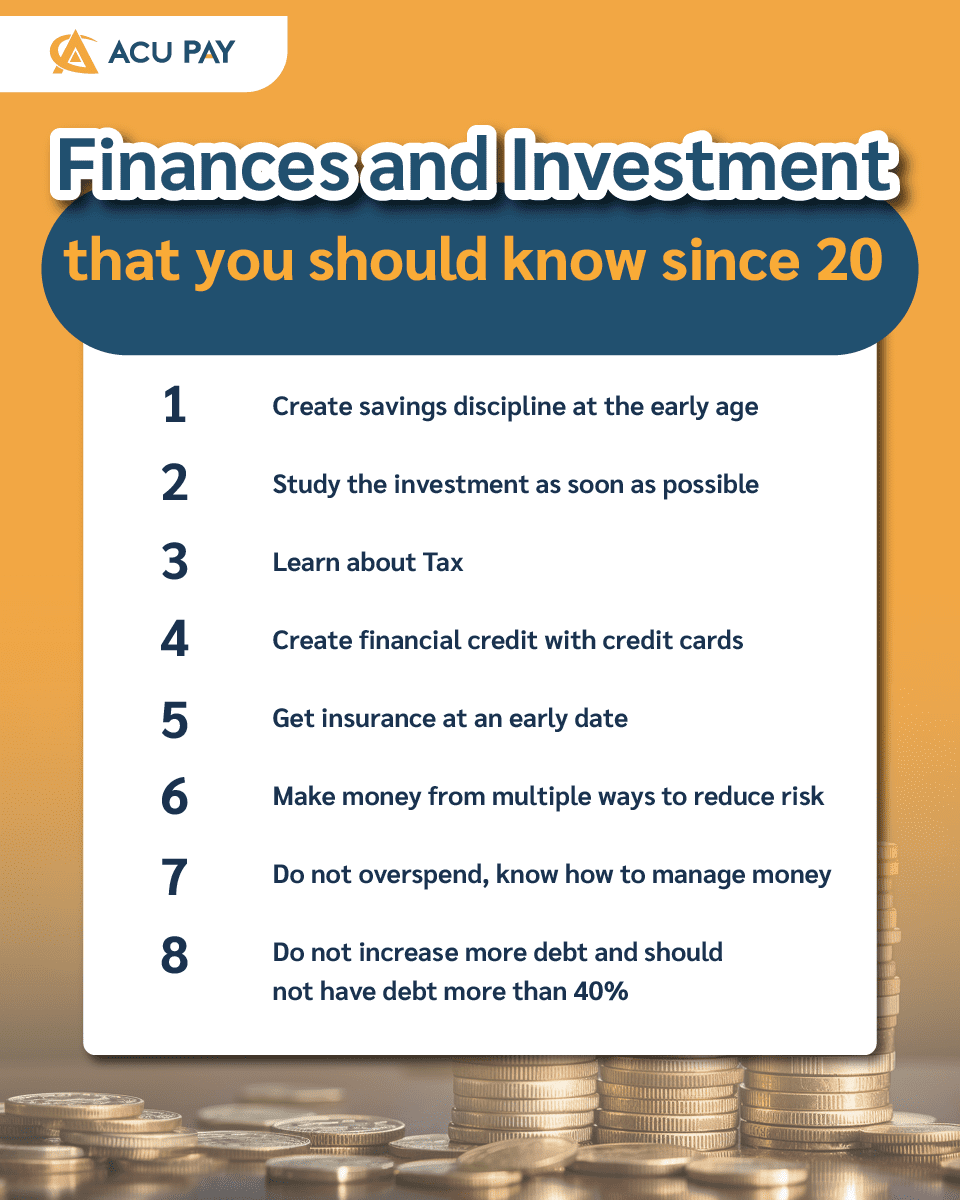

In your 20s, when you graduate and start working, you become even more burdened by house installments, car installments, and family care. The discipline of saving money at an early age will allow you to have more savings to use in future investments. The first savings that should have is emergency reserved money for at least 6-12 months of monthly salary, then other goals may be set, such as saving money to buy a car, buy a house, and study.

It is well known that the older you get, the less risk you face. Learning about investment from now on will give you enough time to learn and correct mistakes. If investments are made in old age, the risk of family burdens increases. When an investment goes wrong, you will lose all of your savings in retirement., causing much more difficulty than when investing at a young age. Therefore, it is best to study and learn how to invest quickly at this age.

In your 20s, when you’re entering your working age, what’s as important as finding a job that you like to do is to file taxes. The more net income you earn, the more tax you have to pay. However, excessive taxation can reduce your wealth. Thus the important thing to know is how to legally reduce the tax amount that you have to pay by tax planning. If planned well, you can save up money on tax and more money can be saved.

In addition to the convenience of your credit cards, the other advantage is that they can provide financial support to cardholders. A credit score is a benchmark for your financial credibility. It evaluates information from the history of debt creation, whether users have good debt repayment behavior or not. This information is used by financial institutions to apply for loans. Having a credit card will help you build your credit history, and make your financial credibility so that when you apply for loans to buy homes or other loans in the future will make financial institutions more considerate.

Everyday life is subject to a lot of risks and uncertainties, health insurance, accident insurance, life insurance, or automobile insurance is often considered to be the best thing to do when you are old because right now you are still young and healthy.

In fact, starting insurance at an early age will help us pay cheaper premiums in the long run and get more coverage from an early start. In addition, we can also use it to reduce taxes. The faster you do, the more advantageous.

One-way income may not be the best option in today’s world, because increasing expenditures go against income, therefore, earning multi-way income can help secure financial stability. One of the second incomes contributing to wealth and prosperity is Passive Income, which generates income from assets such as rental property, stocks, funds, bonds, interest rates, copyright charges, and patent fees that are considered to create long-term financial stability.

In addition to having a job and sufficient income, another important thing to do is to manage our finances to be enough for spending and saving each month. You have to know how to manage in a way that you can separate money into parts for each expense and not overspend, because if we lack good management, the future may be even more difficult.

Being in debt is the use of future money, so every debt should be carefully planned and should not exceed your own capacity. According to the principle of good financial planning, the monthly debt installments should not exceed 40% of income. For example, with a monthly income of 15,000 baht, you should not pay debt installments of more than 6,000 baht (15,000 x 40%). If you have more monthly installments, there may be insufficient money to spend each month, causing you to apply for new loans, then become an endless cycle of debt.

These are all financial matters that young people in their 20s and older should know, and the sooner you know, the sooner you can secure stability in working life till retirement.

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY