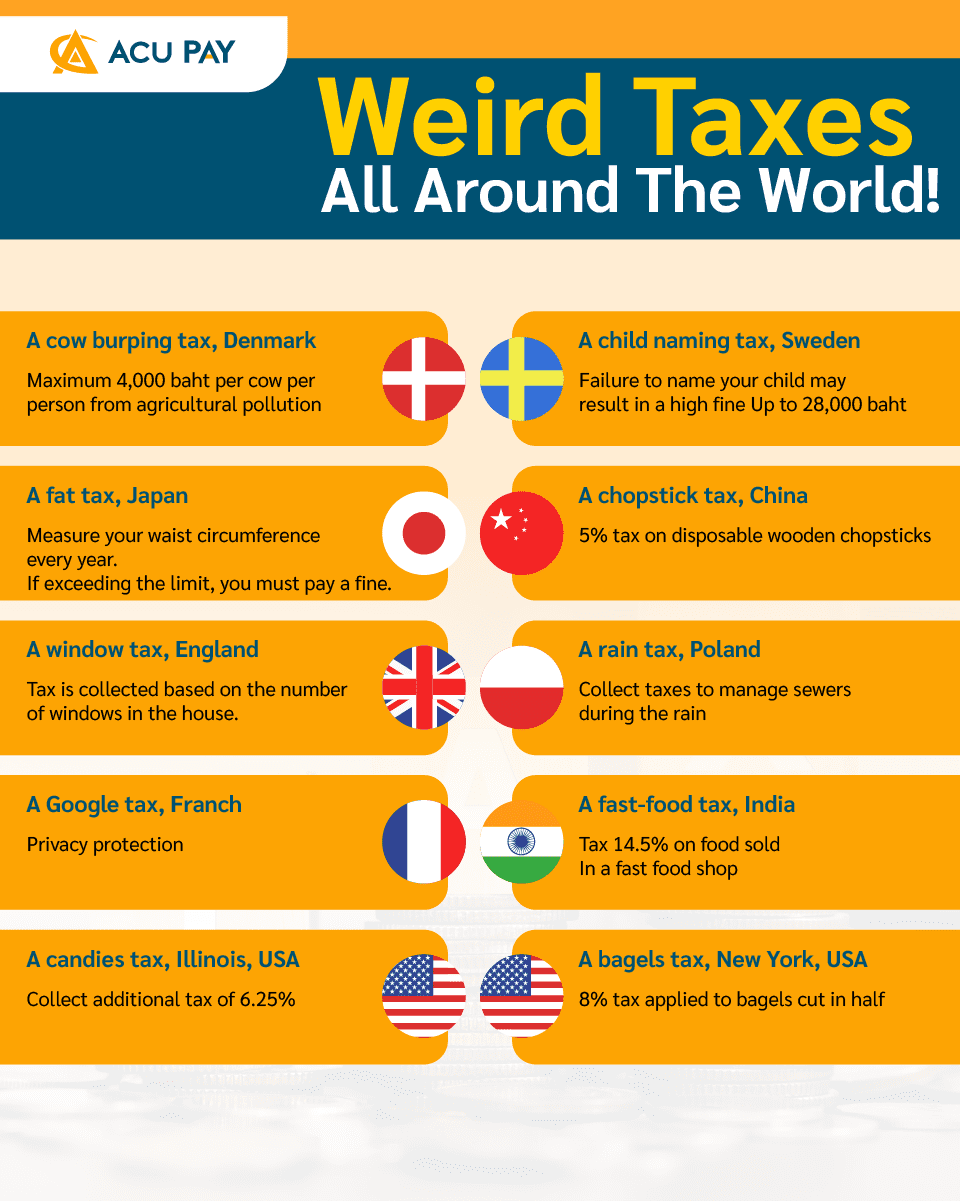

Taxes are money levied by the government from people and entrepreneurs to become income for national development and businesses that benefit the general public. However, in some countries in the world, there are strange aspects of taxation that we might not expect. If we want to know which countries are there, follow ACU PAY.

Many people believe that the cause of Greenhouse Gas is black smoke from the factories, however, Denmark has a different perspective. The cause of Greenhouse Gas in European countries is mainly from ‘cows’.

According to the research, about 18% of European greenhouse gasses come from methane gas, which is a gas emitted from cows that digests green leaf vegetables slowly and ferments them into methane gas released through burping and farting.

To prevent global warming caused by cows, some countries in Europe decided to levy a tax on each cow, one of those countries is Denmark. Thus, each cow in Denmark has a value of 110 dollars or approximately 4,000 baht per cow.

Moreover, in New Zealand, its government also proposes to levy greenhouse gas taxes on the burping and peeing of cows, sheep, and other cattle to fight against climate change problems.

Child naming has always been a hard thing to do. However, in Sweden, naming a child must pass an agency review before the child can be named. Children must have a name before the age of 5. If Swedish parents fail to name their children, they will be fined 5,000 kroner or about 20,000 baht. This is a law enacted in 1982 to prevent people’s names from using royal names, and also protect children from inappropriate names.

In Japan, there is a law called ‘Metabo’ which is very famous. This law determines men and women who age between 40 – 75 years old to measure their waist circumference annually. Men’s waist circumference must not exceed 85 centimeters and women’s waist waist circumference must not exceed 90 centimeters. If their waistline exceeds the specified size, they will have to pay a fine.

Japan’s fat tax has been hailed as an attempt to overcome rising obesity rates and end the spread of diseases such as diabetes.

Every year in China, about 45 billion pairs of disposable chopsticks are made. To produce these many chopsticks, China has to cut down about 25 million trees.

In 2006, the Chinese government imposed a 5% tax on disposable wooden chopsticks to protect and preserve cut forests. Officials believe the measure will encourage people to use reusable plastic chopsticks instead of traditional ones.

327 years ago, in 1696, England had a window tax according to the number of windows in each house. In those days, the British people had an idea against income tax because they thought that the government knowing their income violated their rights. As a result, the British authorities must find strategies for tax collection.

At that time, window-making was considered a costly task. The large number of windows can represent the wealth of homeowners. Window taxes have been levied for hundreds of years.

The initial tax rate of the collection will be levied at 2 shillings for every house with less than 10 windows and will be levied more with houses with more windows. This makes the window tax a type of progressive tax form.

After the tax was introduced, people tried to reduce the number of windows by applying cement to cover them. This tax was strongly criticized for depriving citizens of their rights. In 1851, the British authorities decided to abolish it.

Even though this tax is called rain tax, it is not directly about the rain but about the drains which are covered with sewage and garbage from houses and stores. The common waste disposal system is not fully operational during the rainy season until flooding occurs in different areas.

The city’s residents have to pay taxes at an average rate of 10-15 US dollars (about 306 – 460 baht) per year so that local governments can use that tax money as a budget for waste and drainage systems in the area of 1.5-2 million US dollars (about 46 – 61 million baht) per year.

As we know, European countries tend to secure their privacy more than the USA, so there’s always more control over tech companies. Even so, coupled with the economic crisis in the European zone, they are more likely to follow large technology companies. They say they are generating income from their citizens without paying their taxes on schedule.

In France, there is a digital tax levied on multinational tech companies such as Google, Facebook, and Apple that earn more than 750 million euros (850 million U.S. dollars) and earn at least 25 million euros in France. It will be taxed at 3% and will effect back to early 2019.

After Kerala which is a city in the south of India was ranked to be the city’s second-largest population of overweight children and youths in 2015, the state has announced a tax levied on fat-rich foods, or the ‘Fat Tax.’

The foods that are specially targeted include burgers and pizzas, which the government levies about 14.5% more tax on this type of food at popular fast-food chain restaurants like McDonald’s and Domino’s Pizza.

Although the ‘Fat Tax’ measure will never stop children from eating junk food, it may at least reduce consumption as higher food prices will result in parents limiting their children’s consumption of that food.

People who love sweets and candies in Illinois would be quite shocked because sweets without flour in Illinois would be charged a 6.25% sales tax.

For New Yorkers who want to eat bread for breakfast, whether that bagel is cut in half or cream cheese toppings are prepared on the bagel face, it will be charged an 8% tax. If they don’t want to pay taxes, they must eat a whole thing without a cut and must not eat it at the stores.