Many people may have similar problems with saving money, or not being able to save money, or having a lot of expenses. What should we do? Let’s take a look at the guidelines for how we can save it efficiently.

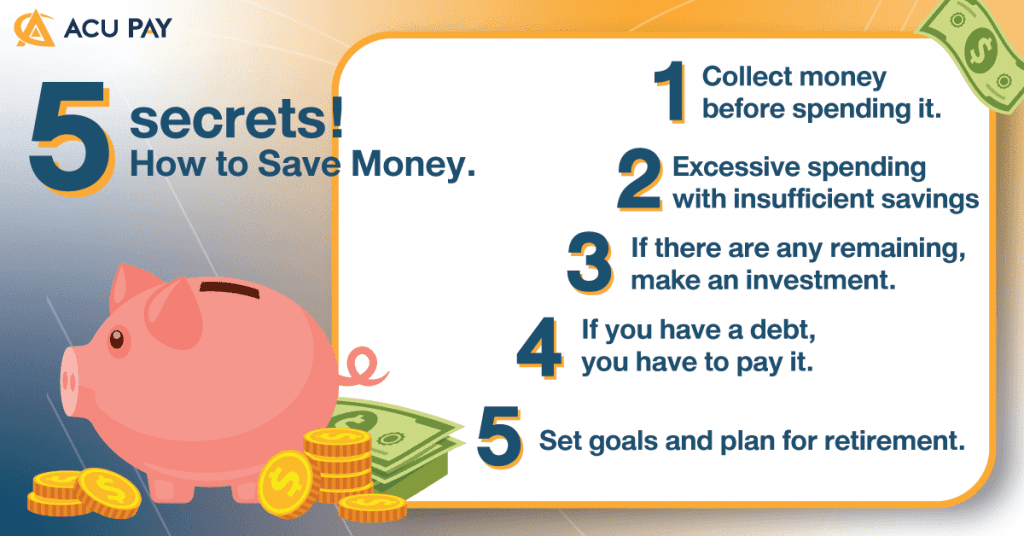

A salaryman is a group that is able to plan their finances very accurately because we know their monthly income precisely. So, when they receive a salary, it is better to save it before spending it in everyday life. Because if we use the money first and then save it later, of course, most people will hardly have any money left. Therefore, we should collect money before spending it, starting at 10%–30% of our salary per month.

We should start by listing all of our expenses and then analyzing which parts of our expenses we can reduce and which ones we cannot reduce. because each person has different duties. If you can’t really reduce your expenses, we should consider other ways to increase revenue.

Investing can take many forms. The basis for investing is to consider risk and invest in stable stocks or assets, such as stocks with good business fundamentals. or a low-risk fund, such as investing in bonds, debentures, or SET 50, or investing in real estate. All investments carry risks. Therefore, we should learn to limit or reduce the risk as much as possible.

Debt is not a bad thing or a bad thing. which depends on the purpose of the loan and the ability to pay off debt. If we have debt that must be paid or are unable to pay, escaping is not a solution. What we should do is to pay off all debt, or if we are unable to pay, we should go to talk to the bank to find a solution together.

Setting goals and planning for retirement will help determine all of our savings, income, and expenses. Most people live up to 80 years and may live another 20 years, but may not have a job, but we have to spend it. So, to have enough money to last another 20 years, if we try to calculate how much we will spend in a month, if using 20,000 baht per month for 20 years or 240 months, we need 5 million baht after retirement, so how much should we save and how can we increase our income to be enough for life after retirement?

Anyone can study finance courses from SET for free by clicking on this article, including 5 free finance courses! and received a certificate. All of this is a guideline for collecting money. However, it should be improved to suit you too.