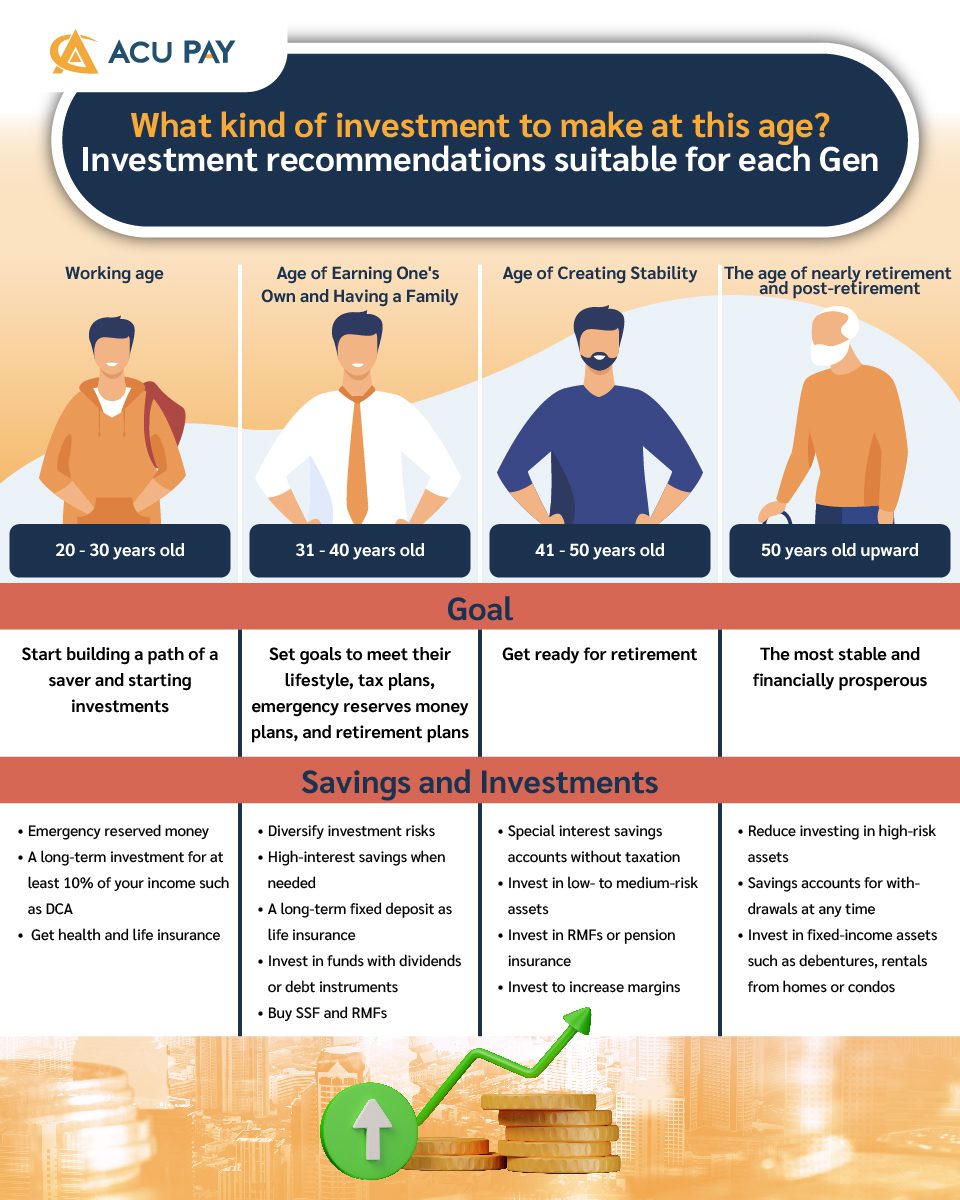

People at this age have a relatively high potential and flexibility in investment because they have less financial burden compared to other ages, but most of them spend on satisfying their needs or happiness, such as travel, eating, and shopping, or start buying and installing large assets such as automobiles and condos when their financial position is not yet ready, which may cause debt problems.

Therefore, the goal of these people should be to start building a path of a saver and starting investments because they can take risks higher than other ages. For those who dream of becoming a business owner, the best way to do so is to start defining your own life from now on. The sooner you do so, the more likely you are to be successful. The most important thing in this age is financial discipline.

What should be a saving and investment for this age?

This age should establish regular savings discipline, which may start with emergency reserved money of at least 6 to 12 times the cost of expenses. If you are interested in investing, choose a long-term investment that accounts for at least 10% of your income. You may choose DCA, Dollar Cost Averaging, which automatically debits the account at the same amount every month.

People at this age are the most financially burdened age. Many people at this age are more financially stable, but also with greater burdens such as marriage, family expenses, home installments, and car installments. For those with children, there’s gonna be extra costs like childbirth, school fees, and child support.

If they reach this age and still not be serious about their financial goals, it might be difficult for them to have financial stability as expected. Therefore, people in this age group should set goals to meet their lifestyle, tax plans, emergency reserves money plan, and retirement plans.

What should be a saving and investment for this age?

At this age, high-interest savings should be had when necessary. Investments should diversify investment risks such as long-term fixed deposits as life insurance, invest in funds with dividends, debt instruments, or buy SSF and RMFs. In addition, they may purchase two or more health insurance policies because they are at the age of earning one’s own. It is important to prevent risks from becoming a burden on the people behind them.

This is the most financially stable age in terms of job security, early financial planning, and reduced responsibilities for children who may graduate from school, also large assets such as homes and cars are paid off. Therefore, the goal is to be ready for retirement.

What should be a saving and investment for this age?

At this age, investments in RMFs or pension insurance will be suitable for the upcoming retirement age, such as special interest savings accounts without taxation, investing in low- to medium-risk assets, investing in RMFs or pension insurance, or investing in two or more health insurance policies.

If financial planning has been well planned throughout, this age will be the most stable and financially prosperous. Therefore, the goal of this age is to take time off from previous years’ accumulated money and maintain health to reduce the risk of medical expenses.

What should be a saving and investment for this age?

People at this age can take lower risks, so investment in high-risk assets should be reduced to reduce principal loss. Investments in fixed-income assets such as debentures, rentals from homes or condos, and there should be savings accounts so that withdrawals can be made at any time.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY