Due to the pressure from the government, Mr. Srettha Thavisin, the Prime Minister, suggested that the BOT should reduce the interest rate to boost the economy and reduce the burden for investors and the public after the economy figures in 2023 grew only by 1.9% which is lower than expected.

In the special interview with Nikkei Asia, Dr. Sethaput stated that the central bank was not “stubborn” on the current interest rate which is at a high level in decades, but considered the latest figures showing weak economic growth and negative headline inflation. The Gross Domestic Product grew only 1.9% which is lower than the markets’ expectations due to the political situation that has no progress which delayed the 2024 government budget.

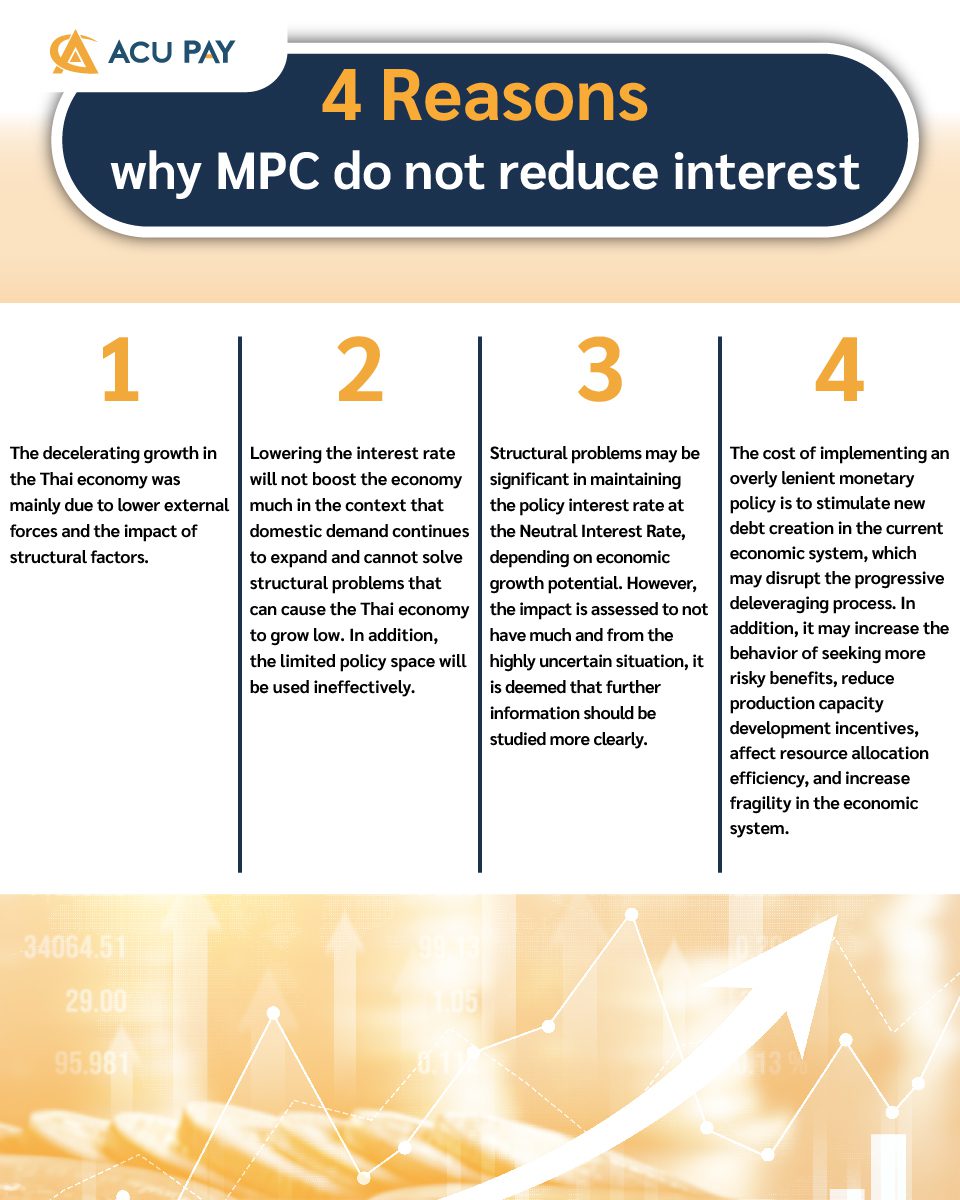

Recently, the Bank of Thailand (BOT) revealed the meeting report of the Monetary Policy Committee (Short version) No. 1/2567. It stated the result of the committee consideration with most of The MPC decided to maintain the policy rate at 2.50% per annum in a 5-to-2 resolution. 4 votes view that maintaining a neutral policy rate will help support sustainable economic growth, which requires maintaining financial stability.

Dr. Sethaput also said that the increased household debt is not a minority because interest rates have been very low for a long time, it will encourage borrowers to borrow money, and another rate lowering will give the wrong signal in trying to manage household debt more sustainably.

However, the MPC is flexible and ready to lower its policy rate if economic development and inflation change significantly. Lastly, whether the MPC decides to hold an urgent special agenda meeting or lower the interest rate or not?

ให้ทุกเรื่องการเงินเป็นเรื่องง่าย เริ่มต้นวันดีๆ ไปกับเรา MAKE A GREAT DAY WITH ACU PAY