What is a cashless society? Why is it popular?

What is a cashless society?

A cashless society is a description of the economic and social conditions in which financial transactions are performed without the use of banknotes or coins.

What is a cashless society?

A cashless society is a description of the economic and social conditions in which financial transactions are performed without the use of banknotes or coins.

There are many forms of investment, one of which is DCA investment. People have probably heard of this term quite well. Some may know the name but don’t really know the meaning or principle of DCA investments. Let’s take a look.

Nowadays, e-Wallets are becoming a huge influence on everyday spending. As a result, the spending behavior of people in society is related to consumption and consumption is changing. Do you wonder how e-Wallet has made a difference? Let’s see.

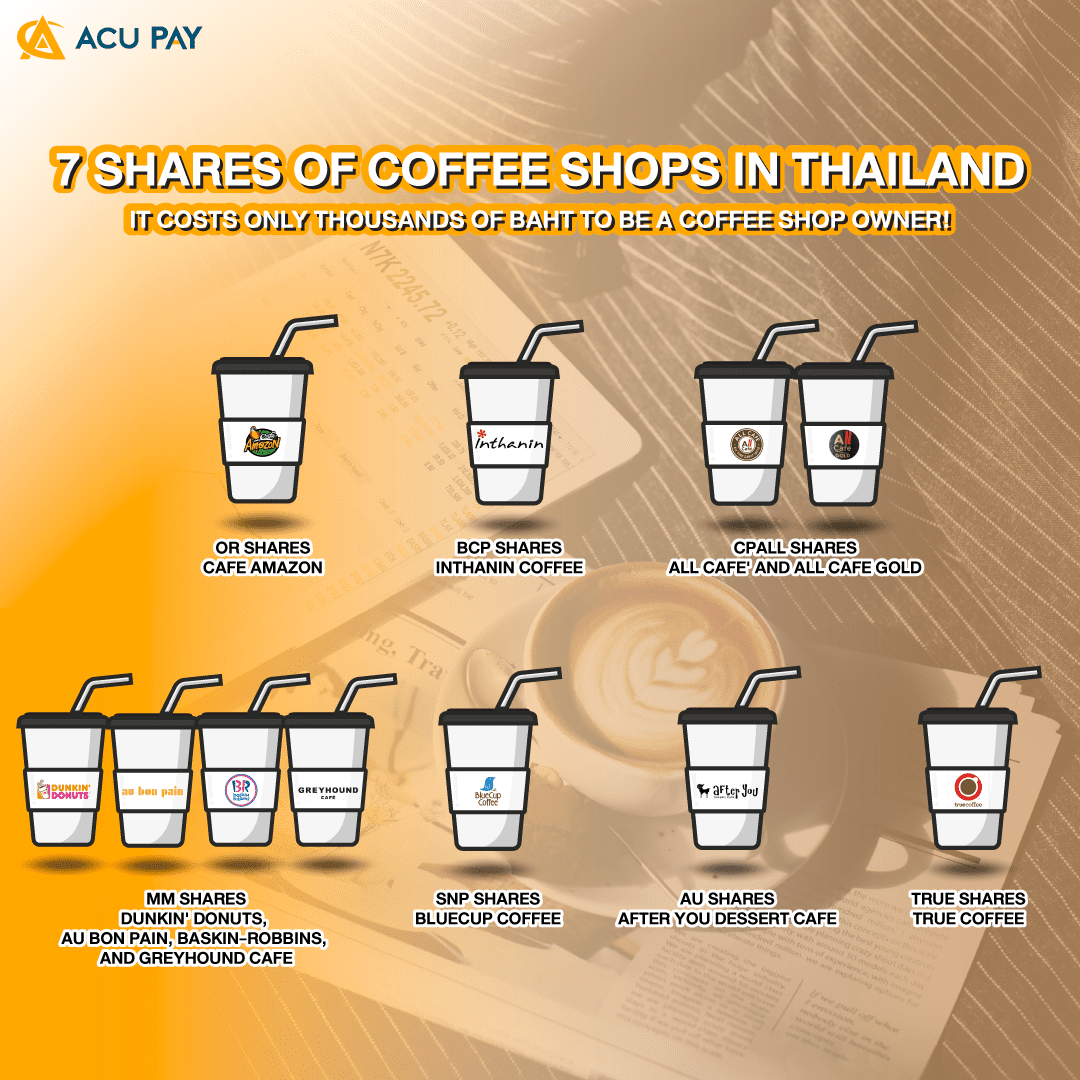

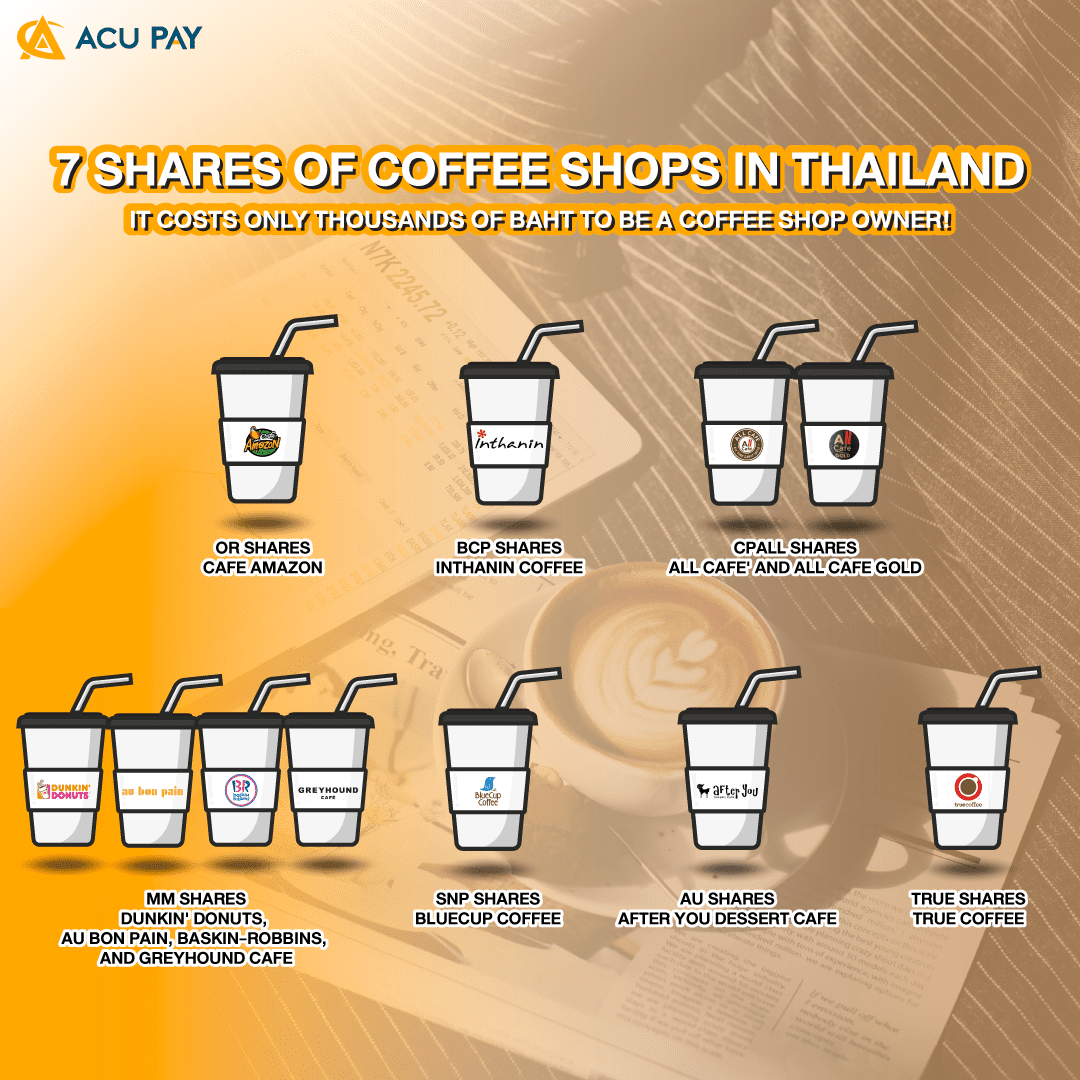

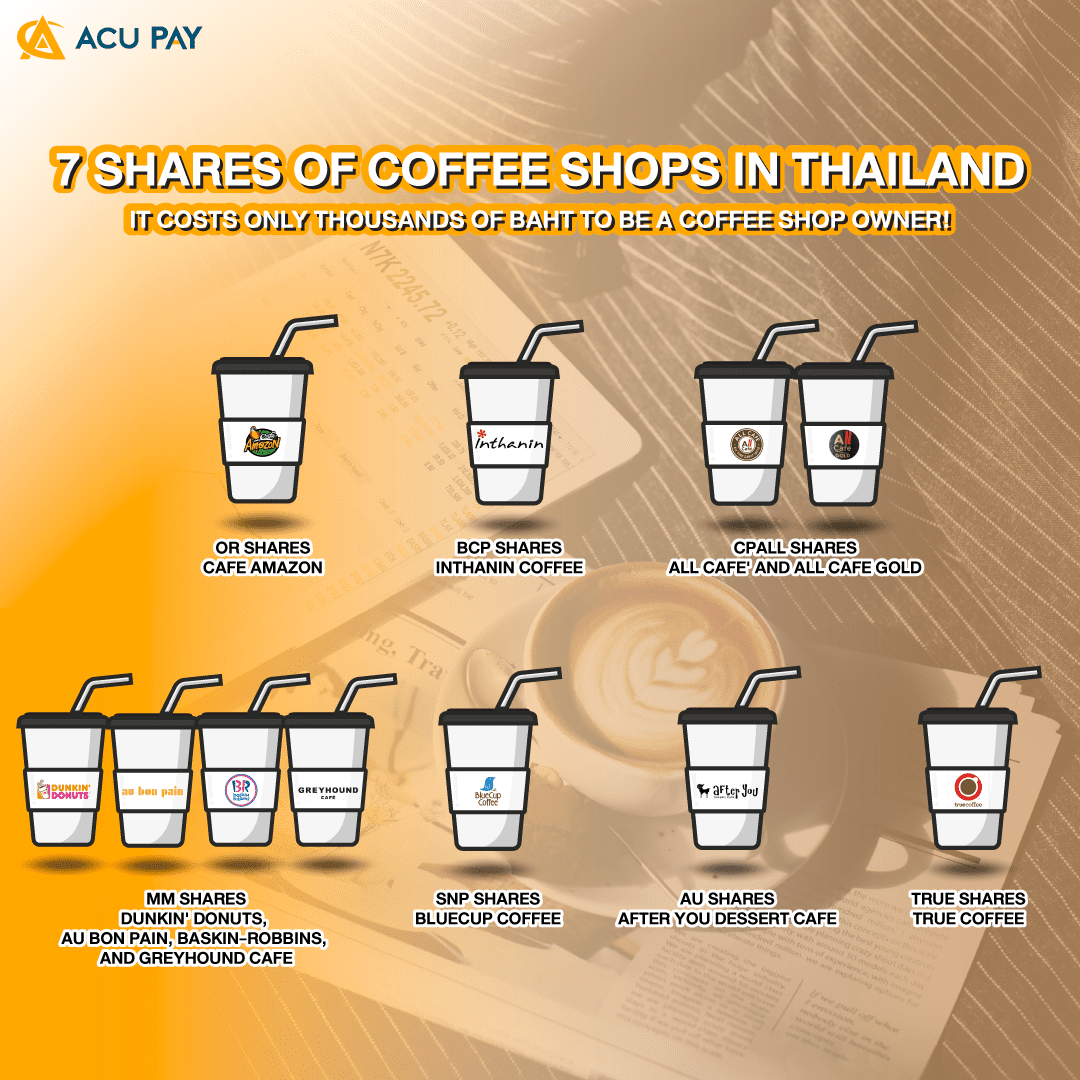

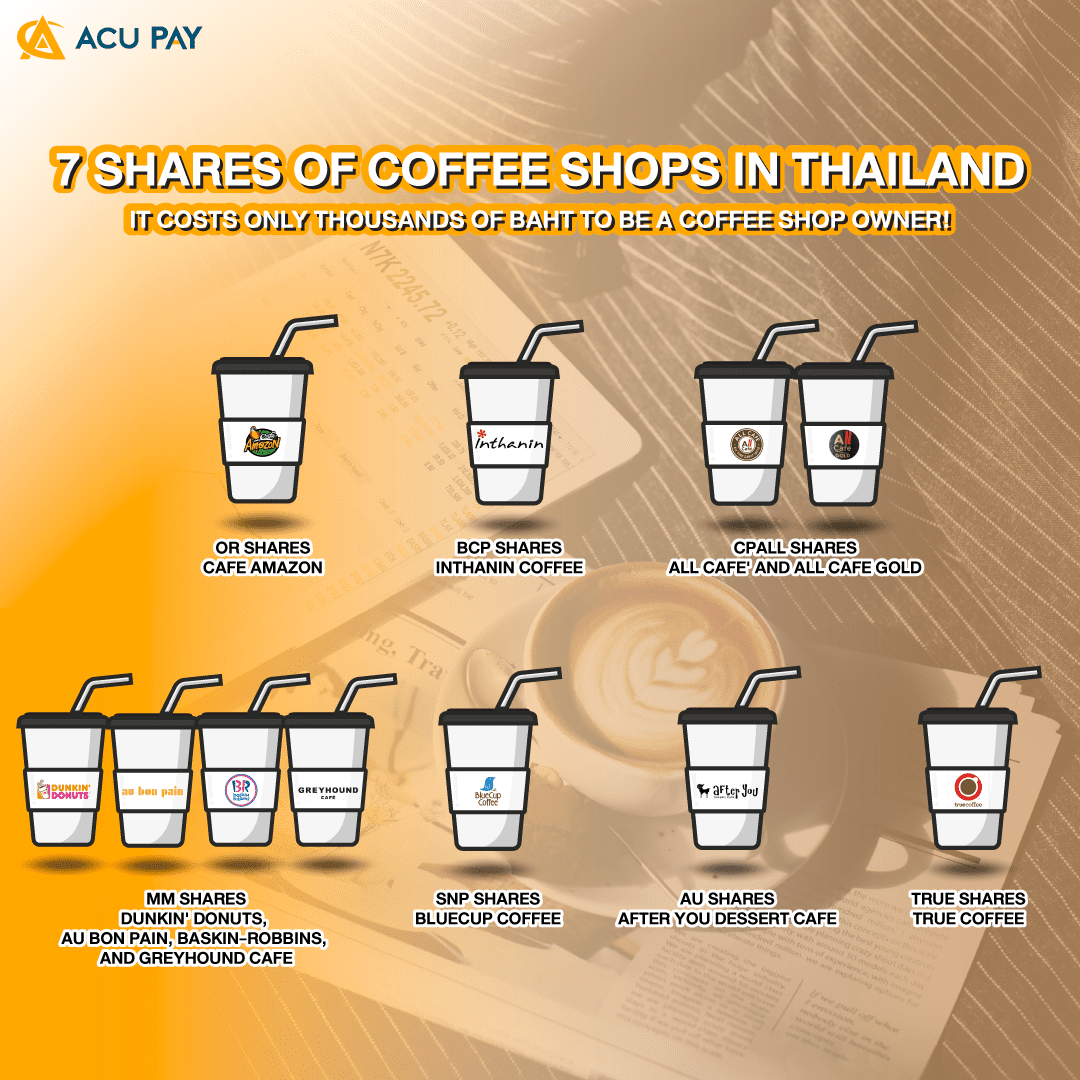

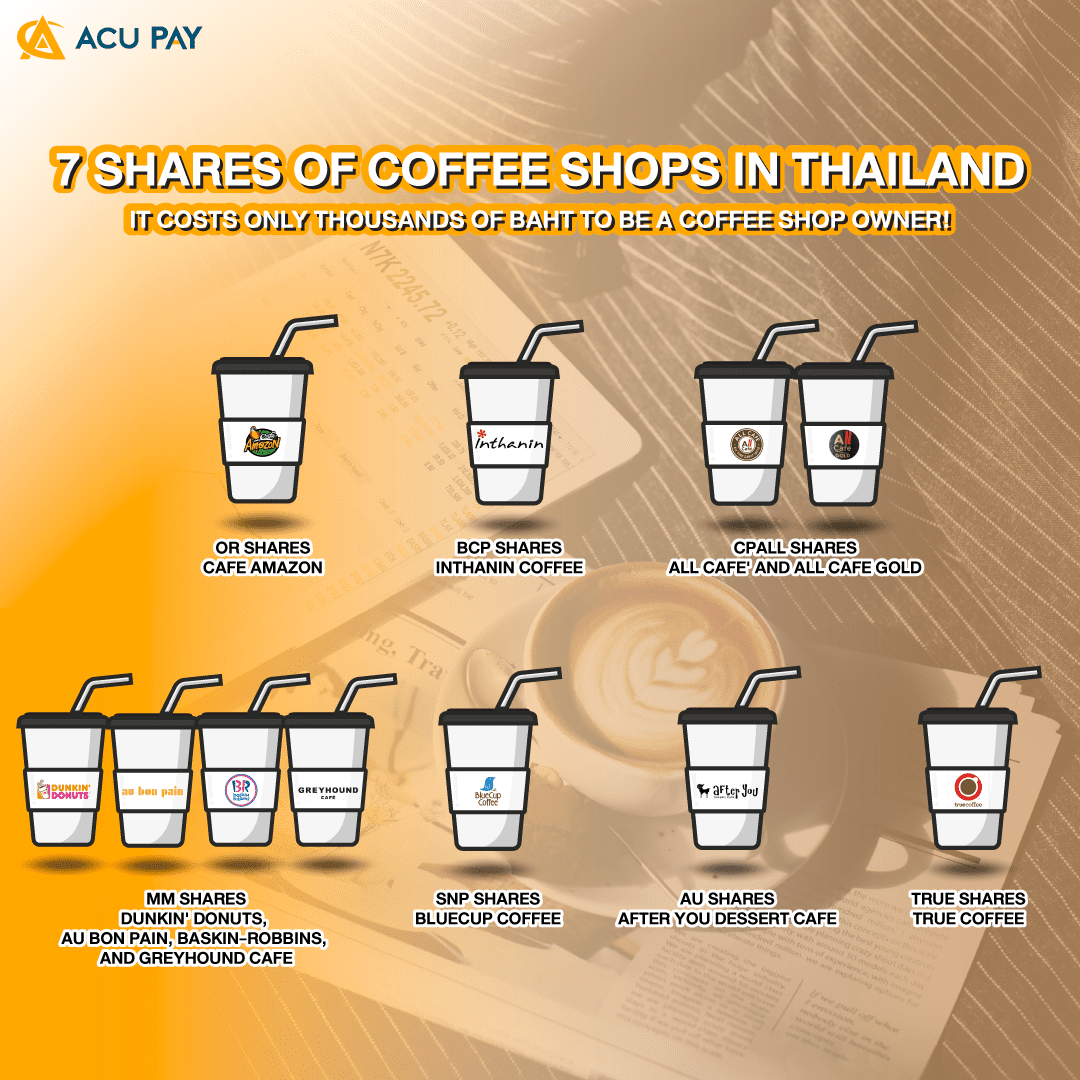

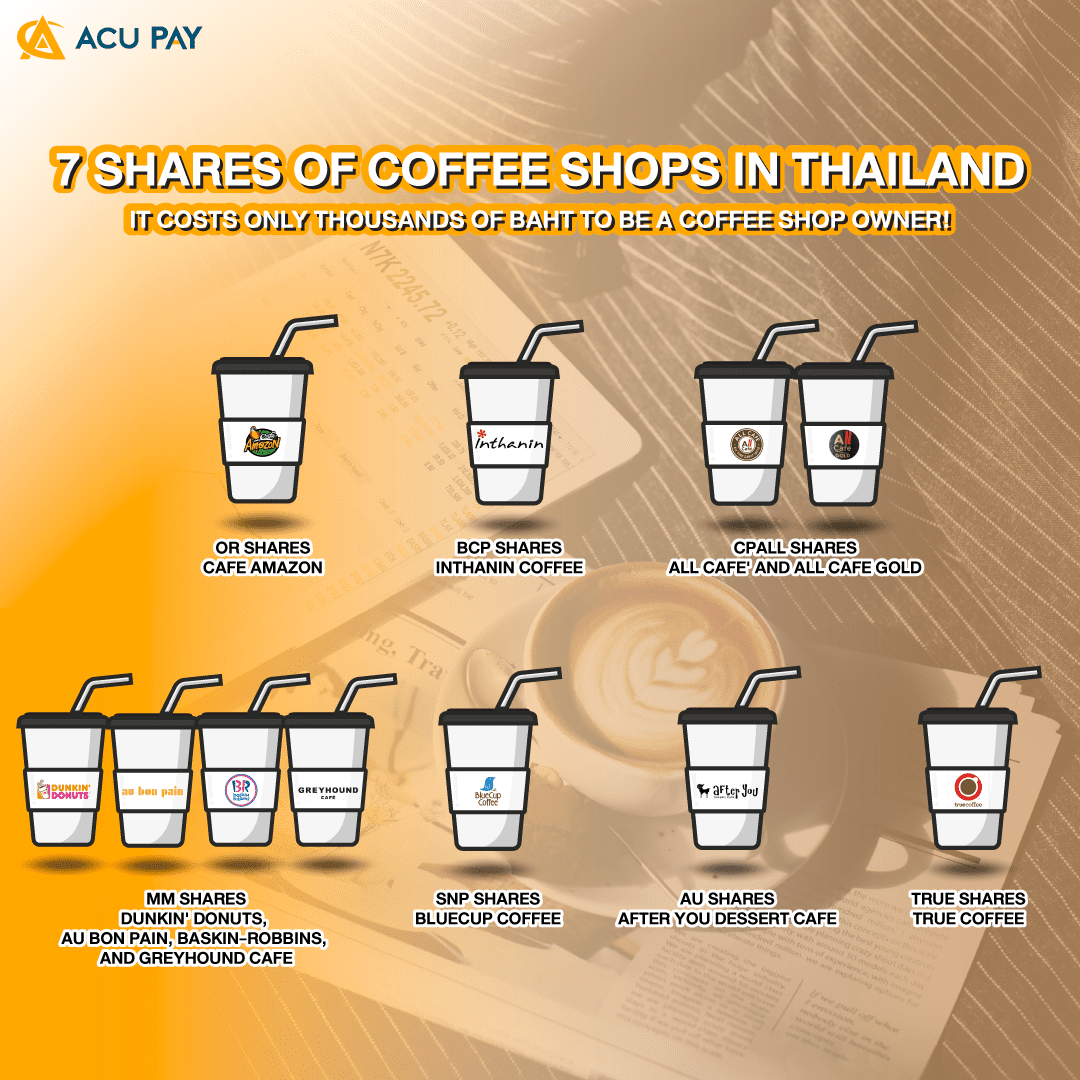

8 shares of coffee shops in Thailand let’s see eight coffee shops that have stocks on the stock exchange that many people are familiar with.

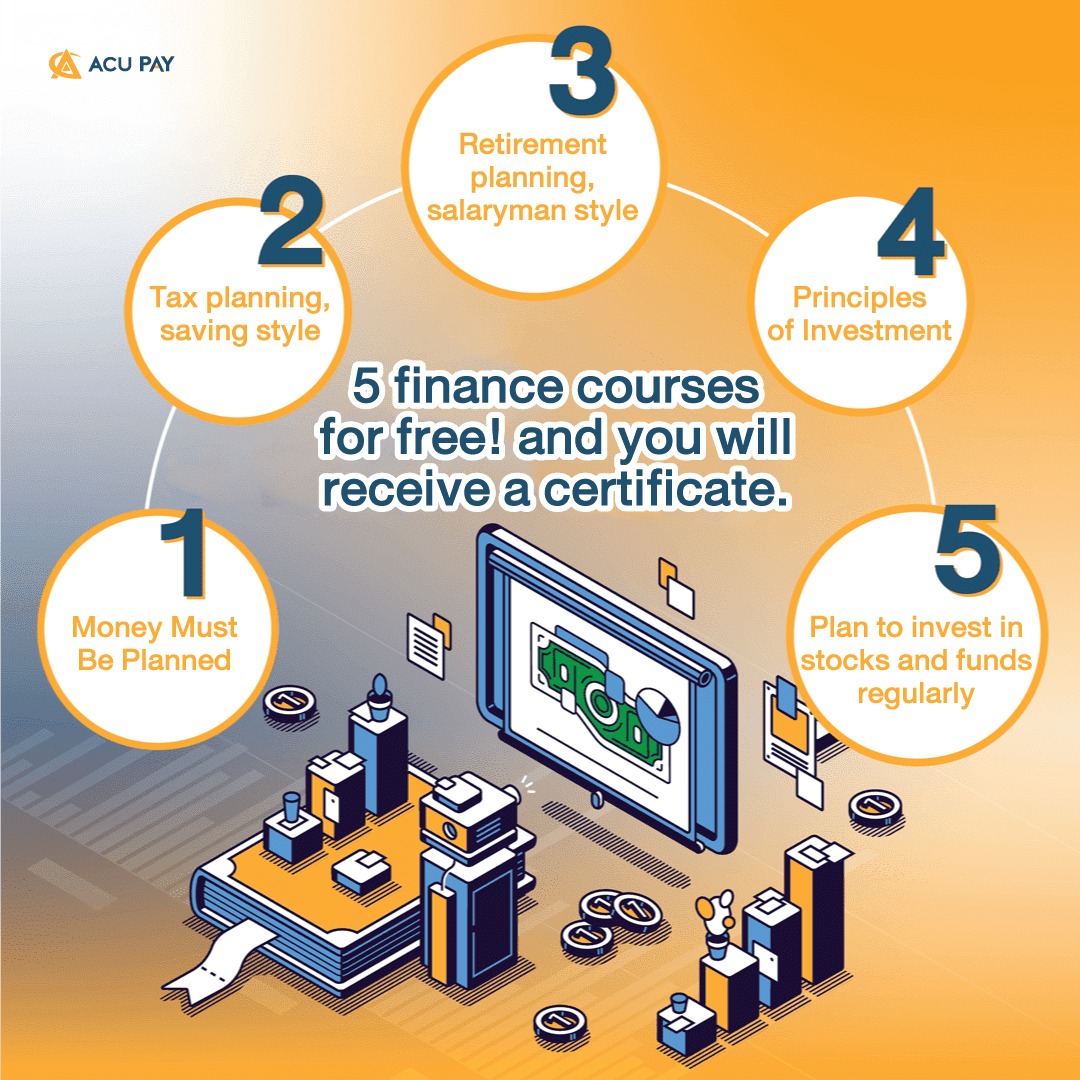

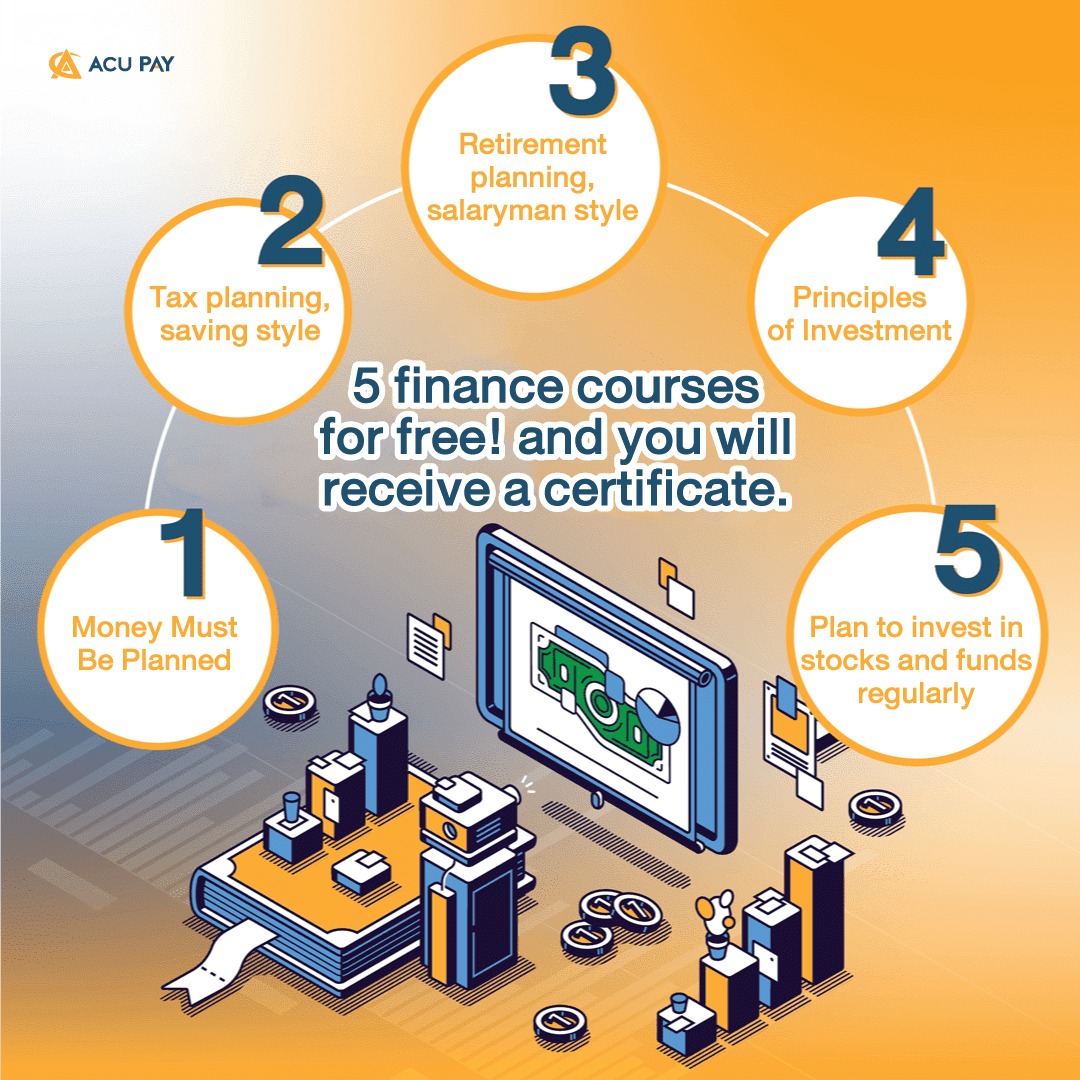

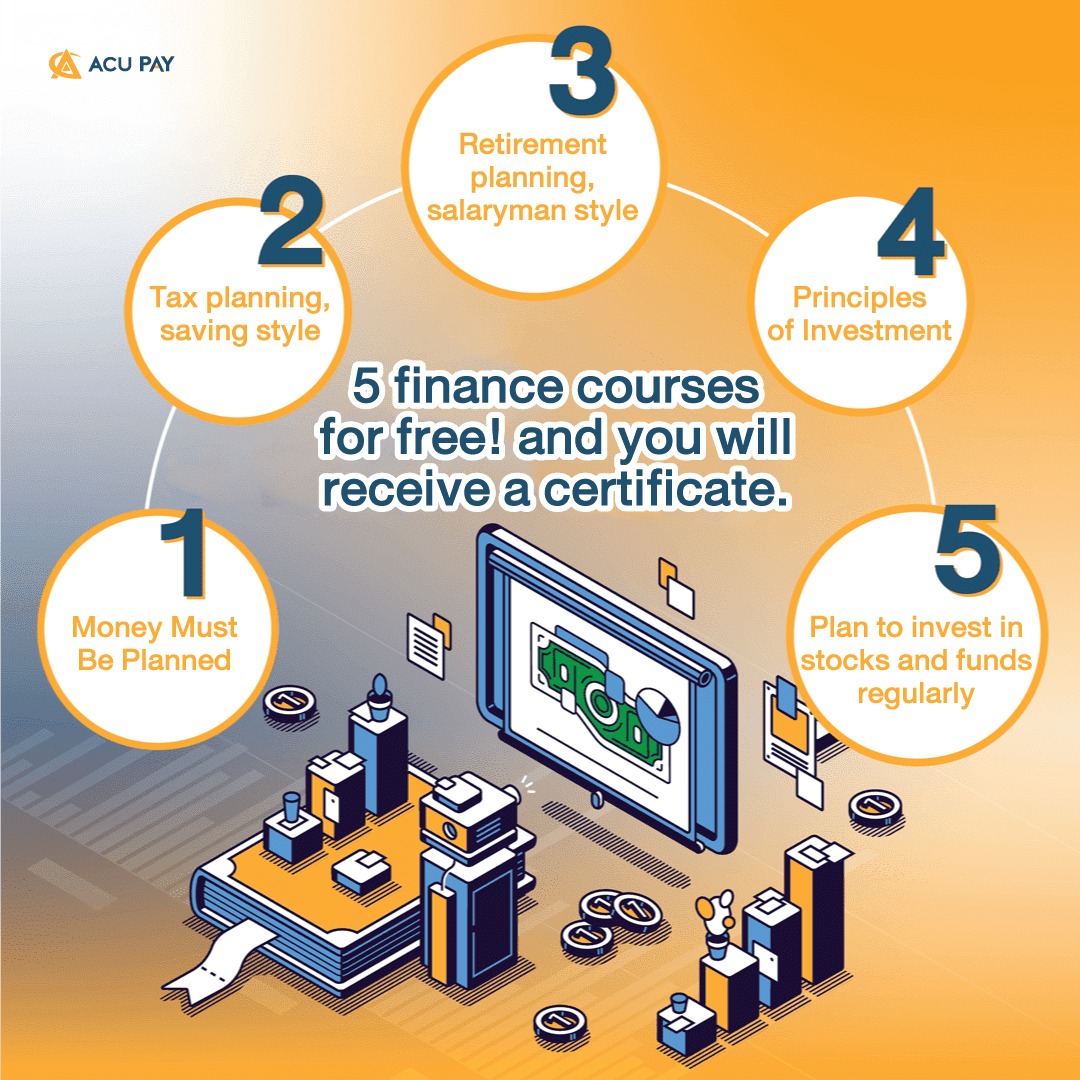

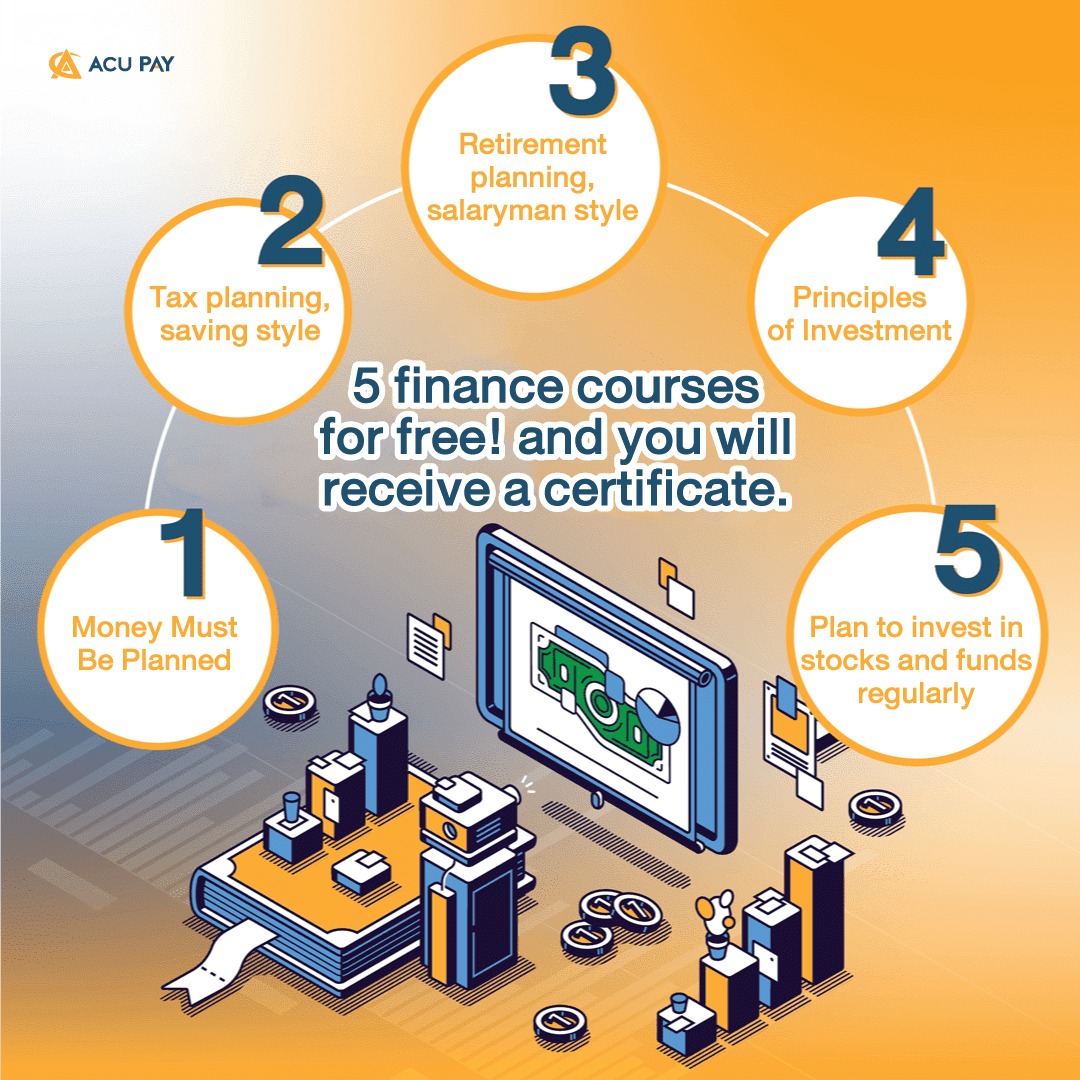

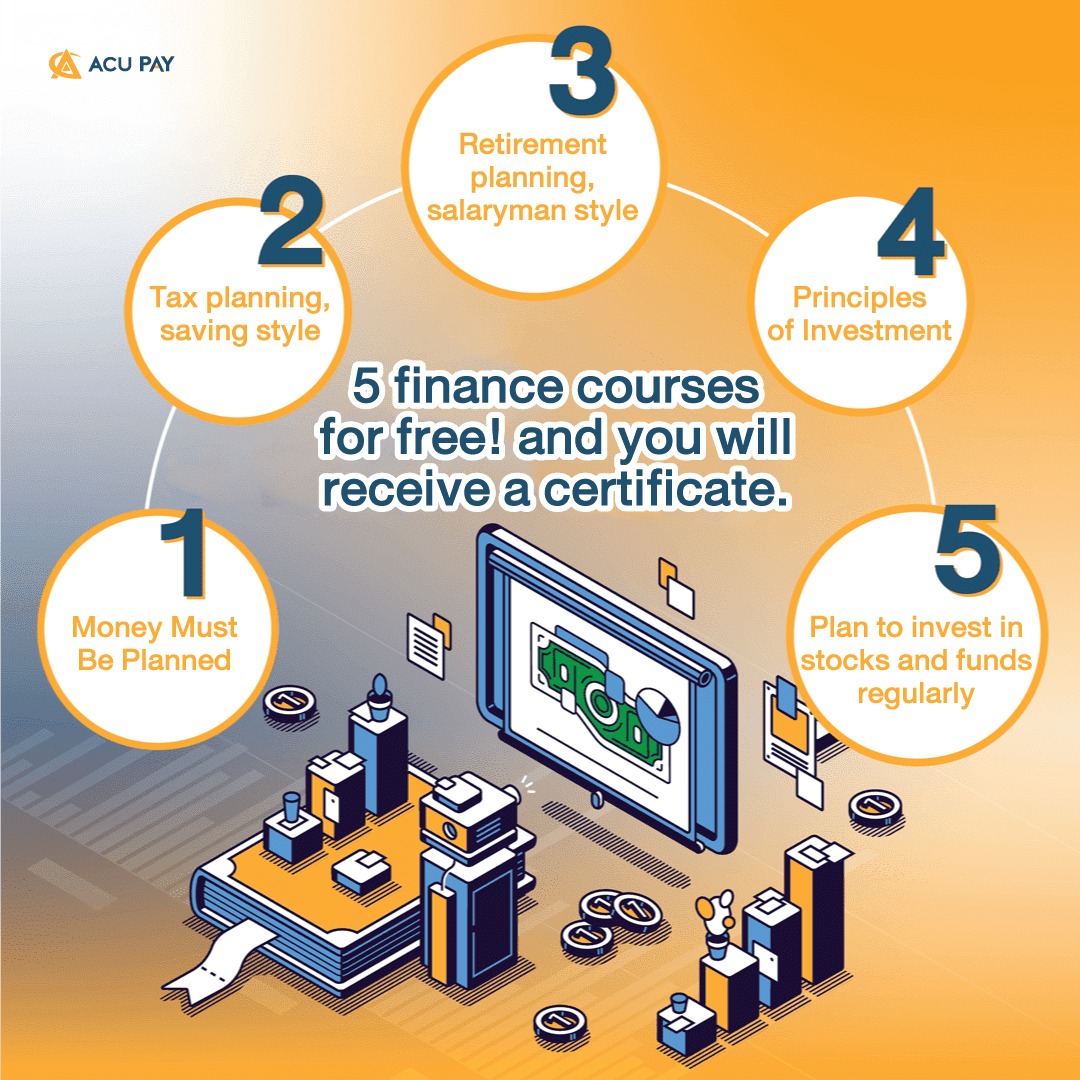

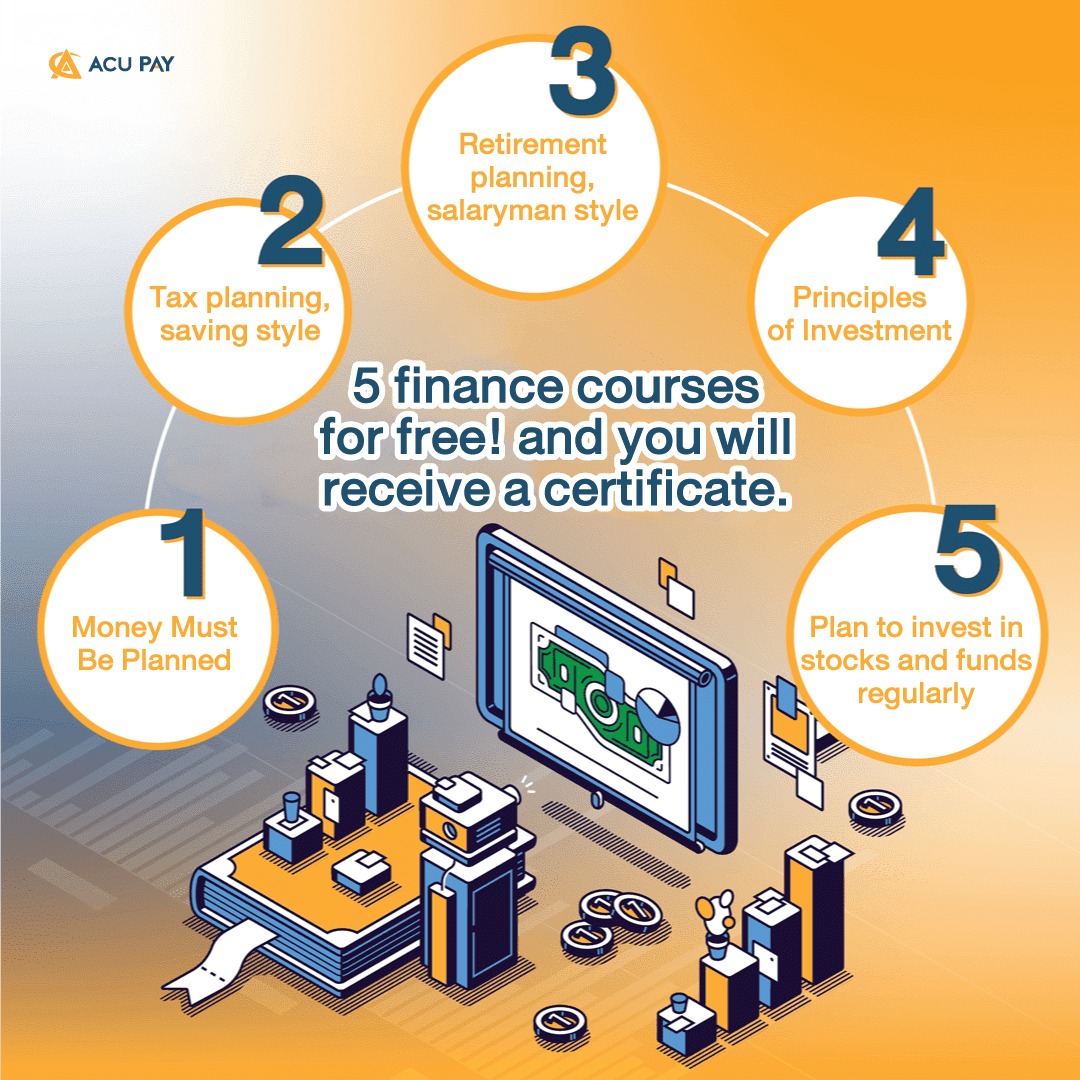

Another important factor for us in this era is money, and the key to managing our money effectively is financial knowledge. We can’t deny that money is essential to our lives, whether it’s eating, sleeping, or even medical care. So, let’s try to learn how to manage money to enhance our stability in life.

many people may have used e-Wallets, which are electronic wallets. In order to collect money in electronic form, known as e-Money, and to spend it, we need to top it up first.

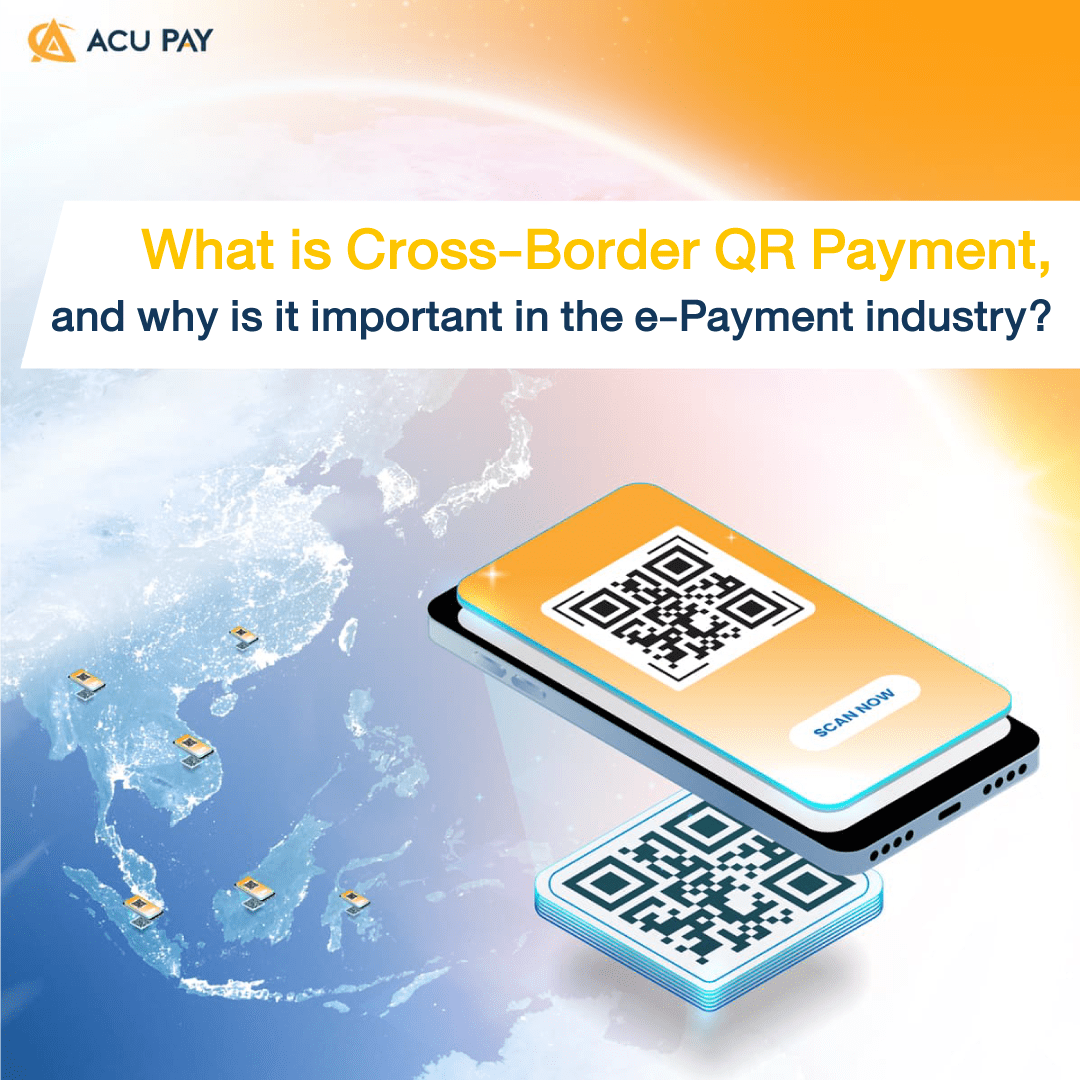

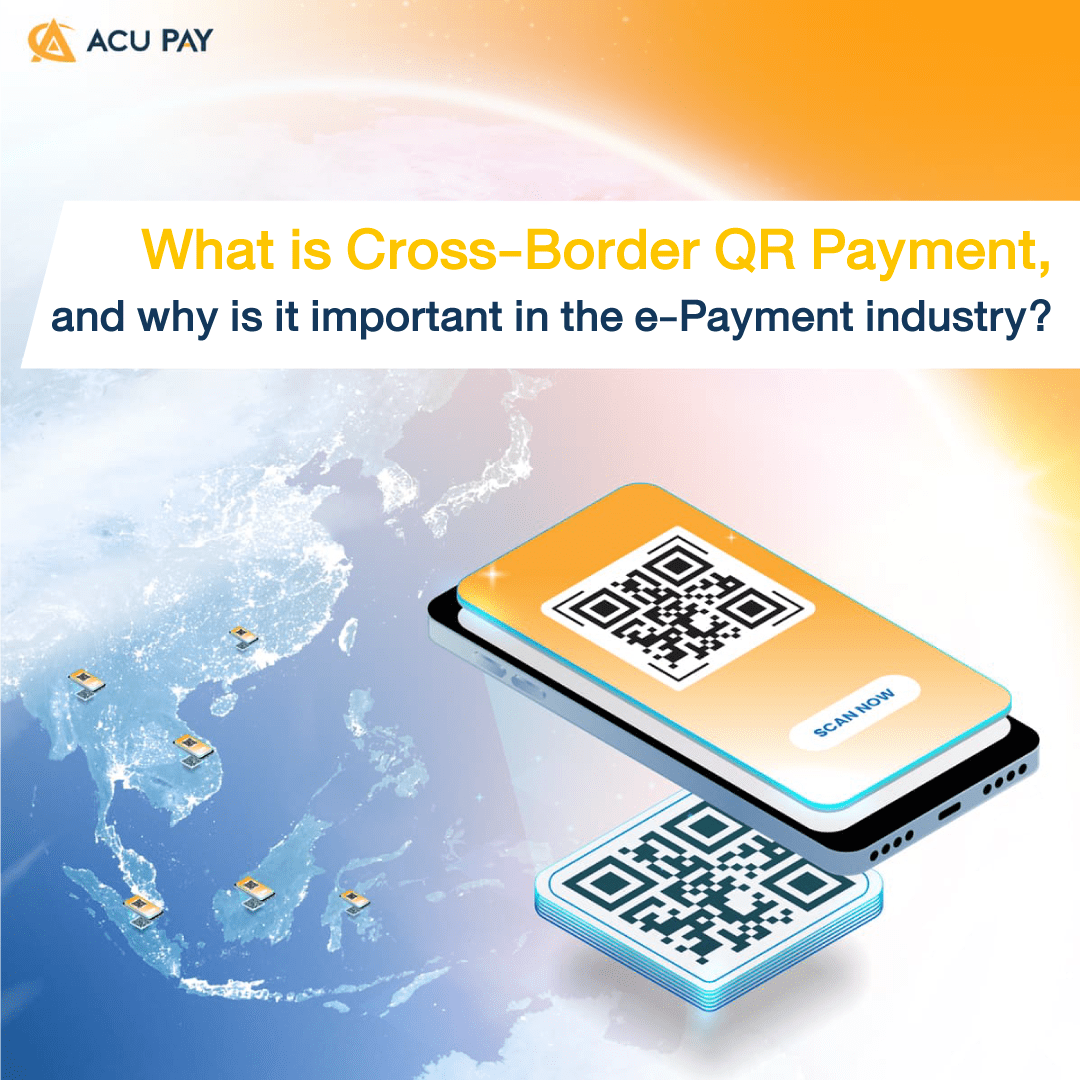

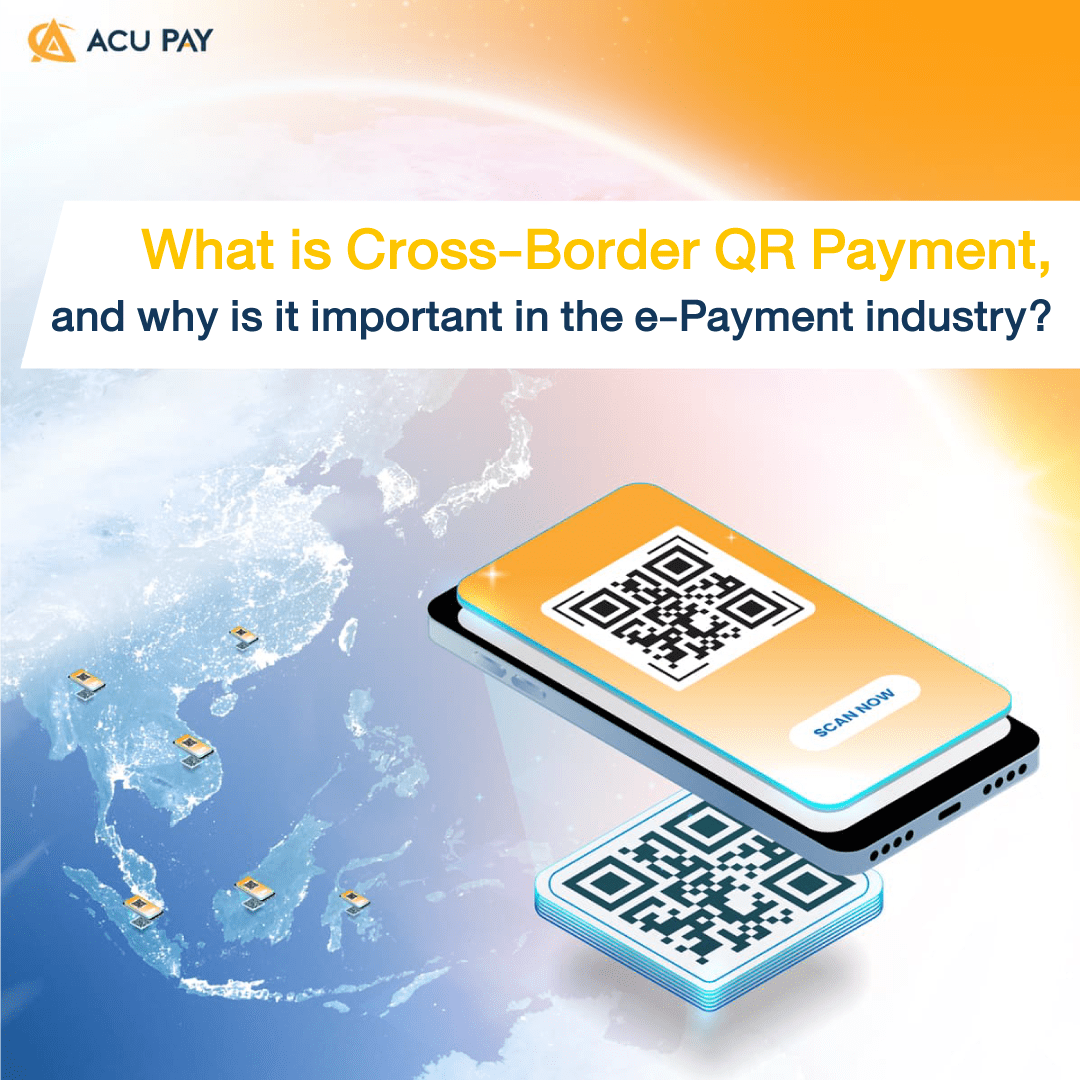

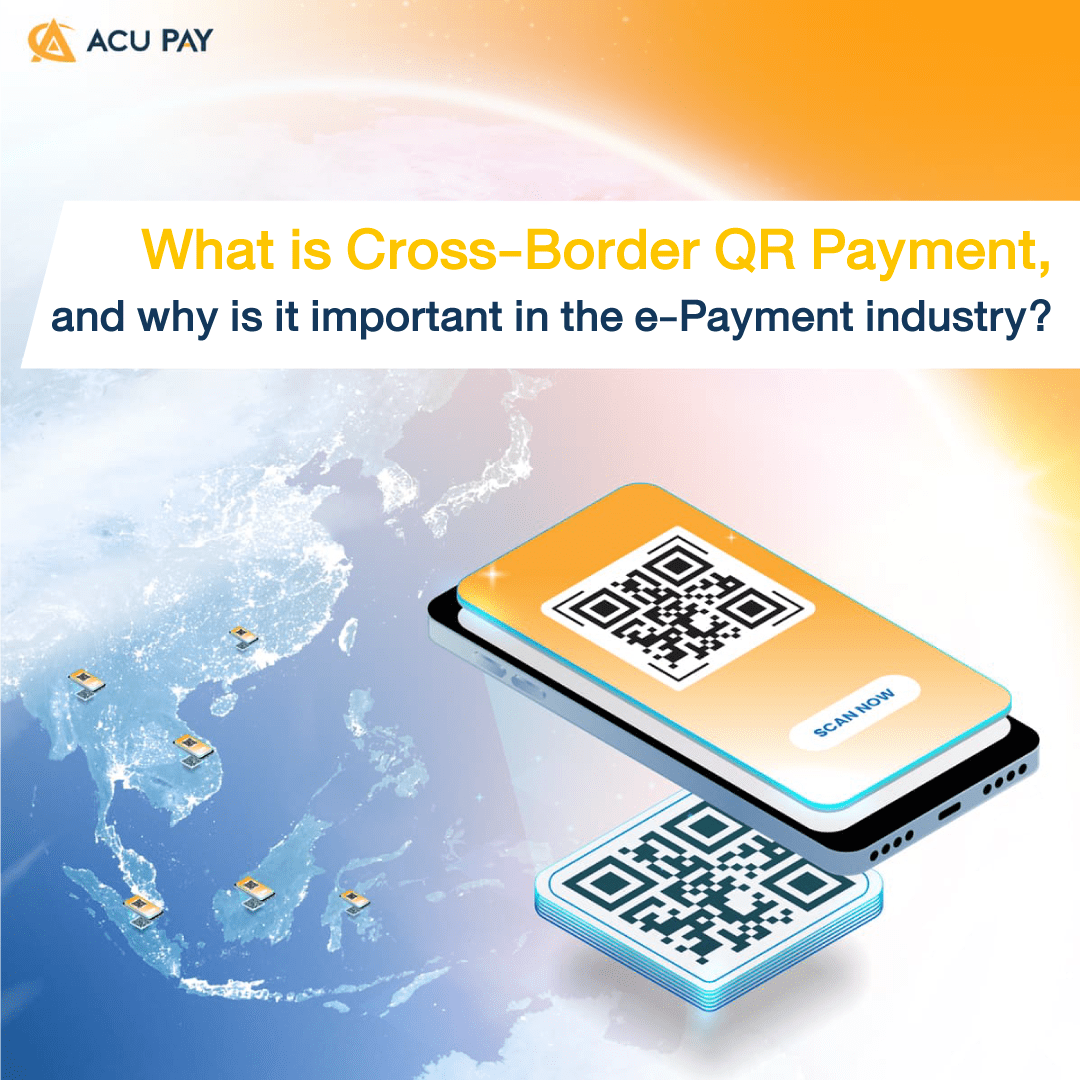

We already know that e-Payment is electronic payment via QR Code, but we can only use it in the country, not abroad.

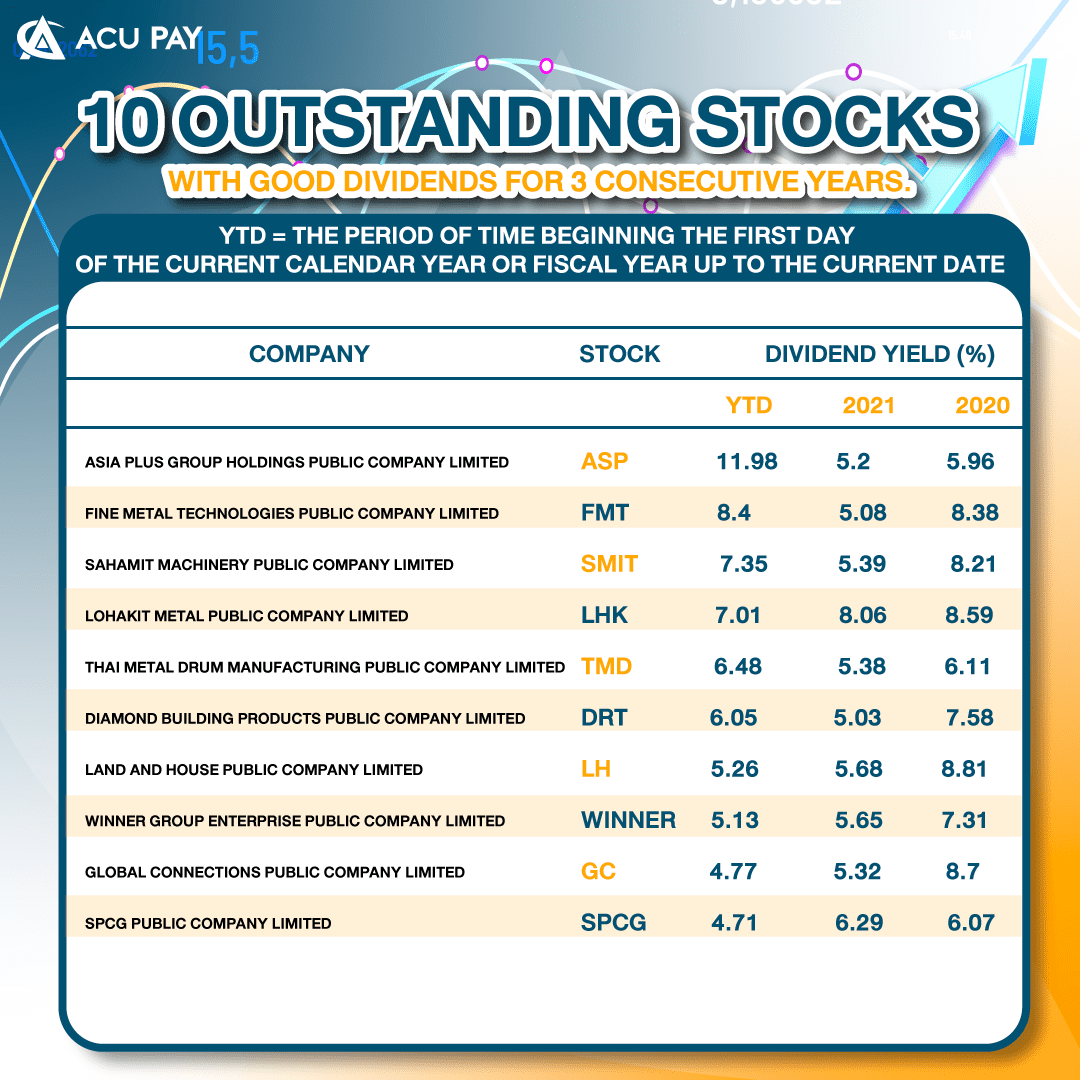

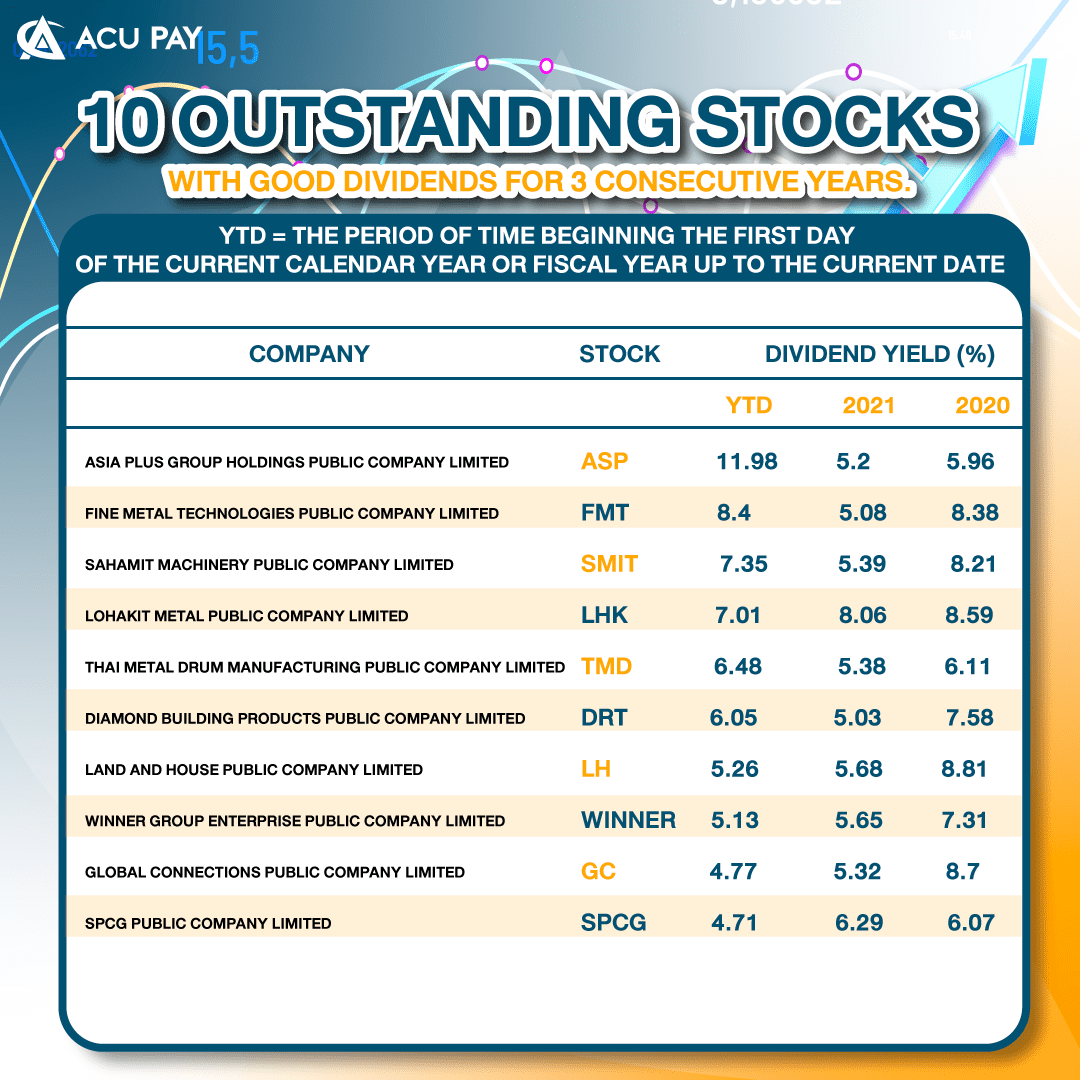

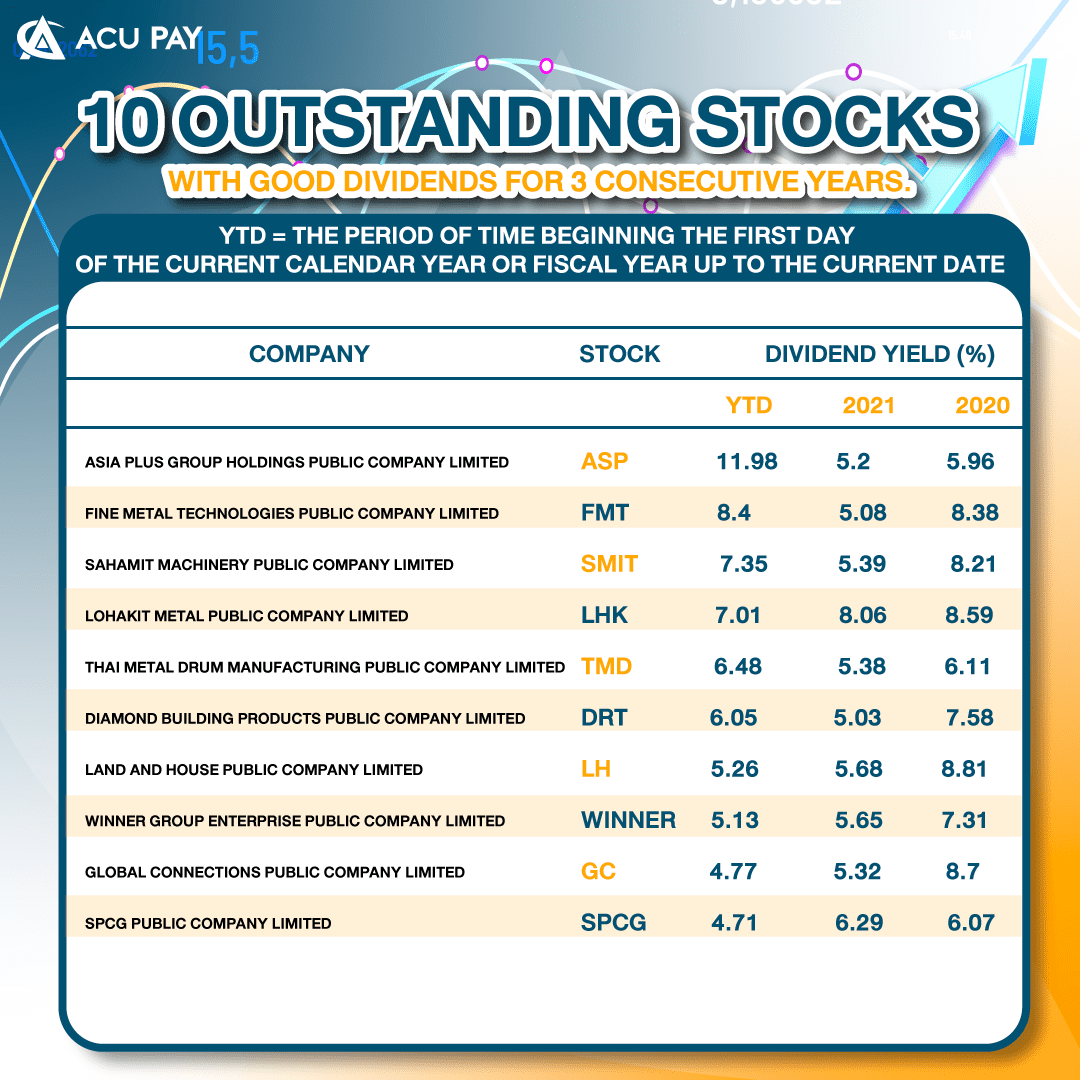

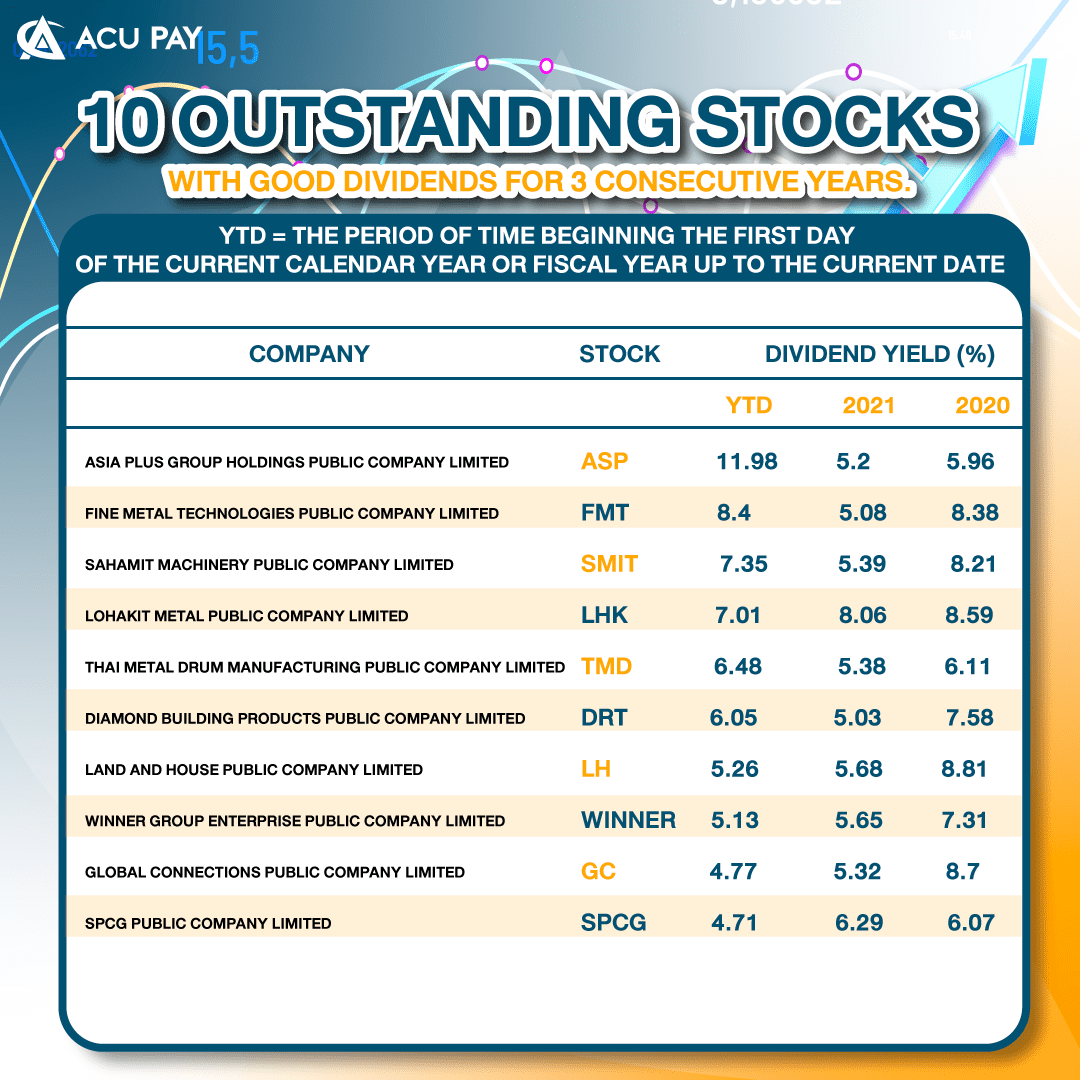

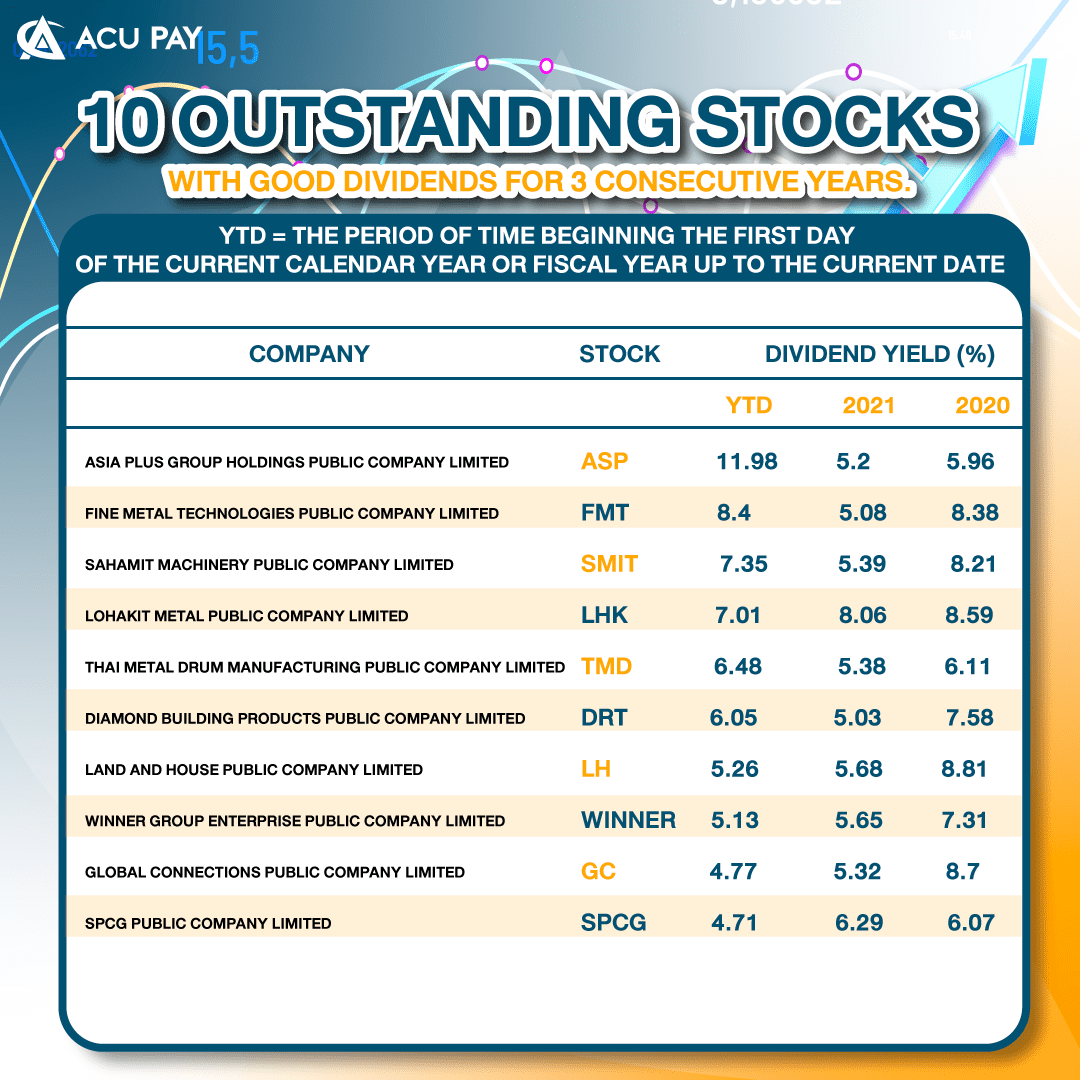

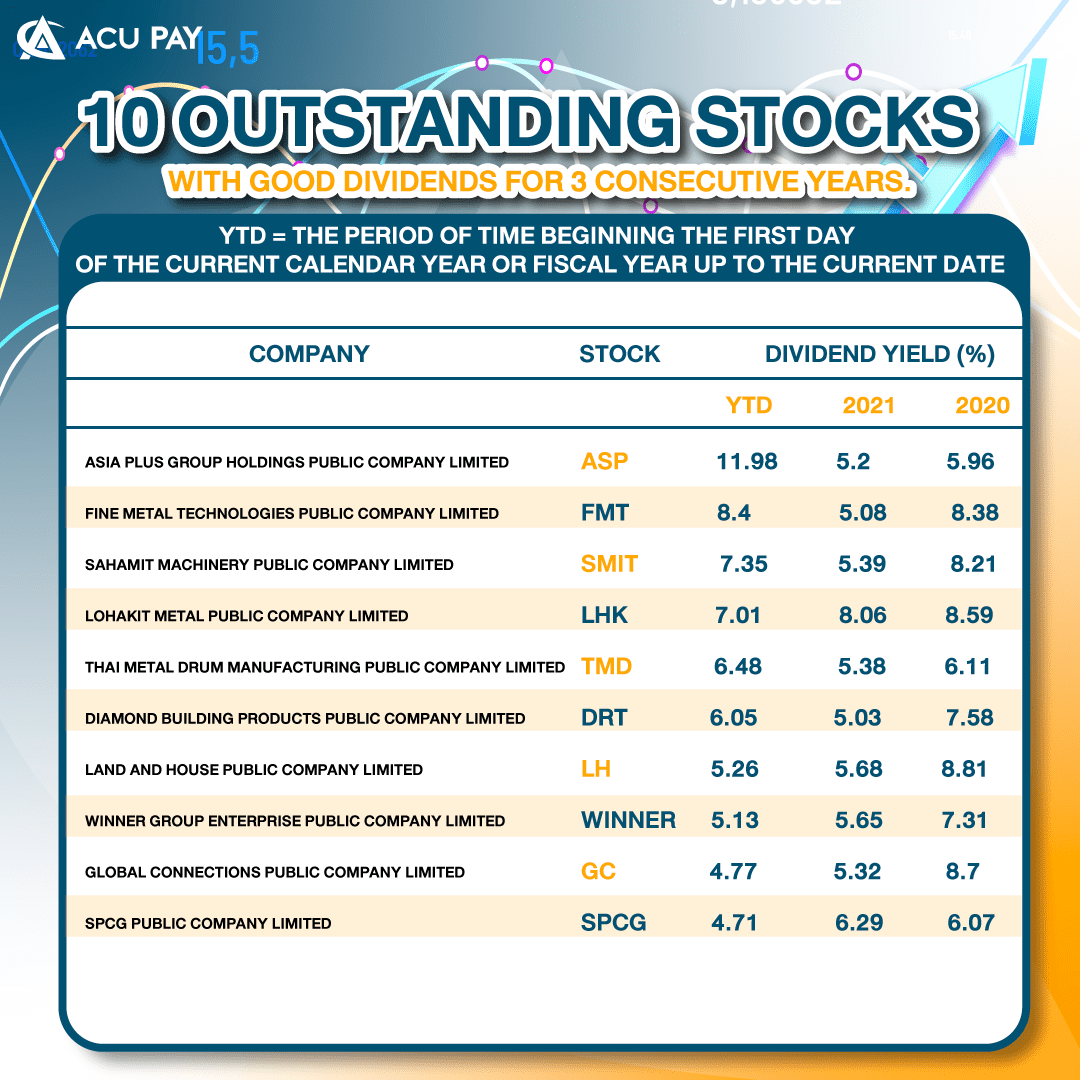

10 outstanding stocks with good dividends for 3 consecutive years.Which stocks are there for those who want to invest long-term in stocks with continuous dividends? Let’s see.

The use of mobile phones across the world is increasing dramatically, and in 2021, the global use of mobile phones is greater than the world’s population.

Are you familiar with the word GDP? When we listen to economic news or read articles related to investments, we often hear the word GDP on a regular basis, so let’s simply summarize: what is GDP? And how is it related to investment or related to us?

What is a cashless society?

A cashless society is a description of the economic and social conditions in which financial transactions are performed without the use of banknotes or coins.

There are many forms of investment, one of which is DCA investment. People have probably heard of this term quite well. Some may know the name but don’t really know the meaning or principle of DCA investments. Let’s take a look.

Nowadays, e-Wallets are becoming a huge influence on everyday spending. As a result, the spending behavior of people in society is related to consumption and consumption is changing. Do you wonder how e-Wallet has made a difference? Let’s see.

8 shares of coffee shops in Thailand let’s see eight coffee shops that have stocks on the stock exchange that many people are familiar with.

Another important factor for us in this era is money, and the key to managing our money effectively is financial knowledge. We can’t deny that money is essential to our lives, whether it’s eating, sleeping, or even medical care. So, let’s try to learn how to manage money to enhance our stability in life.

many people may have used e-Wallets, which are electronic wallets. In order to collect money in electronic form, known as e-Money, and to spend it, we need to top it up first.

We already know that e-Payment is electronic payment via QR Code, but we can only use it in the country, not abroad.

10 outstanding stocks with good dividends for 3 consecutive years.Which stocks are there for those who want to invest long-term in stocks with continuous dividends? Let’s see.

The use of mobile phones across the world is increasing dramatically, and in 2021, the global use of mobile phones is greater than the world’s population.

Are you familiar with the word GDP? When we listen to economic news or read articles related to investments, we often hear the word GDP on a regular basis, so let’s simply summarize: what is GDP? And how is it related to investment or related to us?