Are e-Wallets and e-Payments the same?

e-Payment, or electronic payment, is spending or transferring money through electronic channels, such as paying bills via mobile phones

e-Payment, or electronic payment, is spending or transferring money through electronic channels, such as paying bills via mobile phones

In reality, we all have at least one wallet used to store money or banknotes. In the world of cashless society, e-Wallets are like one wallet

The protracted Russian-Ukrainian conflict is unlikely to end, and Western countries may impose more sanctions on Russia, including measures related to energy exports.

At present, we can see that our world has come to know about digital currencies or cryptocurrencies.

The world is becoming a cashless society. What will be undeniably modified are the money format and the payment format

GuildFi is a web-3 gaming platform created to connect gamers and investors together. For example, Mr. A has funds but has no time to play games or can’t play games.

Today, ACU PAY will introduce you to Shoppi Coin. A Shoppi Coin is a coin or token of the Shoppi company based in London.

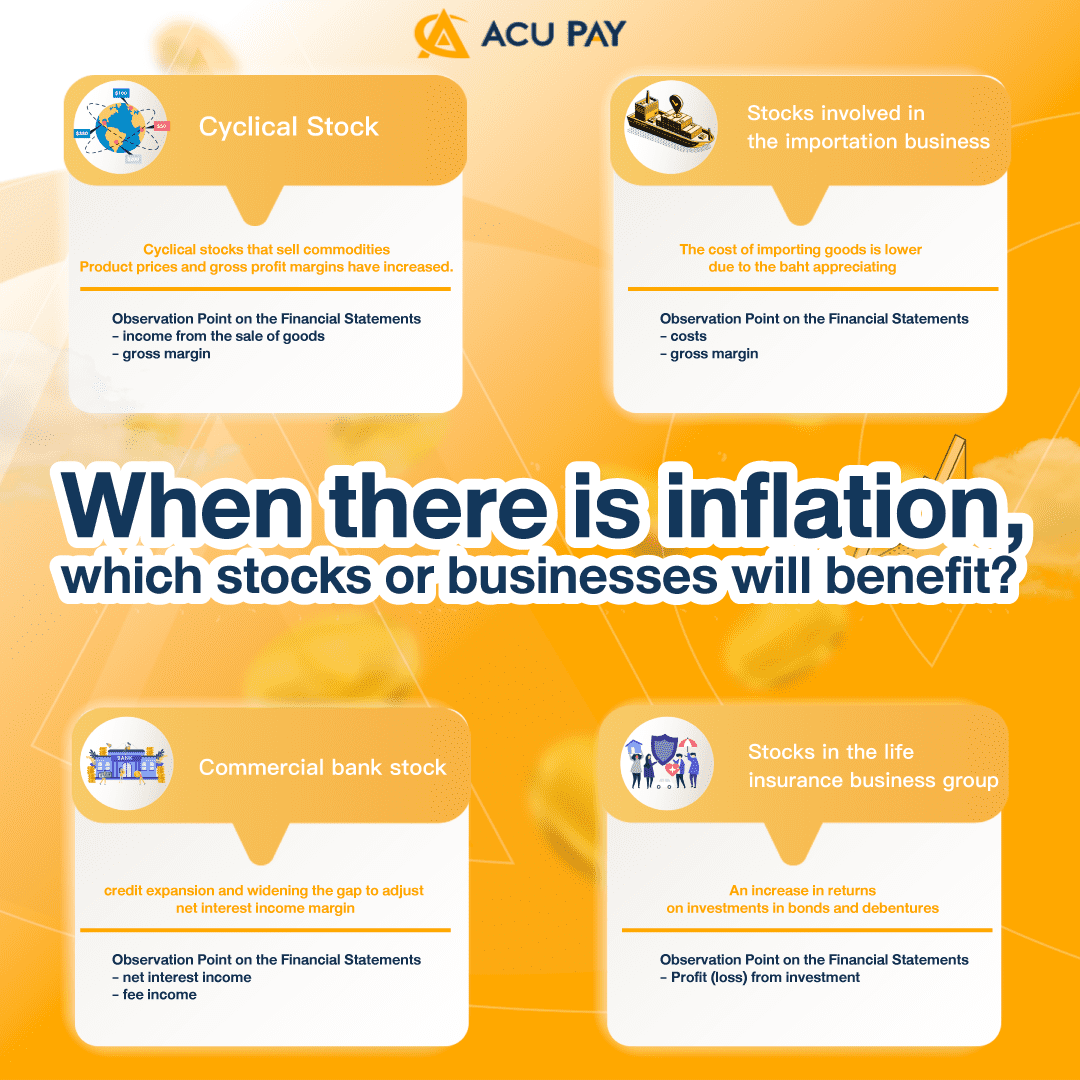

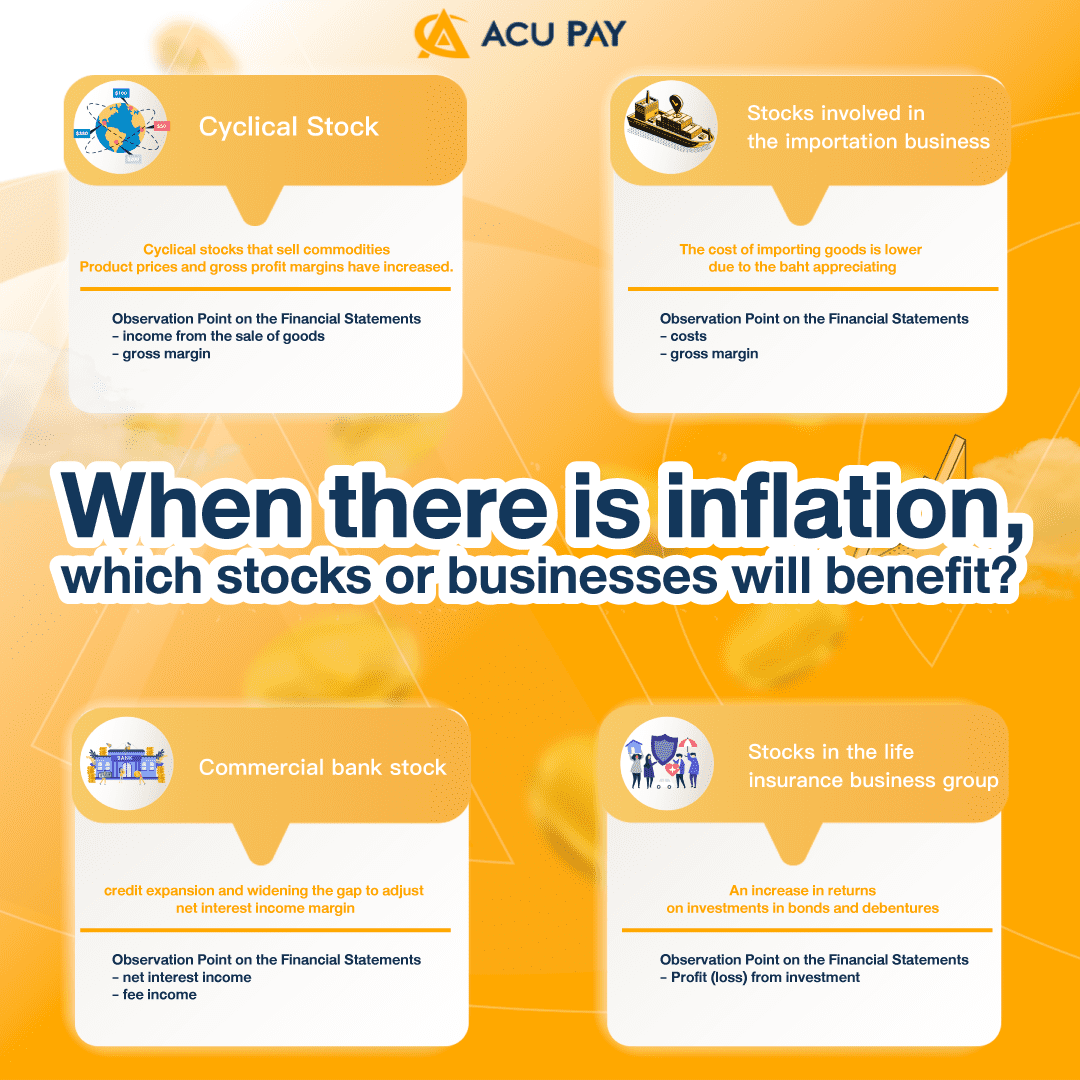

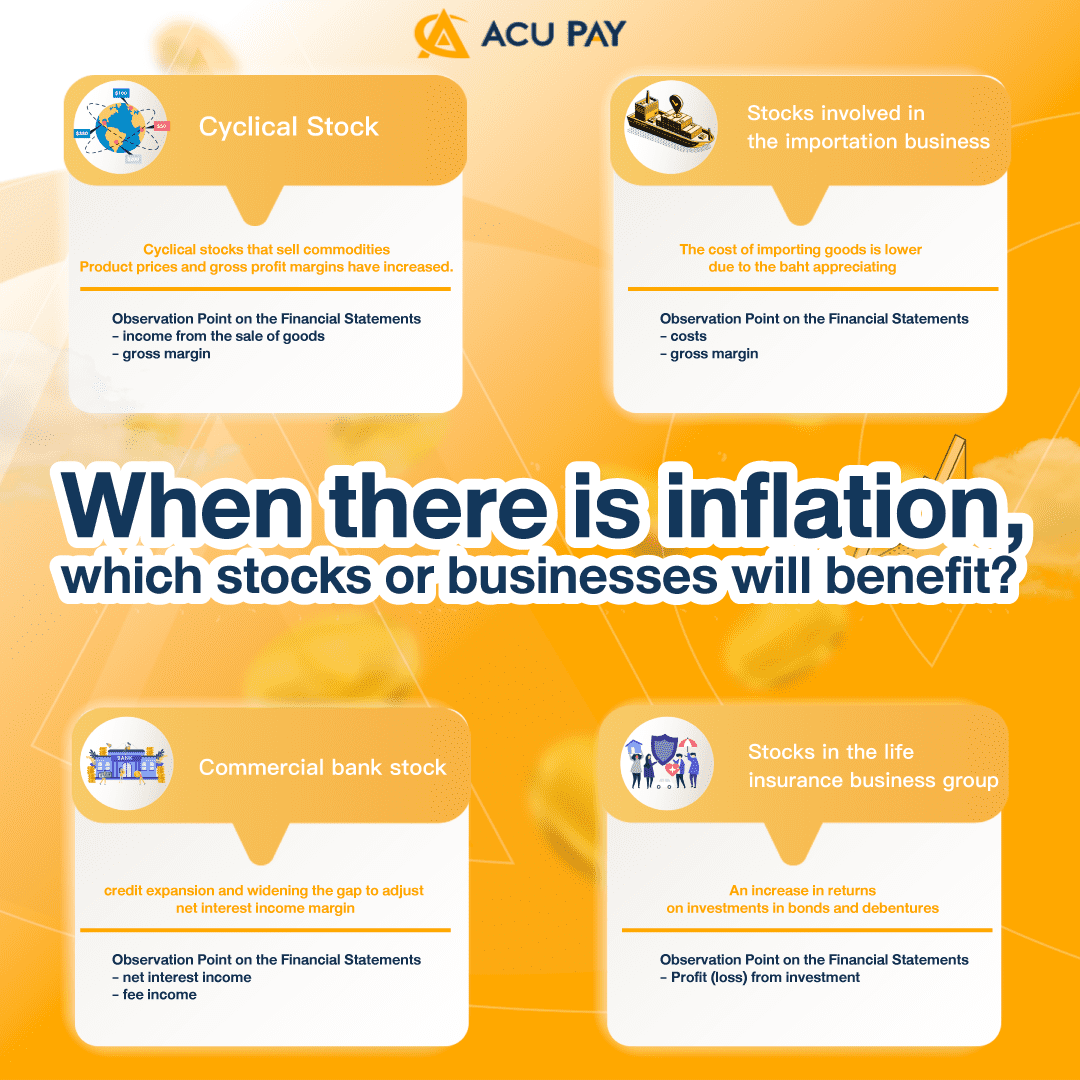

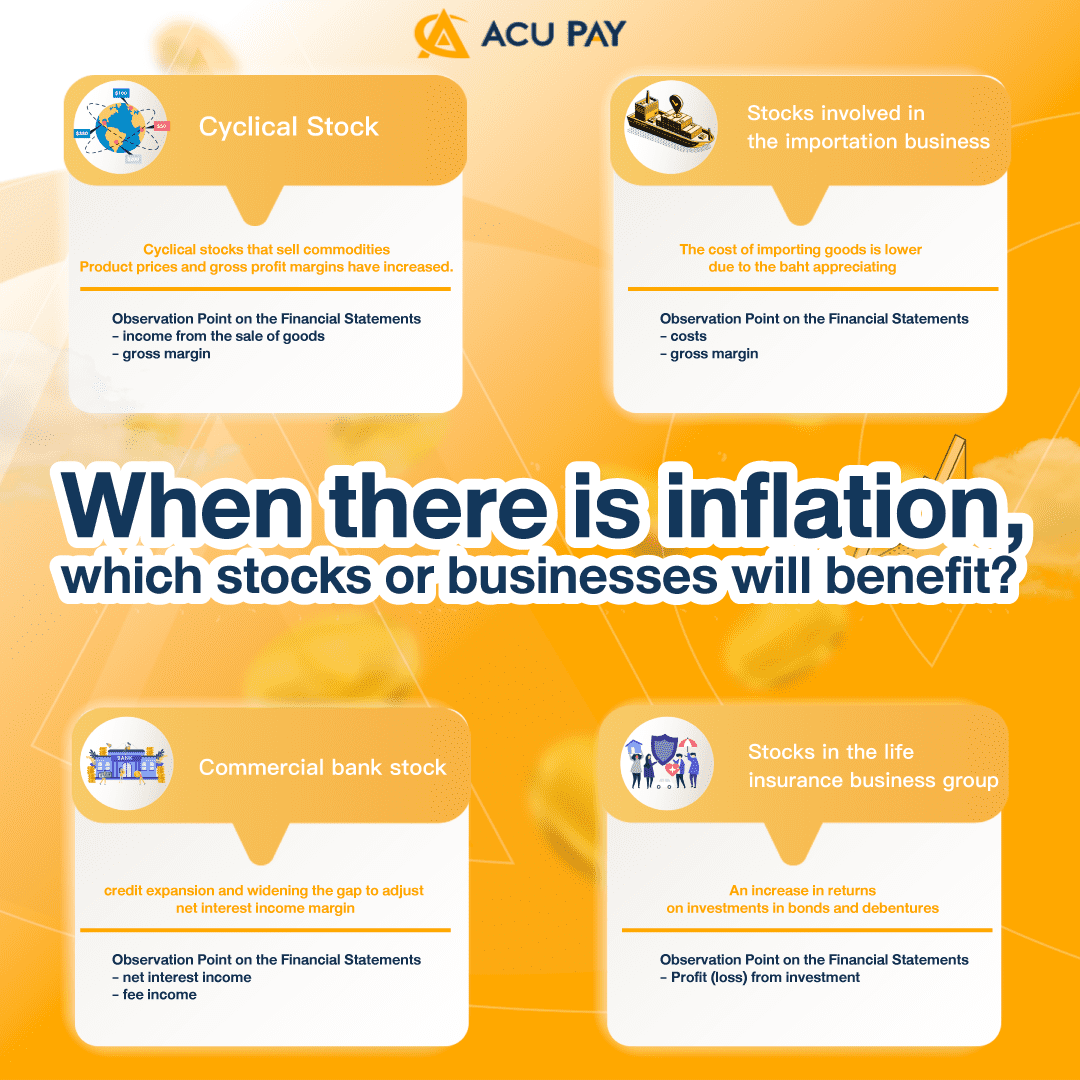

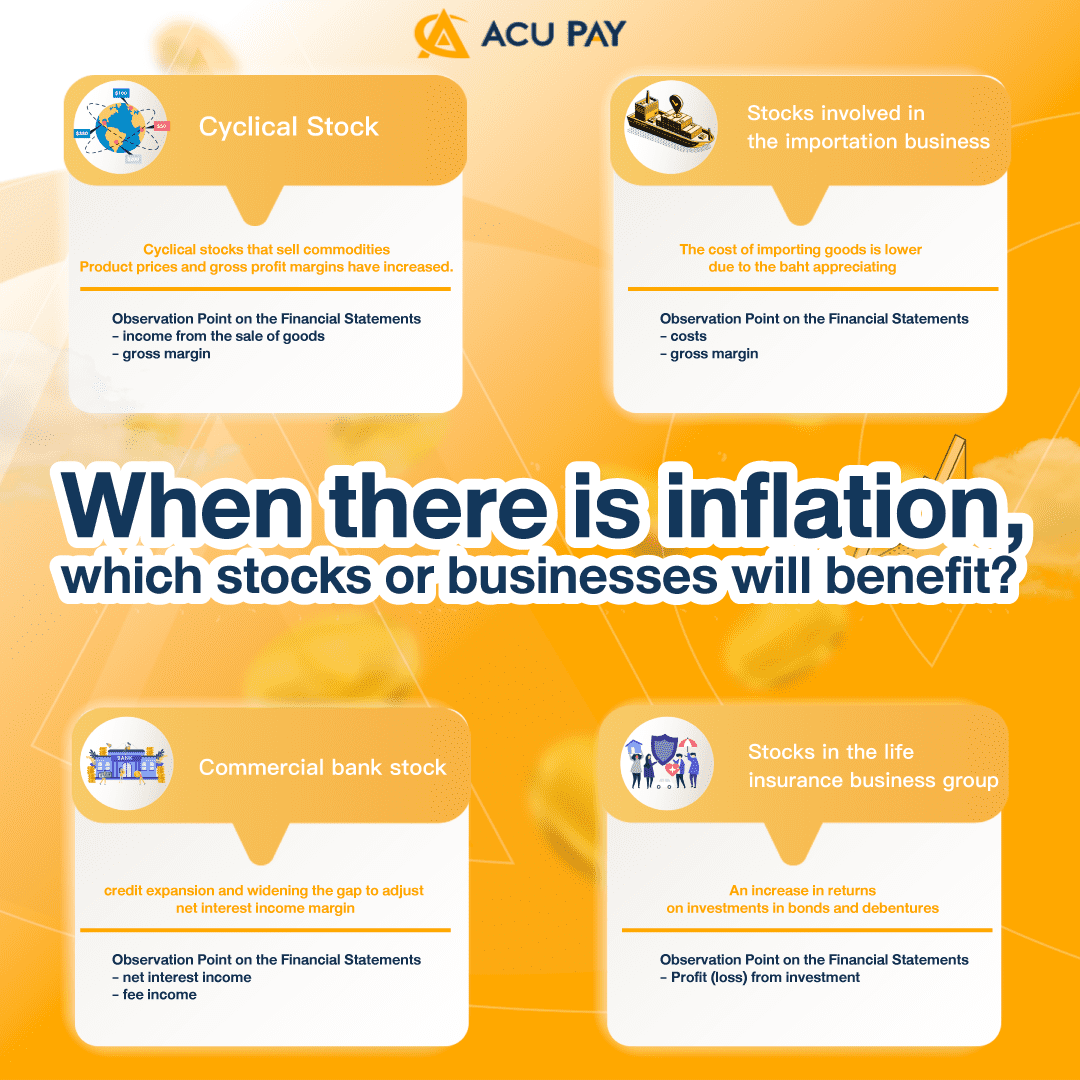

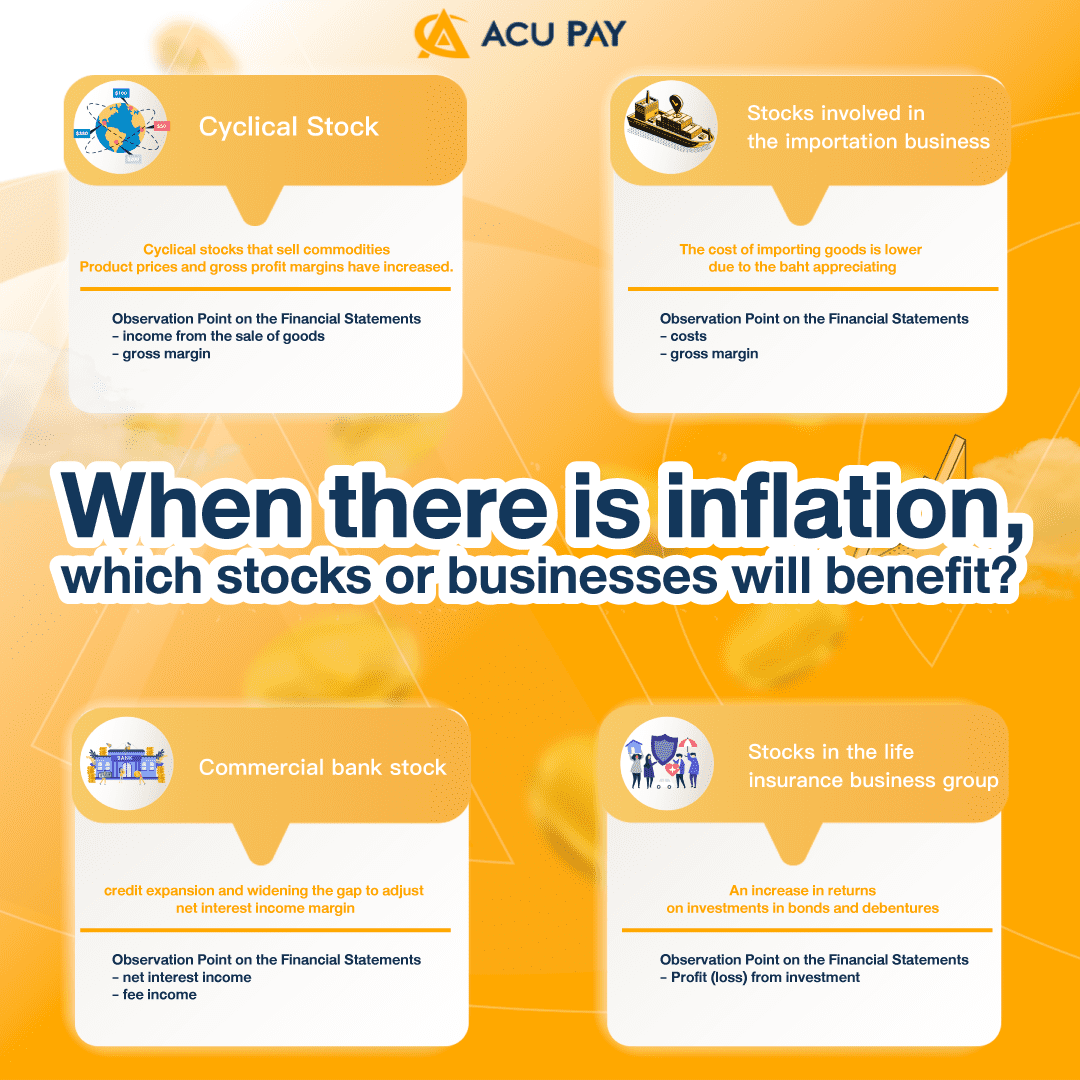

Inflation or not, we use CPI (Consumer Price Index), which is a statistical number that measures the change in the prices of goods and services that consumers currently purchase for regular consumption compared to prices in a given year as a base year.

For anyone who thinks “taxes” are difficult, try to think it again. Because taxes are easier than you think. If you run a cafe or restaurant, tax matters are an important basic skill you should know.

