Foreign Currency Deposit Account (FCD) is an important tool for those who want to save money in foreign currencies, and is also suitable for SMEs that deal with foreigners.

Foreign Currency Deposit or US Dollar fixed deposit account can be divided into 4 groups.

1. Spending

Those who prefer to travel or shop abroad and do not want to exchange money frequently can keep the money in their accounts without having to exchange money from one currency to another and not have to be saddened when the currency fluctuates highly.

2. Long-term saving

This is a good case for long-term planning, such as for parents who plan to send their children to study abroad. They can also buy foreign currency saved up in the long run.

3. Used for foreign investment

It is suitable for those who want to save USD for investment, especially during the Baht’s appreciation and investment abroad, whether buying stocks or investing in mutual funds sold overseas.

4. Doing business with foreigners

Those who do business with foreign countries can keep a USD account to allow them to spend their goods with their foreign counterparts in foreign currencies without having to spend any time on currency exchange.

The 6-month US Dollar fixed deposit gives out an interest rate of 5.2% per annum. Moreover, receive special exchange rates when purchasing US Dollars for deposits into the foreign currency deposit account (FCD) with a special interest rate of 5.2%, or transfer USD to deposit in a Baht deposit account at a special exchange rate.

Duration: 5 Jan 2024 – 31 April 2024

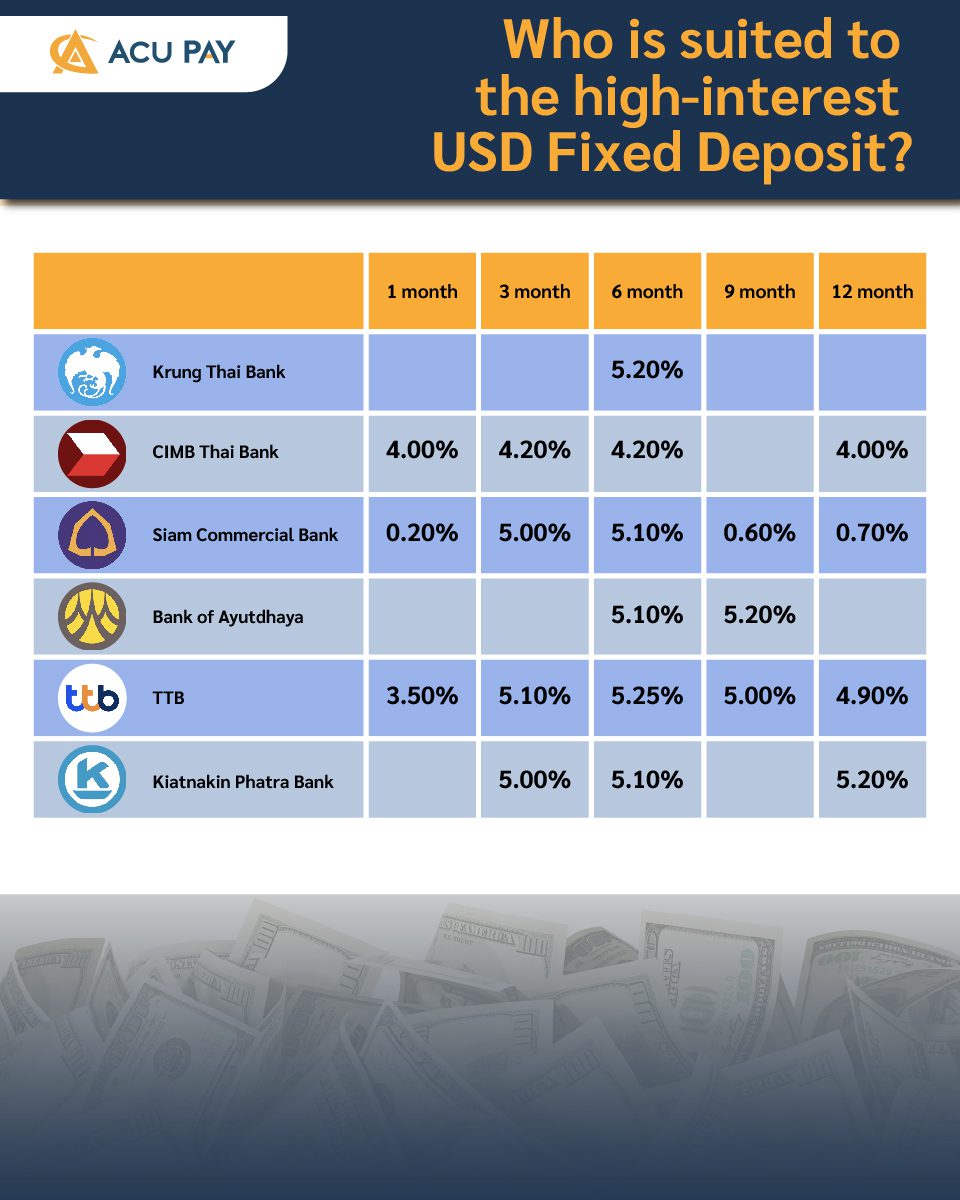

USD fixed deposit for individuals with foreign currency savings deposits. Choose to deposit over the period starting from 1 month with a 4.00% interest rate per year, 3 months with a 4.20 interest rate per year, 6 months with a 4.20 interest rate per year, and 12 months with a 4.00 interest rate per year. A minimum deposit is 2,000 USD at a time.

Duration: 2 Jan 2024 – 31 Mar 2024

The 6-month and 9-month USD special fixed deposit accounts, receive interest rates of up to 5.1% and 5.2% per annum, respectively. The first and the next deposit amount is 50,000 USD for individuals.

Duration: Today – 31 Mar 2024

Foreign currency deposit (FCD), USD currency for the 3-month type receives a 5.00% interest rate per annum and a 5.10% interest rate per annum for 6-month type.

Duration: Until January 31, 2024.

Foreign currency deposit account TTB for individual customers to open an account with a minimum deposit amount of 10,000 USD or an equivalent to, and the next deposit amount of 2,000 USD. (In the case of deposits in banknotes, the maximum amount per day is limited to 15,000 USD. In case of a deposit in other currencies, the amount must be equivalent to USD according to the exchange rate of the Bank.) There are types of 1-month, 3-month, 6-month, 9-month, and 12-month fixed deposit accounts to choose from.

Foreign Currency Deposit Accounts in terms of special fixed deposits in the USD currency start at 1,000 USD and receive interest rates of up to 5.25% per annum. The duration of special fixed deposit accounts are 3 months or 6 months.

Duration: Today – 31 March 2024

The reason why banks have turned to issuing US Dollar fixed deposit products is to raise regular deposits to support business activities and lending to customers, usually, loans will be made in both Thai and foreign currencies.

In terms of foreign currency deposit techniques, banks do not need to submit funds to the Financial Institutions Development Fund (FIDF) at a rate of 0.46% per annum. If banks want to issue loans in Baht, banks can swap from foreign currencies to Baht. The cost of financing will be reduced and offer high foreign currency deposit rates to attract customers.

For example, the Baht deposit interest rate is 2.46% per annum, but the US Dollar will be over 5% per annum, but after the swap, it will be 2% but this 2% will not pay FIDF fees.

References from

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY