The world is becoming a cashless society. What will be undeniably modified are the money format and the payment format, or the payment of goods or services, that will make us more convenient, safer, and reduce our use of cash by switching to electronic money, also referred to as e-Money.

e-Money, or electronic money, is the value of money that is recorded in electronic form (such as a computer chip on a physical card or plastic card, or telephone network or internet network) which users have paid or top-up in advance or pre-paid through a bank account to the e-Money service provider, also known widely as an e-Wallet, which can be used to pay for products or services at a shop that accepts payment.

There are many advantages, such as ease of payment; decreased use of cash or banknotes; a decrease in errors in receiving and changing money; etc.

As for users, they can top-up and withdraw money through various channels, depending on each service provider, such as top-up via mobile banking, top-up via top-up machines, top-up with merchants that accept top-up, top-up via the mobile phone network, or direct debit through the user’s bank account or credit card that is directly linked, etc.

As for top-up or withdrawal, you can check your transaction history via SMS or e-mail depending on the service provider.

e-Money is classified according to the type of e-Money provider, divided into 3 types:

1. Account ก – It is an e-Money service that is used to purchase a specific product or a specific service as pre-defined items from a single service provider. In addition, there are exempt service providers, such as e-Money cards used to buy food in food courts at department stores.

2. Account ข – It is an e-Money service that is used to purchase goods or services from service providers at places that are under the same distribution and service system, such as a franchise. businesses or distributors with the same symbol or trademark, such as gas stations. Businesses with the same service model, such as mass transit systems, Businesses that are under the same group management policy, such as affiliated companies, and Businesses that operate in the same area or distribution area, such as shopping centers.

3. Account ค – It is an e-Money service that is used to buy goods or services from multiple service providers without limiting the location and not under the same distribution and service system, such as using it to pay for goods or services sold through websites, the Internet, or shops that accept e-Money payments, such as shopping centers.

ACU PAY is a service provider of e-Money Account ค that provides e-Wallets or electronic wallets that can be used to pay through various payment points such as restaurants, coffee shops, shopping, and many other shops. with promotions that are only ACU PAY.

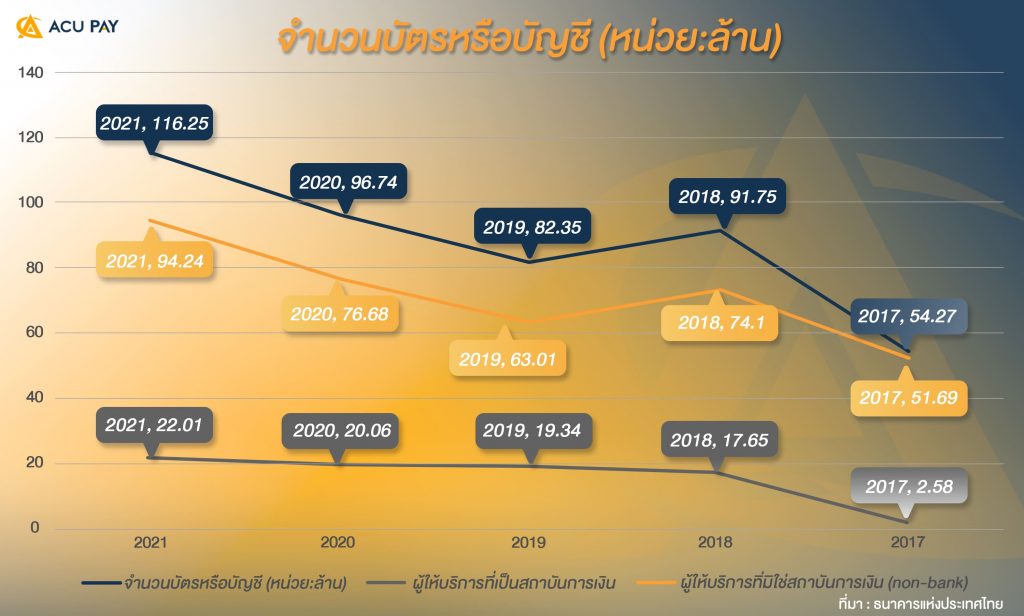

| No. | Section | 2021 | 2020 | 2019 | 2018 | 2017 |

1 | the number of electronic money cards or accounts (unit: million) | 116.25 | 96.74 | 82.35 | 91.75 | 54.27 |

2 | Financial institution | 22.01 | 20.06 | 19.34 | 17.65 | 2.58 |

| 3 | Non-bank | 94.24 | 76.68 | 63.01 | 74.1 | 51.69 |

From the data, it can be seen that in 2018, there was a significant increase in the use of e-Money, and in 2019-2020 there was a COVID-19 incident that made the use of e-Money very popular and necessary in daily life. It also shows us that Thai people have more than one card or account per person, and there is a significant increase.

| No. | Section | 2021 | 2020 | 2019 | 2018 | 2017 |

| 5 | The value of a top-up e-Money | 472,922.94 | 314,429.44 | 292,121.69 | 217,456.99 | 127,588.86 |

| 6 | Financial institution | 66,223.10 | 38,360.67 | 91,771.42 | 38,862.98 | 11,275.30 |

| 7 | Non-bank | 406,699.84 | 276,068.77 | 200,350.27 | 178,594.02 | 116,313.56 |

No. | Section | 2021 | 2020 | 2019 | 2018 | 2017 |

9 | The value of spending e-Money | 467,179.74 | 309,553.49 | 276,317.42 | 203,475.21 | 126,171.87 |

10 | Financial institution | 55,164.97 | 33,157.55 | 77,395.86 | 29,946.22 | 10,652.40 |

11 | Non-bank | 412,014.77 | 276,395.94 | 198,921.56 | 173,528.99 | 115,519.47 |

From the past 5 years of data, it can be seen that top-up and spending reflect Thai people’s spending patterns, and the use of e-Money has increased significantly when compared to the card or account balance graph.

5 years ago, many people couldn’t imagine a cashless society. What will it be or will it change? Until there is a COVID that has accelerated and changed Thai people’s spending habits. For example, kon la khrueng or Rao Chana (We Win) is a government project. That must be used through the wallet app. Many people may have used it or know it.

Another point worth noting is that despite the high spending or topping up if you look at the source of spending back from non-financial service providers, it is very interesting to see what the role or function of the bank will be in the next few years.

What’s your opinion about the role of banks and non-financial service providers in the trend of a cashless society?