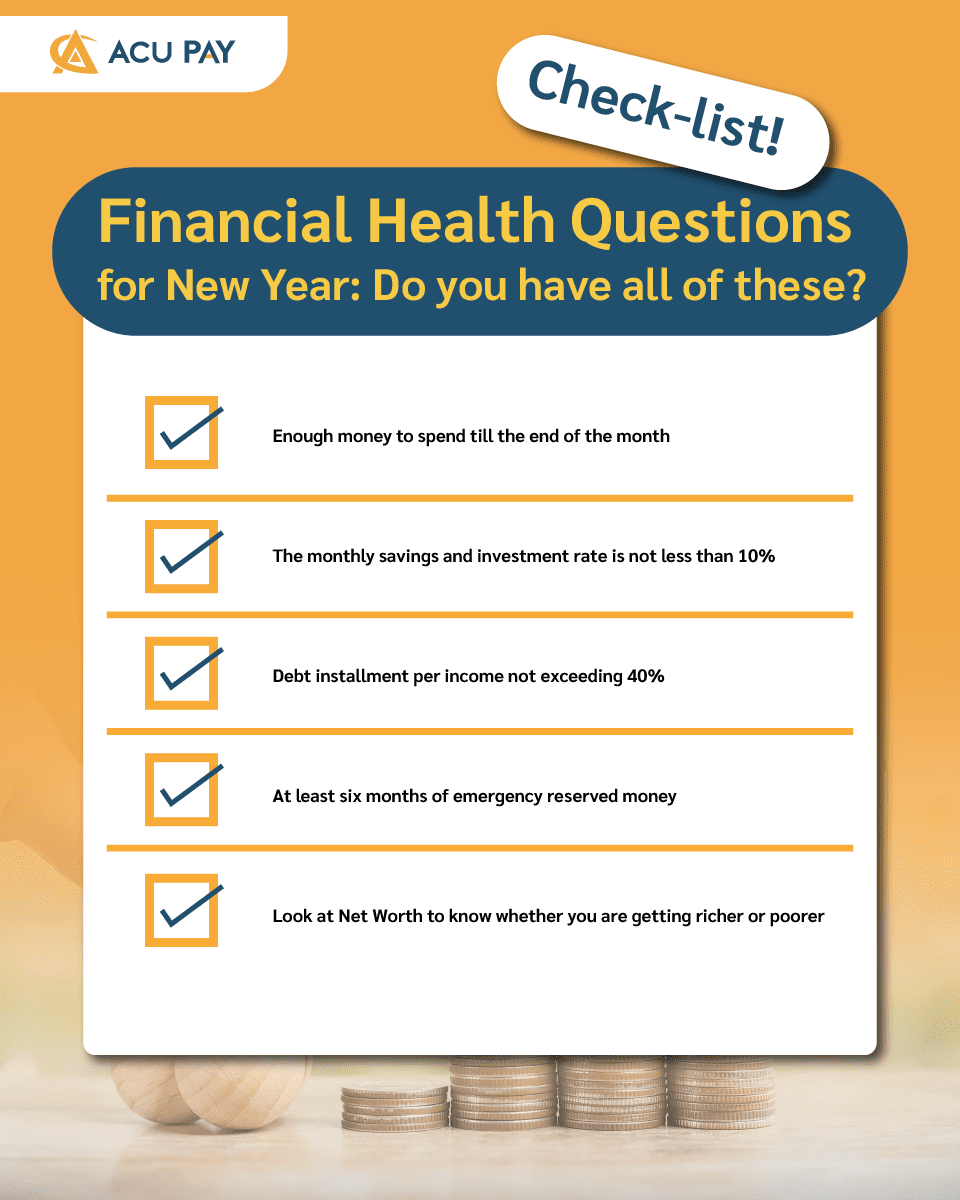

How was your finances last year? If you have enough money to spend, Congratulations!, you made it through the first step. For those who still feel like there’s not enough money left for a month, don’t worry. Let’s start again this year with the next checklist. This year, you will have enough money to spend and save more for sure.

Wealth can be achieved by the beginning of savings and investment. The faster anyone starts saving, the sooner wealth can be made. However, many people often have difficulties with their expenses, such as giving money to the family and paying debt. Thus, there is no money left for saving.

Let’s try to adjust your savings from “Save as much as the money left after using” to “Use as much as the money is left after saving”. We may start saving not less than 10% of our income.

Example

A monthly salary is 20,000 baht, deduct 10% from 2,000 baht will equal 18,000 baht. Then use this money of 18,000 baht to manage other expenses.

In the beginning, it might be a bit frustrating, but if you keep going, you are getting used to saving more. For anyone with less money, and

have a lot of expenses, you can try to start with as much as you can at 3%, 5%, and when you have more income, you can gradually increase your savings to 10%, 20%, and 30%.

Another financial health issue to check is the Debt Service Ratio (DSR) to prevent a flood of debt that could cause a negative account.

Liabilities used in financial health checks will be current monthly liabilities such as rent, home installment, car installment, telephone installment, and credit card installments. The income used in calculating will be all income per month such as salaries and income earned from online sales.

According to the Financial Health Check standard, each person should repay up to 40 – 45 % of their monthly income. If more than this, they are not in good financial health.

How to calculate

Debt to Income Ratio Ratio = monthly debt installment (constant expenditure) / total monthly income (revenue) x 100

Example

Mr. A has a monthly income of 30,000 baht with monthly debt installments of 10,500 baht.

From the DSR = 10,500 / 30,000 x 100 = 35%.

So Mr. A is in good financial health.

Conclusion of Debt To Income ratio (DSR)

Another thing to check is if there’s enough emergency reserved money. For anyone who does not know how important emergency money is, try thinking of the day when you lose your job or have an accident that requires urgent money. It’s like a stronghold to relieve stress, not to take out emergency high-interest loans, which can be a debt trap that you need years to clear.

Basically, you should have at least six times the monthly allowance, including daily expenses and monthly savings that we have targeted.

How to calculate

Emergency reserved money ratio = fixed monthly expenses x6

Fixed expenses are expenses that have already been determined and must be paid the same amount over a specified period, which do not vary according to sales, such as rent, telephone bills, food, and travel expenses, insurance premiums, and money for parents excluding extravagant expenses such as bag expenses and vacation trip costs.

Now you know what your six-month emergency fund for living expenses should be. Also, during the emergency savings, we can make a combination of investments to make our assets grow.

The way we can check whether our financial conditions are now “richer” or “poorer” is not by looking at asset value, but by “Net Worth.” We can check every year to know that all the time of earning a living, what we have accumulated more between “property” and “debt”?

How to calculate

Net Worth = Assets – Liabilities

You could split the paper in half and write down the assets on one side and the liabilities on the other.

There are 3 types of assets used in the calculation such as;

The liabilities used in the calculation will be short-term liabilities such as home debt, and credit card debt.

Then minus the total assets with the total liabilities to see how much net worth remains. Good net worth should always be a positive (+) value.

The more net worth you have each year, your financial health will be stronger, and you will have a more stable life.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY