It is widely known that taxation is one of the worldwide Government’s income channels. The aim of taxation is to provide for the management and development of welfare for the people in that country to live comfortably.

On the other hand, some countries have little taxation or do not have any taxation at all, but they can continue to run the country through other alternative channels like tourism or oil trade.

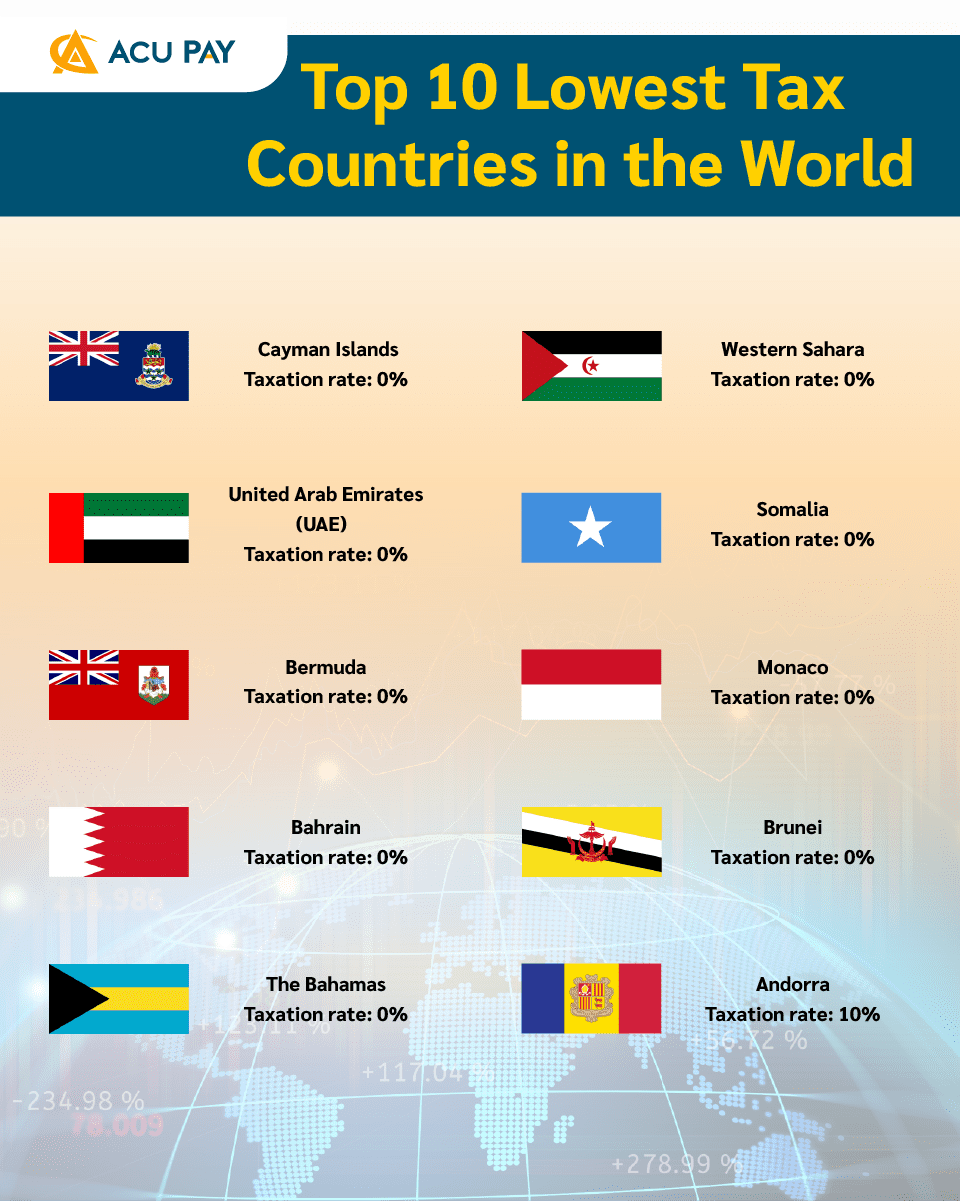

This time, ACU PAY will reveal the list of top 10 lowest taxation countries in the world, heavens for businessmen and investors who have a lot of money. What countries will there be? Follow ACU PAY to find out.

The United Arab Emirates (UAE) is a country in Southwest Asia with a main income from oil trade, so there is no tax levied on people in the country including local and international income, capital gain, and other forms of personal wealth will be exempt from all taxes.

Apart from its tax advantages, the country is open to free trade within the Middle East and around the world, becoming a pleasant and attractive investment destination. In terms of well-being, the UAE is considered another country with high cultural diversity. It has facilities in education, health care, business districts, public transportation, and restaurant entertainment.

