many people may have used e-Wallets, which are electronic wallets. In order to collect money in electronic form, known as e-Money, and to spend it, we need to top it up first. So, in order for everyone to be sure that the money we top up will not be lost, let’s see what the service providers have for us to use e-Money without worry.

e-Money, or electronic money, is the value of money that is recorded in electronic form (such as a computer chip in a cash card or plastic card, telephone network, or Internet network) that the user has paid or pre-paid through a bank account to e-Money service providers, also known as e-Wallets, which can be used to pay for goods or services at a shop that accepts payment.

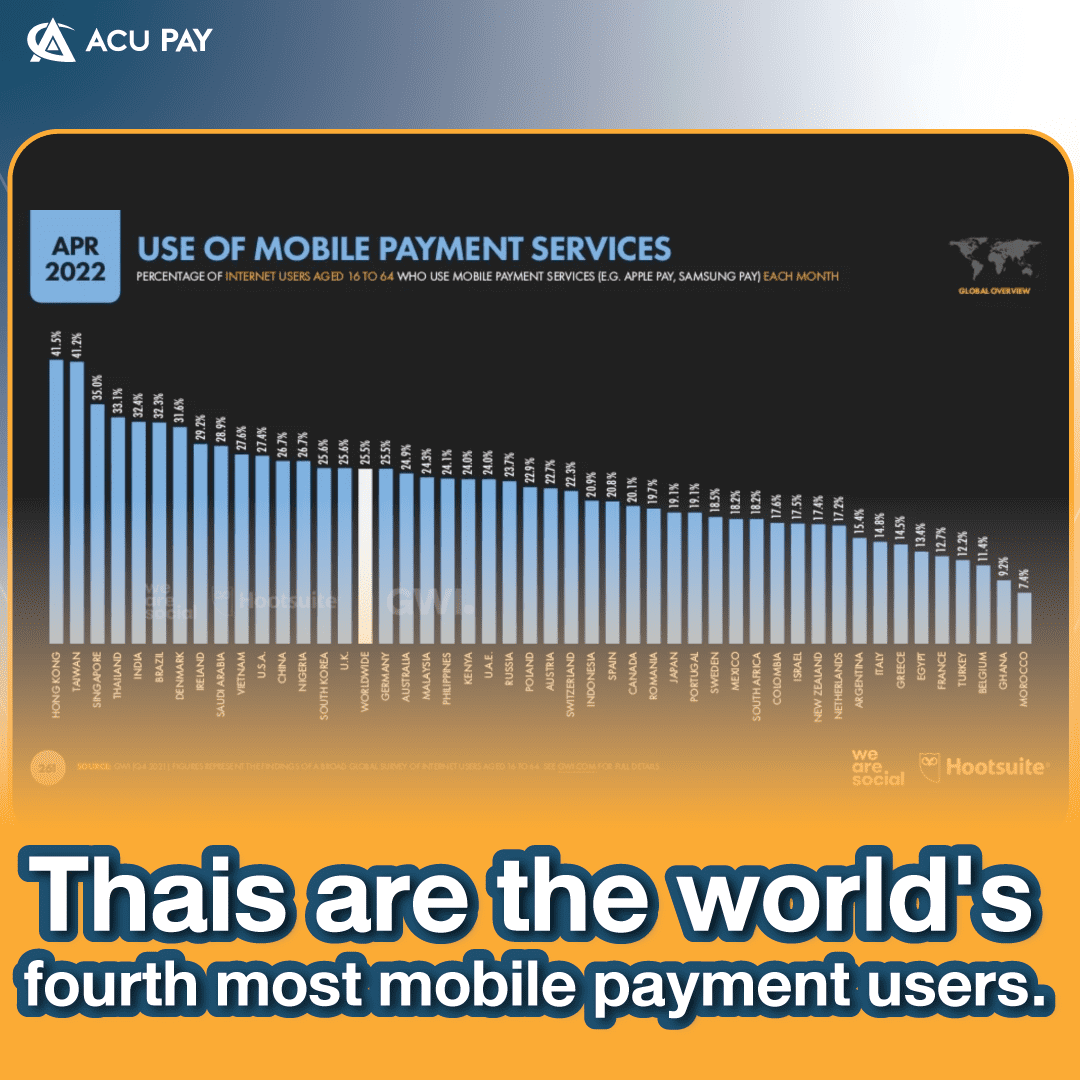

At present, e-Money is growing steadily. It is considered an important development in payment. And when looking at the behavior of spending with e-Money, it was found that more than 83% of transactions were worth less than 100 baht, with an average value of only 41 baht per transaction. The lower the cost, the higher the frequency. And spending with e-Money is an option that Thai people choose to spend or pay for products daily instead of using cash.

According to data, in the past year of 2021, there were more than 2,537 million spent or an average of more than 7 million per day. In Thailand, spending one hour per day per person accounts for 10% of the total population. and compared to the overall e-Payment system that has a spending volume of more than 20 million transactions, accounting for 25% of all e-Payment systems,

All of the above information reflects the behavior of Thais in using e-Money (electronic money) in daily life, which is more and more likely to be used instead of cash. It can be seen from the average spending value that it is not very high. But the amount of spending on the e-Payment system is high.

In your opinion, what will make the e-Money system grow? Is it a payment system that can be used instead of cash?