According to a survey by PAYMENT DIARY, today, Thai people still use cash as their main payment method. Some of the samples believed that banknotes still played a role in wealth accumulation. As a result, the banknotes will have a longer circulation period in the system before they are returned to the BOT. But the new generation has turned to use e-payment in an increasing proportion. Therefore, it is expected that, in the long term, the demand for cash is likely to continue to decline.

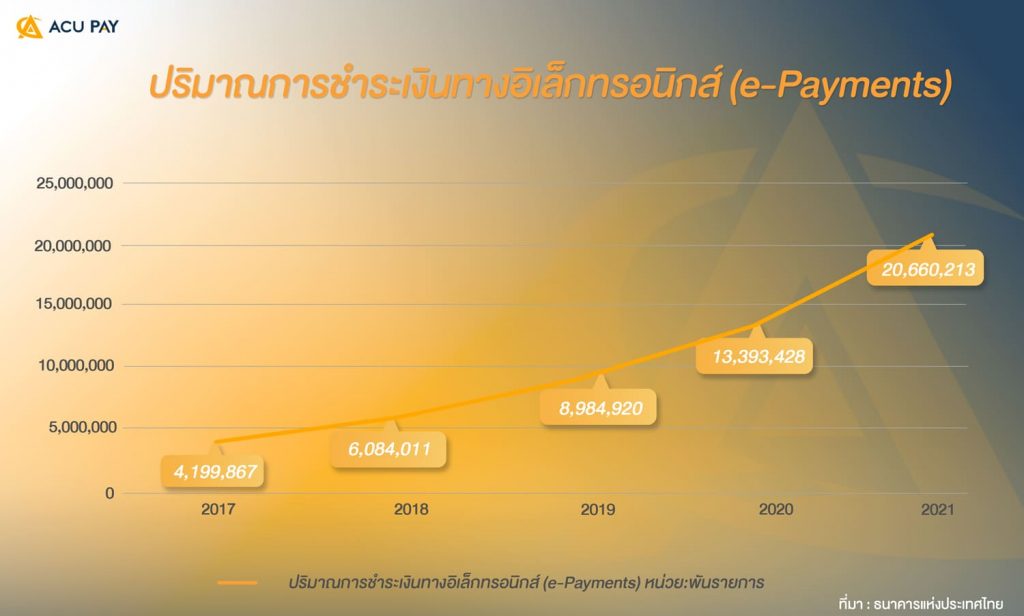

From the graph, we can see that in 2021, there was a huge increase of 7,266,785 thousand, or 54.25% from 2020. Looking back 5 years ago, in 2017, it can be seen that it has increased by 5 times.

From the graph, we can see that there is a continuous rate of value growth. This reflects Thai people’s spending habits, as they spend more via e-Payment, an increase of up to 16.170 billion baht, or 3.68%, from 2021.

If we compare quantity and value, it can be seen that the growth in the volume of electronic payment transactions (e-Payment) has higher growth and is inconsistent with the value of electronic payments (e-Payment), reflecting the behavior of Thai people that use e-Payment to pay more for goods and services in daily life.

Did you know that Thailand spends more than 50 billion baht per year on cash management? which is a very large amount. If we reduce the use of cash, this will help reduce the cost of cash dealing too.