Highlights:

สหรัฐอาหรับเอมิเรสต์ (ยูเออี) เป็นประเทศเอเชียแถบตะวันตกเฉียงใต้ที่มีรายได้หลักจากการค้าน้ำมัน ทำให้ไม่มีการเก็บภาษีจากประชากรในประเทศ ไม่ว่าจะเป็น รายได้ที่มาจากท้องถิ่นและต่างประเทศ กำไรจากส่วนต่างราคา และความมั่งคั่งส่วนบุคคลในรูปแบบอื่น ๆ จะได้รับการยกเว้นภาษีทั้งหมด

นอกเหนือจากข้อได้เปรียบด้านภาษีแล้ว ประเทศนี้ยังเปิดรับการค้าเสรีภายในภูมิภาคตะวันออกกลางและทั่วโลก กลายเป็นแหล่งน่าอยู่และน่าลงทุน ในแง่ความเป็นอยู่ ยูเออีถือได้ว่าเป็นอีกหนึ่งประเทศที่มีความหลากหลายด้านวัฒนธรรมสูง มีสิ่งอำนวยความสะดวกทั้งด้านการศึกษา การดูแลสุขภาพ ย่านธุรกิจ การขนส่งสาธารณะ และความบันเทิงร้านอาหาร

ไฮไลท์สำคัญ:

Bermuda is a British overseas territory located in the North Atlantic Ocean. It is an ideal country for tax adjustment to be appropriate. The Bermuda government does not levy personal income tax, but employers and employees are obliged to pay payroll taxes.

The tax rate is between 0.5 and 12.5%, with the employee in charge paying in half, or the employer may be responsible for paying all payroll taxes, but it depends on that type of business and position. It means that many Bermuda residents and workers can avoid paying taxes on their own income. In addition, most businesses operating in Bermuda are also exempt from corporate taxes.

Highlights:

Bahrain is an island country in the Persian Gulf, with a bridge connecting Saudi Arabia about 28 kilometers from the island. Bahrain is wealthy from the oil trade, making it the best tax-free bay for residents and businesses in Asia.

Unlike the United Arab Emirates, Bahrain does not levy corporate taxes on companies other than the oil and gas industry, but corporate taxes are still under discussion.

The Bahraini people do not have to pay all income-related taxes, but the only taxes levied are the acquisition and sale of goods such as VAT, import tax, and land tax.

Highlights:

The Bahamas is a nation-state consisting of small, unified islands located in the Atlantic Ocean. The country is famous for its beautiful beaches, high-end tourist resorts, and lively nightlife entertainment, similar to the Cayman Islands.

The Bahamas is considered a tax-free place. Since independence in 1960, the Bahamas has been known as a low-tax regime. There is no personal income tax, corporate tax, investment profit tax, inheritance tax, or property tax as the government relies on taxation on other channels such as sales tax and tourist tax to generate income. The Bahamas has become an attractive destination for families who want to minimize their tax burden.

Highlights:

Western Sahara is a land located in the northwest of Africa. Although this country’s name is rarely found in places you want to travel to, here the tax rate is 0%. Despite the ongoing civil war, West Sahara was able to establish diplomatic relations with 42 countries and was recognized as a full member of the African Union. Even so, the country does not have any alternative sources of income to compensate for the non-taxation and also has territorial disputes.

Highlights:

Somalia is a country in South Africa adjacent to the Cape of Africa. Since the fall of the dictatorial regime of Siad Barre in 1991, Somalia has been plagued by divided struggles and currently lacks effective national governments. There were two provisional governments twice in 2000 and 2004.

The country has an informal economy mainly composed of livestock, money transfer companies, and telecommunications. Its income now comes from tourism and foreign investment solely.

In 2015, the Somali central government passed a new policy to limit the country’s foreign dependence and opened more jobs for local workers.

Highlights:

Monaco is a city-state in Western Europe, located in the French Riviera area in southern France next to the Mediterranean Sea. The hometown of the Monaco Grand Prix, Formula One racing race, and the richest person in the world.

Monaco is one of the countries with the lowest tax rates in Europe and countries around the world cannot be comparable. The Monaco government has no income from individual income tax collection, but the government has earned income from state-owned casino operations and proceeds from sales of several products to compensate.

Even though the cost of living in Monaco is high and has the most expensive land price in the world, its charm is to serve as a destination for those who want to preserve wealth, especially those with large financial assets.

Highlights:

Similar to Bahrain, Brunei has enjoyed economic prosperity. Most of it comes from oil and natural gas resources, accounting for 65% of GDP, allowing the Brunei government to provide free medical services and free education through universities under absolute monarchy by the Brunei dynasty for more than six centuries.

Brunei’s tax measures include no individual and partnership income taxes, and no export taxes, sales taxes, payroll taxes, and production taxes. Only corporate taxes are levied on corporations. In addition, it is very difficult to obtain a permanent residence permit in Brunei, which requires rigorous testing about local cultures, traditions, and languages.

Highlights

Andorra is a small Catalan-speaking state located between Spain and France in the Pyrenees. Although it is not 0% tax-free, the government will exempt income taxes for people earning less than 40,000 euros. (about 1.5 million baht per year) People with income more than that will have to pay 10% income tax, which is a very small amount compared to many other nations.

In addition, Andorra is considered the country with the lowest VAT rate, accounting for 4.5% of its sales. Even though it is located in the heart of Western Europe, there are many double taxation agreements with neighboring countries to maintain a good tax environment.

Highlights: