The beginning of having money savings is a struggle against one’s own mind. You have to restrain yourself from extravagant spending such as discounted products or a-must-have things. Consider carefully how important this thing is to your life. Try adjusting your attitude toward spending money, and the problem of overspending will be solved.

In the early stages, it may be possible to set goals such as saving money for a new phone. Use these goals to remind yourself what you are saving money for and savings habits will grow on its own.

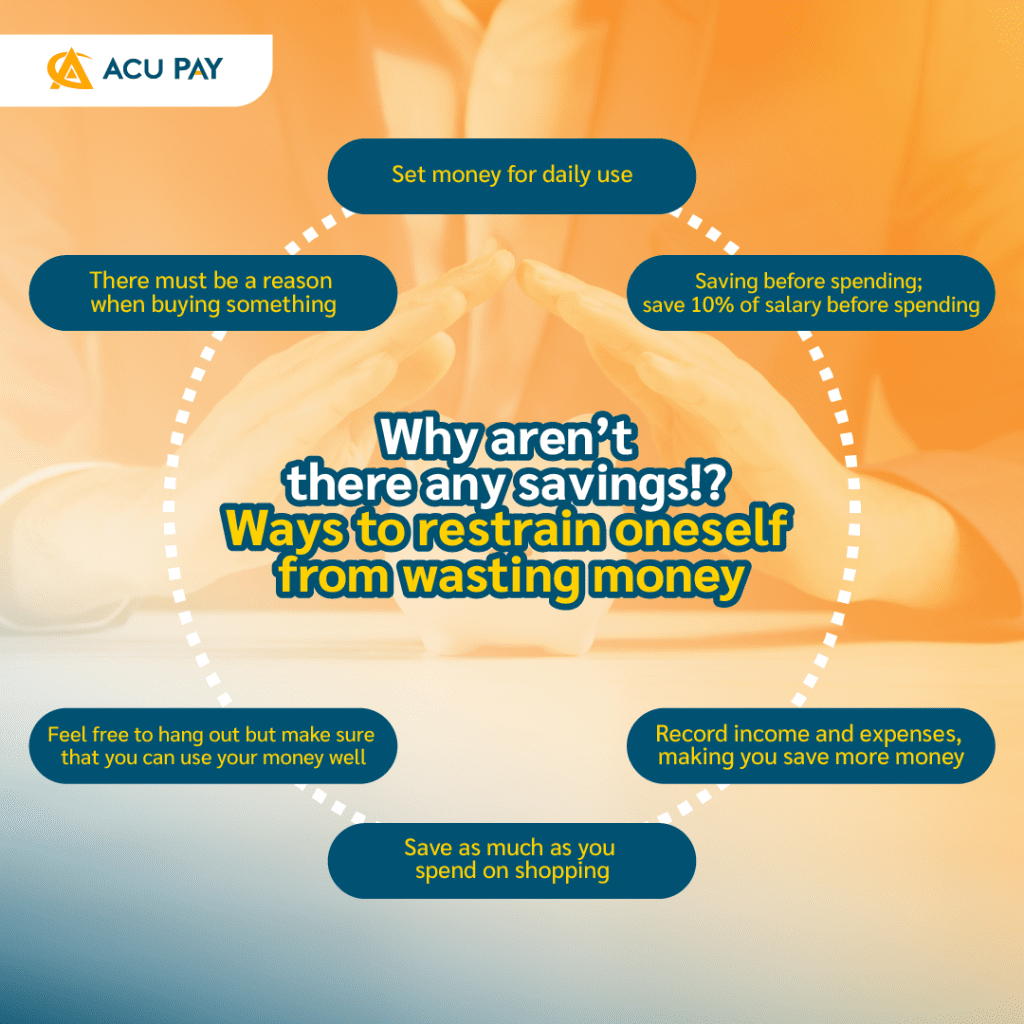

Another way to save money is to set money for daily use by subtracting the necessary monthly expenses first, such as rent, and travel, calculating how much we should spend in a day, and then setting that amount for ourselves to use daily to prevent overspending.

For example, Mr. A has a monthly salary of 20,000 baht, with fixed expenses such as accommodation and travel expenses of 8,000 baht. After deducting fixed costs, Mr.A will have 12,000 baht. Mr. A calculates that he could use 200 baht per day or 6,000 baht per month, with the rest money being emergency reserves or savings for the future.

The simplest way to save money is to divide 10% of your salary into savings. Let’s say that Mr. A earns 20,000 baht, he divides 2,000 baht for saving immediately. At the end of one year, Mr. A can save up to 24,000 baht.

However, in the case of anyone who has very tight expenditures, they may start saving at 5% of salary first. They may create separate accounts to receive 5% of the monthly salary which is set to transfer in advance as soon as they receive their salary.

Even though you know that the record of income and expenses is important, many people may feel lazy and feel like wasting their time doing it. Do you know that the benefits of recording income and expenses will give us a whole picture of how much money we spend on the most each day, and what parts we can reduce, cut, or delay in spending for savings?

This technique is a good way to adjust your shopping habits. On the other hand, it’s ‘borrow your money to use first’ and then return it later, just like a credit card, but it’s an interest-free card. You can buy anything you want, but make a note of it and return your money to yourself. Don’t cheat yourself.

We can save money while we are living our life happily. At this point, we need self-discipline, never forget to manage to have enough money, and save regularly so that we can make sure that this lump of money that will be used for the party does not affect other expenses. Disciplined savings will help build a stable future for us.

In addition to depositing our savings into high-interest savings accounts at banks, another way to increase revenue in complying with expenses with more security and less risk is by investing cold money in low-risk assets. For example, funds, debt instruments, and other assets and then investing in Dollar Cost Averaging (DCA). This will result in greater profits. The conditions of return and risk of the fund or asset should be studied in detail before making a decision.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY