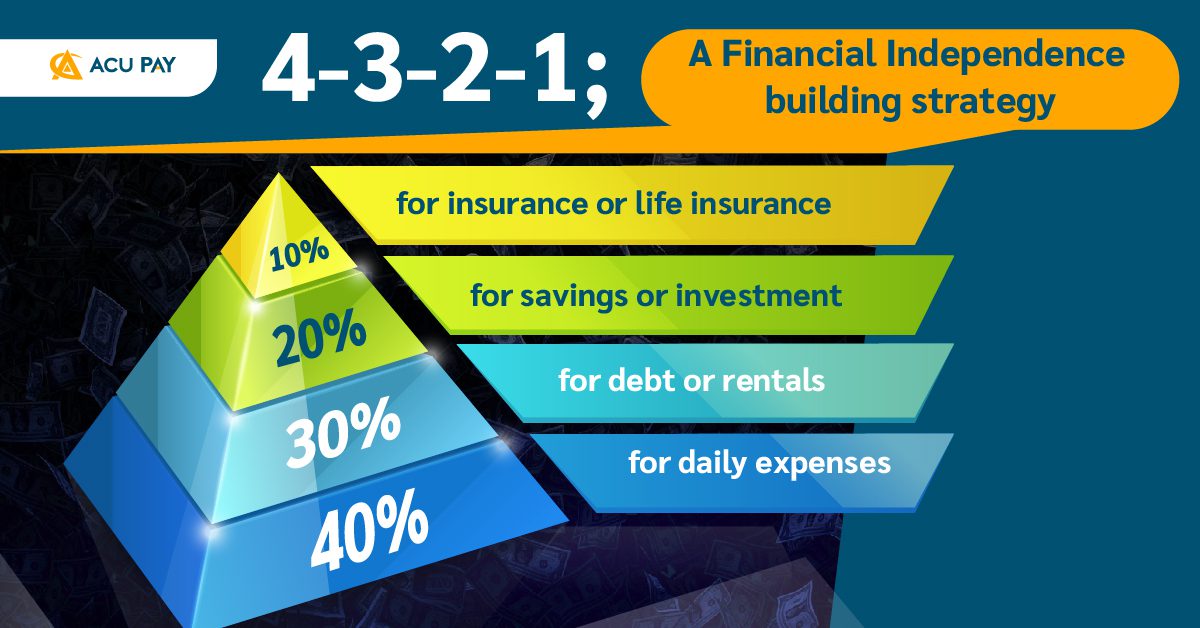

It’s very difficult to put the expense budget under a given budget, but this way will make it easier for us to spend the money within a given budget. You should divide your salaries by 40 % from the income and figure out exactly how much it costs each week, because if you don’t have a certain percentage of your money, you are going to go overboard. This 40% will be daily expenses such as food, transportation, water bills, electricity bills and other shopping expenses which is considered the right amount.

The next big part that comes after expenses is the liabilities, whether it’s home loans, car loans, credit card debts, total liabilities, or rentals that you pay each month. Having a debt is not a bad thing if your debt is still controlled. Normally, good monthly liabilities should be in the range of 35% – 45%, which is an indicator of whether your financial health is healthy or not. The 30% debt expense is still considered to be acceptable to you. For those who don’t have any debt, you can save up this money to prepare for future debt obligations, such as taking out a home loan and buying a car.

You should save at least 20% of our income to distribute for savings such as emergency reserves and investment in financial assets such as gold, stocks or mutual funds. Initially, if you still have low income, you could start by saving emergency reserves equal to 3-6 times of fixed cost and then investing the rest of the money. You could divide this 20% for both savings and investment. This investment is very important because it will provide you with returns and long-term wealth.

Another financial issue that should not be overlooked is insurance for oneself, whether it be health insurance or life insurance, because life is always at risk of illness, accident or death. It wouldn’t be a good thing if all the money you are trying to save is gone with the hospital bills instead of spending it to buy yourselves happiness.

The insurance will provide you with thick mattresses to support you on the unexpected day of events. The premium you pay should not exceed 10% of your monthly income, which will help you have no worry.

In conclusion, it is not too late to set the financial direction for your own financial freedom in the future. This 4-3-2-1 strategy may be one of the techniques that will help you control costs or help you save money. You can adjust the ratio to suit your salary, but it should not be reduced or increased by more than 10 %, especially for debt payments, which should not be increased any further.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY