Central Bank or Monetary Authority is an agency established to be an intermediary in the country’s financial affairs. We’ve probably heard of a U.S. bank like Silicon Valley Bank going bankrupt in early 2023, causing the Fed, the Federal Reserve, and other agencies to come to give help.

Have you ever wondered about the origin of the Central Bank? How is it so important to the nation’s economy? Which countries have the biggest central bank? Today, ACU PAY will explain it to you.

The central bank originated in the 17th century or about 300 years ago. The first bank to be considered as the central bank is Sveriges Riksbank, a central bank of Sweden which was founded in 1668 to give loans to the government and serve as a clearinghouse for trading prices between Sweden and other countries.

After World War II, financial difficulties and economic crises occurred, the central bank’s role then became more recognized. The central bank has played a role in solving economic and financial problems. As a result, many countries have established their own banks.

At present, most countries of the world have their own central banks. The latest central bank was established in 2001 which is the central bank of Timor-Leste. Despite similar authorities, the size of each central bank varies depending on the size of each country’s economy.

ธนาคารกลางของทุกประเทศในปัจจุบันมีหน้าที่คล้ายกันคือทำหน้าที่เป็นองค์กรหลักที่คอยดูแลเสถียรภาพทางการเงินของแต่ละประเทศ โดยธนาคารกลางจะทำงานกับหน่วยงานรัฐหรือสถาบันการเงินเป็นหลัก และจะไม่เปิดให้ประชาชนทั่วไปมาทำธุรกรรมการเงินด้วย เช่น การรับฝากเงิน ถอนเงิน หรือปล่อยกู้ให้กับลูกค้ารายย่อยอย่างที่ธนาคารพาณิชย์ทั่วไปทำ โดยในปัจจุบัน ธนาคารกลางมีอำนาจหน้าที่หลักตามนี้

Nowadays, the central bank of all countries has a similar function, which is to act as the main organization that oversees the financial stability of each country. The central bank will mainly work with government agencies or financial institutions and will not allow the public to engage in financial transactions such as deposits, withdrawals, or loans to retail customers as commercial banks do. Currently, the central bank has main functions as follows.

1. Establish a country’s monetary policy

For example, establishment of ‘policy interest rate’ which is the country’s benchmark interest rate. The central bank may lower its policy rate during the economic downturn to stimulate spending, such as raising the policy rate to control inflation.

2. Supervise the issuance of banknotes

Supervising money circulating in the system, controlling the amount of money in the economic system not too much or too little by adding money in or drawing it out of the system. Supervise the issuance of banknotes and coins as well as ensuring proper exchange rates between currencies.

3. Supervising the domestic financial system, commercial banks and governments

Regulate the banking industry to protect people from financial institutions, such as establishing rules to control domestic financial institutions, set commercial banks to deposit cash reserves for debt repayment to guarantee protection in the event of a financial problem, control lending at the appropriate level and ensure an efficient payment system in the country.

4. Give loans to banks

Assist commercial banks in case of liquidity problems, including taking care of their customers in case of bankruptcy.

5. A financial adviser

Serving as a Financial consulting agency, which may provide useful financial research or useful financial reports to both government and private agencies.

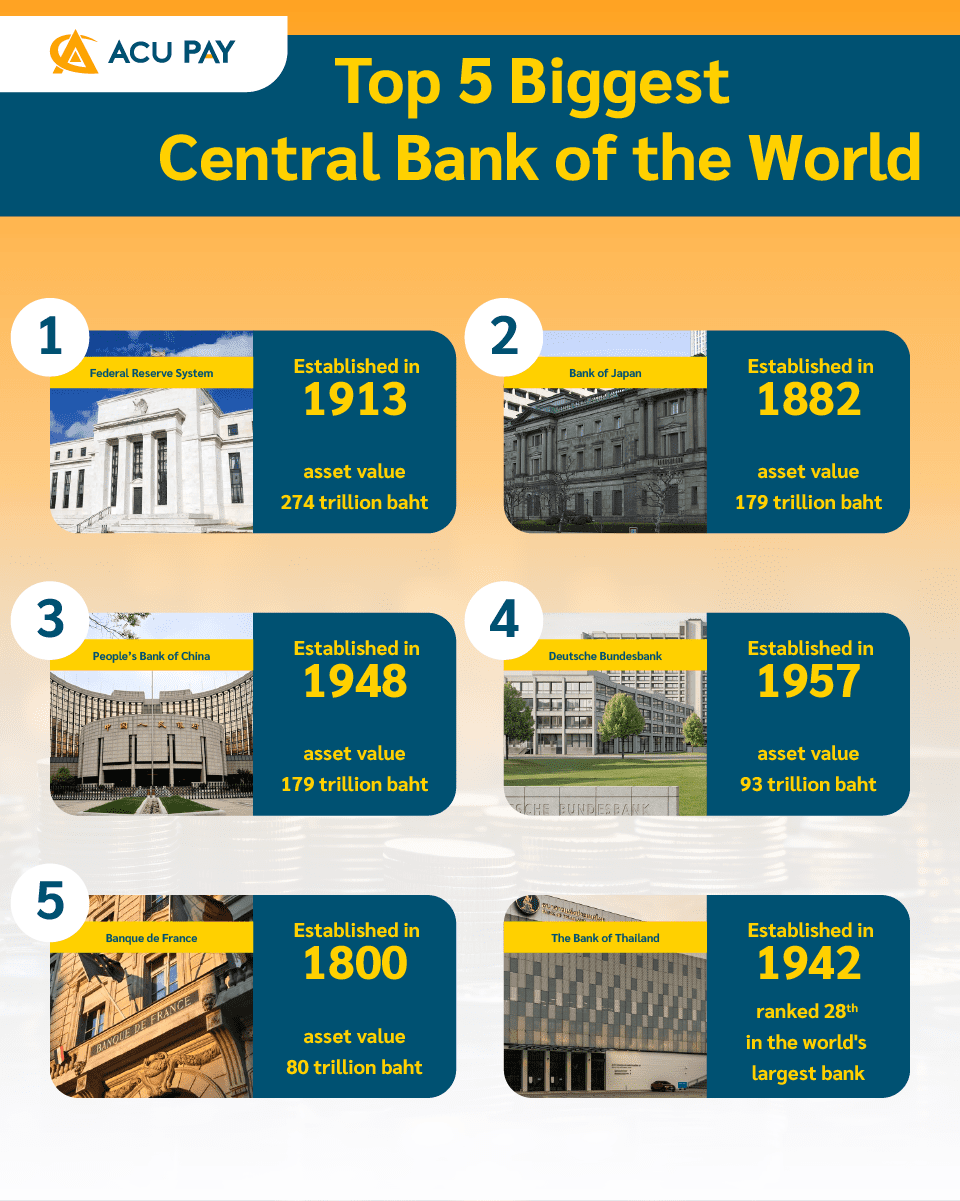

According to the Sovereign Wealth Fund (SWF), it ranks all of the central bank’s asset management in the world with 5 central bank rankings as follows:

Established in 1913. It has an asset value of 7.86 trillion dollars or approximately 274 trillion baht.

Established in 1882. It has an asset value of 5.15 trillion dollars or approximately 179 trillion baht.

Established in 1948. It has an asset value of 5.14 trillion dollars or approximately 179 trillion baht.

Established in 1957. It has an asset value of 2.68 trillion dollars or approximately 93 trillion baht.

Established in 1800. It has an asset value of 2.3 trillion dollars or approximately 80 trillion baht.

Nevertheless, The Bank of Thailand (BOT) is ranked 28th in the world’s largest bank, established in 1942.