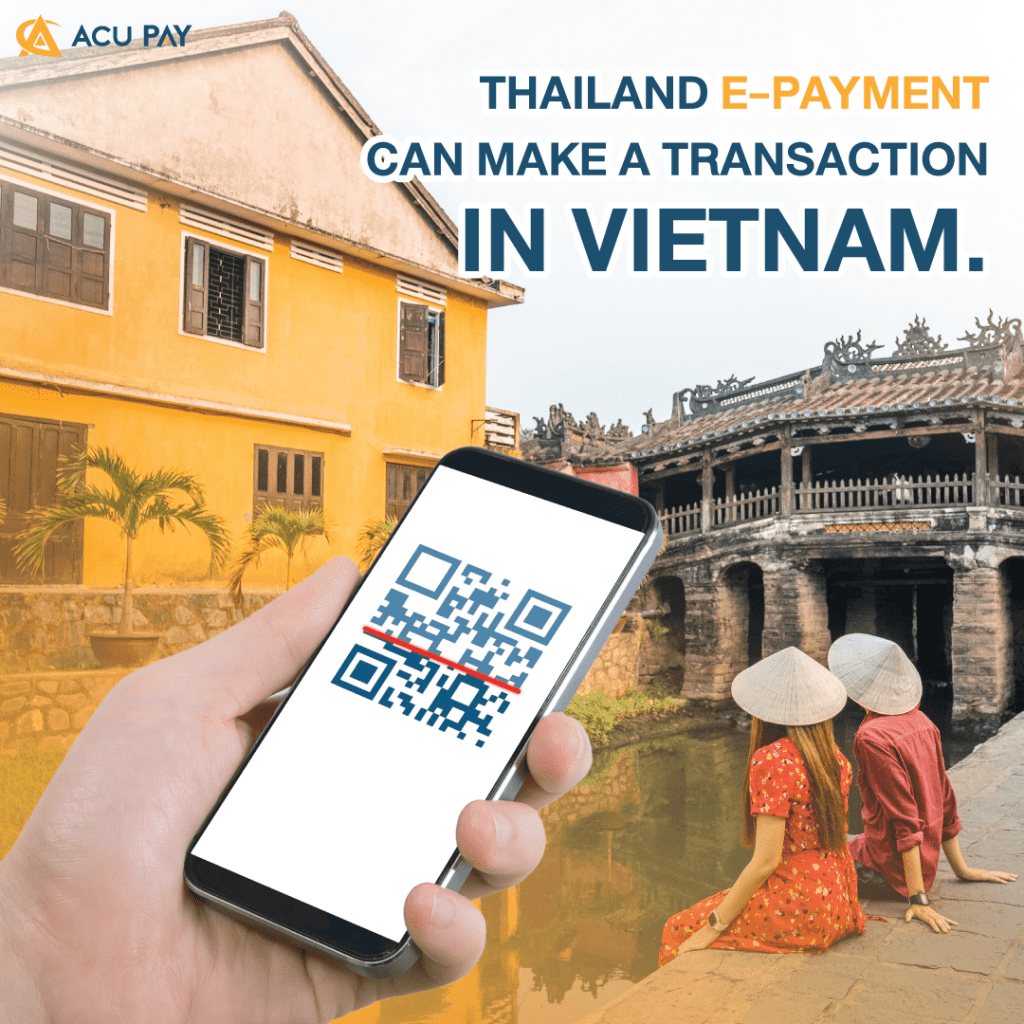

Payment is very important in tourism, to reduce the payment process. The State Bank of Vietnam (SBV) and the Bank of Thailand (BOT) have launched innovative QR Code payments between the two countries under ASEAN Payment Connectivity to promote sustainable growth and development of the regional financial system.

In the first phase, Thai tourists using Bangkok Bank’s mobile banking application under the Cross-Border QR Payment service can scan the Vietnamese QR Code under this program at merchants that use the services of TP Bank and BIDV to pay for goods and services. On the other hand, tourists from Vietnam can use the mobile banking applications of TP Bank and Sacombank to scan QR Codes of merchants in Thailand that use Bangkok Bank.

Cross-Border QR Payment is a payment service for goods and services by scanning the QR Code of overseas merchants via mobile banking from Bangkok Bank. The bank will deduct money from the Thai baht deposit account linked to mobile banking using the exchange rate at the time of the transaction.

*In the first phase, scans can be paid to merchants in Vietnam and Indonesia only.

The Bank of Thailand revealed that the QR Code payment service for overseas merchants will help support international payment transactions, especially when the travel situation returns to normal. Because in 2019, the number of tourists between Vietnam and Thailand reached 1.5 million. Users can use smartphones to pay for goods and services via QR codes, which will stimulate economic growth in both countries and regions.

On this occasion, SBV deputy governor Nguyen Kim Anh said: “This opening of the payment service between the two countries is a significant achievement for the relationship between the two central banks. It is also an important step for cooperation between central banks in the ASEAN region. to drive QR Code payments. This is part of the regional economic integration and encourages each country to enter the digital economy. “

Mr. Ronadol Numnonda. The Deputy Governor of the Bank of Thailand added that “This payment service linkage project will benefit many sectors. because it can facilitate people’s travel between the two countries. leading to the growth of the tourism industry and most importantly, it helps to make the payment of goods and services between each other convenient and safe, as well as encouraging both countries to move towards a digital society as well.”

The success of this project is due to the cooperation of relevant sectors, with the central banks of the two countries, the SBV and the BOT, driving the cooperation of the payment infrastructure providers between the National Payment Corporation of Viet Nam (NAPAS) and NITMX, as well as international settlement banks, Viet Nam Joint Stock Commercial Bank for Industry and Trade (Vietinbank) and Bangkok Bank.

Initially, banks providing QR Code payment services to customers and merchants were Tien Phong Commercial Joint Stock Bank (TP Bank), The Joint Stock Commercial Bank for Investment and Development of Viet Nam (BIDV), Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank), and Bangkok Bank via the Cross-Border QR Payment service.

In the next phase, the banks that will open additional services include The Joint Stock Commercial Bank for Foreign Trade of Viet Nam (Vietcombank), Bank of Ayudhya, CIMB Thai Bank, Kasikorn Bank, Krung Thai Bank, and Siam Commercial Bank.

SBV and the Bank of Thailand believe that cross-border QR Code payment services will be safe, efficient, and have a reasonable fee. This will be the starting point for other financial innovation collaborations.

Source : ธปท , ธนาคารกรุงเทพ