The tax allowance is important for people with taxable income, which each year has different things. Let’s see what they have and how much we can get.

e-Payment, or electronic payment, is spending or transferring money through electronic channels, such as paying bills via mobile phones

In reality, we all have at least one wallet used to store money or banknotes. In the world of cashless society, e-Wallets are like one wallet

The protracted Russian-Ukrainian conflict is unlikely to end, and Western countries may impose more sanctions on Russia, including measures related to energy exports.

At present, we can see that our world has come to know about digital currencies or cryptocurrencies.

The world is becoming a cashless society. What will be undeniably modified are the money format and the payment format

GuildFi is a web-3 gaming platform created to connect gamers and investors together. For example, Mr. A has funds but has no time to play games or can’t play games.

Today, ACU PAY will introduce you to Shoppi Coin. A Shoppi Coin is a coin or token of the Shoppi company based in London.

Inflation or not, we use CPI (Consumer Price Index), which is a statistical number that measures the change in the prices of goods and services that consumers currently purchase for regular consumption compared to prices in a given year as a base year.

For anyone who thinks “taxes” are difficult, try to think it again. Because taxes are easier than you think. If you run a cafe or restaurant, tax matters are an important basic skill you should know.

The tax allowance is important for people with taxable income, which each year has different things. Let’s see what they have and how much we can get.