A cashless society is a description of the economic and social conditions in which financial transactions are performed without the use of banknotes or coins. But it is the transfer of digital information between each other, whether or not through an intermediary between the transactors. The most popular cashless transactions today are e-Money (electronic money) by using e-Wallets (electronic wallets), credit cards, debit cards, including PromptPay, and scanning QR Codes (QR Payment). Cashless payments are a key driver of the future.

policy to reduce fees for transfers and payment of goods and services. Many commercial banks or e-Wallets announce that they do not charge fees for money transfers and online payments. The popular method is e-Wallet, which is increasing the number of retail money transfer transactions. This is reflected by the Bank of Thailand’s statistics for using e-Money in 2021 at 467,197.74 million baht, almost doubled from 2019 at 276,317.42 million baht.

Through government policies that heal people from the situation of COVID-19 through projects such as Kon La Khrueng, we win, allowing Thai people to get to know the Pao Tang app, an e-Wallet application, to make use of payment for goods and services. as well as to the application that merchants use to support payment called tung ngern, make Thai people needing to change their behavior in receiving and spending.

With the growing popularity of quick response codes (QR codes), it is believed that many people, even ourselves, dialing account numbers or even phone numbers are a hassle and it is easy to make mistakes. The transfer and payment of goods and services using Quick Response Code (QR code) via e-Payment and e-Wallet reduces errors and increases convenience a lot. Quick response code (QR code) became popular in late 2017 and its popularity is growing due to part of the COVID-19 situation that we need to spend contactless.

FinTech is a business where modern technology is applied to various forms of financial transaction services to provide efficient services, especially in terms of convenience and lower cost of services.

FinTech is a combination of financial and technology, which means financial technology developed in the 21st century to provide transaction services to support or replace traditional transactions.

It is more convenient and faster to be able to use financial services anytime, anywhere, 24 hours a day via computers or smartphones. There are steps to take that are not difficult and can be done by yourself. In terms of the cost of service, it is lower than using services at commercial banks. This is to meet the needs of new entrepreneurs (startups) who have the idea to close the gap in the inconvenience of using cash or banking services.

Promotion from e-Payment service providers that make payment of products or services by e-Payment more worthwhile because they receive discounts, free gifts, or get cash back from spending. This is why e-Payment is popular because of its low cost of service. Therefore, the fee is greatly reduced. It has a positive effect on users, giving us promotions that are worth more than using cash.

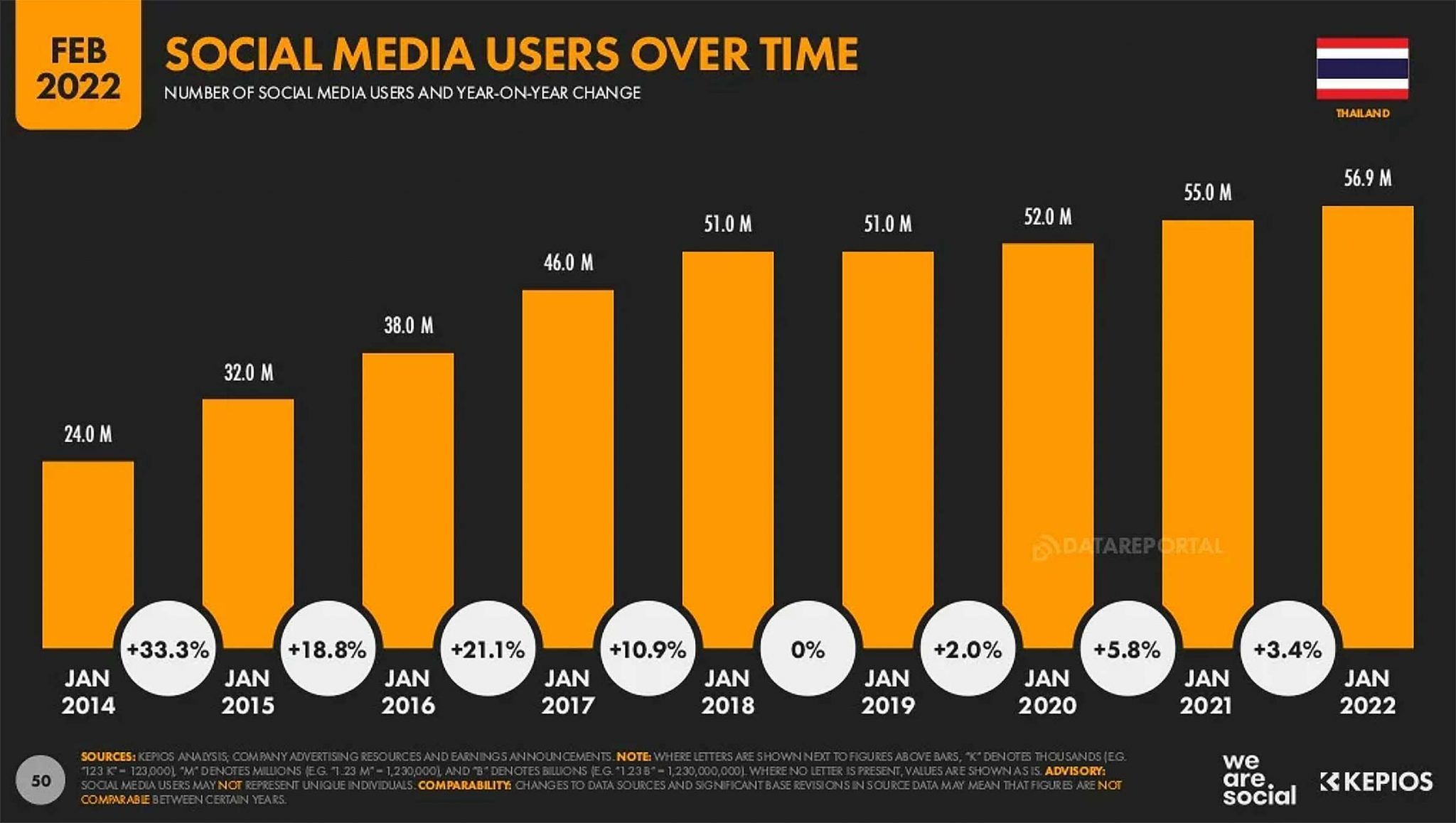

According to statistics from We are social, more than 80% of Thais have access to the Internet and phones, which is another important factor in making Thai people access e-Payment via mobile phones (Mobile Payment). As a result, behavior changes, and the trend of a cashless society is becoming more and more popular by using e-Payment services such as e-Wallets or spending via cards.

Do you think there will be any factors or any events that affect the life or contactless payments Please feel free to comment and let us know?