หลายคนเป็นกันรึเปล่า อยากเก็บเงินแต่ทำไมทำไม่ได้สักที เป็นเพราะอะไรกันนะ ลองมาใช้ทฤษฎีที่เรียกว่า “Nudge Theory” หรือ “ทฤษฎีผลักดัน” ที่จะทำให้เราสามารถเก็บเงินได้อยู่หมัด ซึ่งทฤษฎีนี้จะเป็นแบบไหน ตาม ACU PAY มาเลย

Why do people smoke, drink alcoholic beverages, eat unhealthy food even though we know that they are bad for our health? In terms of finance, people tend to spend extravagantly as well.

The reason for this condition is in the initial assumption of Dr.Richard H. Thaler, an American economist who said, “Human beings are irrational and often make wrong decisions because they tend to be biased toward the surrounding environment that occurs in situations or according to personal emotions and feelings.” This idea has been filtered both economically and psychologically. This theory was to motivate but not force, and then a Nudge Theory occurred.

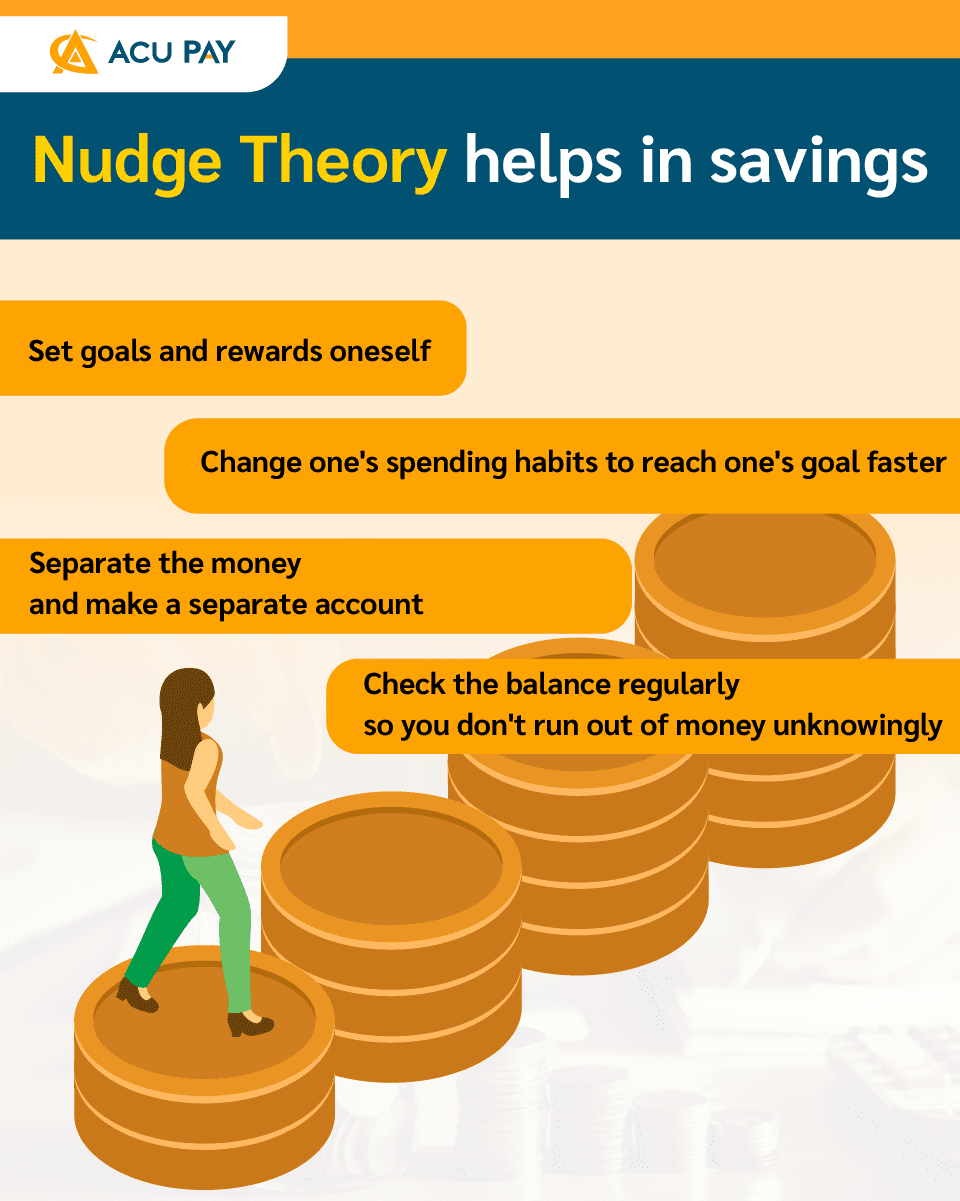

Nudge Theory is the design of alternatives that are not too forced on us so that we can accomplish what we intend to achieve because people usually don’t think much about long-term goals, just short-term goals. Saving money is like forcing us to stress about large goals that we set until it finally makes achieving them difficult. However, this theory will help create the flexibility to save money. There are four steps as follows:

Creating inspiration in saving money such as rewarding oneself after saving money till it reaches its goals. It will help to achieve goals and have the motivation to save money. For example, you intend to save money of 3,000 baht every month. After 1 year, you can reward yourself by purchasing the thing that you want the most with a budget not exceeding 5,000 baht. You will have the motivation to continue saving money.

Once you set your goal to save money of 3,000 baht each month, your lifestyle habits should be adjusted to meet your goals. If you are a party lover or shopping lover, try reducing the frequency of partying or shopping or may find other activities that you can do without spending money or spending less than partying and shopping.

To accomplish anything that you do, not only depends on discipline but also on good planning and management, especially the clear separation of money. For example, you could use a savings application that can now divide its wallet into sub-pockets so that you can save money in each sub-pocket and help you spend it unmixed. Nevertheless, anyone who can’t help but move money from one pocket to another pocket often might try opening separate savings accounts so that they don’t use that money unknowingly.

Even though checking your balance amount often, especially at the end of the month, is something that hurts you due to the shrinking money, checking it regularly and habitually will prevent you from spending money on unnecessary things because you don’t know how much money is in your account. Therefore, this method will be like reminding yourself so that you don’t inadvertently use up all your money. The part that is savings should be clearly separated at the beginning of the month or using automatic debiting methods in case you are afraid that you will forget.

Nudge Theory is another kind of savings technique that gives us more choices for saving and lets us know that saving isn’t always difficult.